FRANCE. The ACI Europe Commercial & Retail Conference began on Tuesday in Nice, posing the key question of how airports could lift average passenger spend at Europe’s airports. Over 400 delegates gathered at the Nice Hyatt Regency Hotel, among them commercial management and concessionaires from Europe’s airport community.

One of the highlight sessions came late in the day as two leading airport companies presented their new commercial investments, with strong contributions from several of their commercial partners.

Aéroports de la Côte D’Azur Chief Commercial Officer Filip Soete outlined the latest projects to improve the consumer experience and maximise non-aeronautical revenues at the Riviera gateway airport (which hosted the event).

In May, the new Terminal 2 retail offer opens, following last year’s T1 unveiling. In T2, commercial space will be extended by +162% once complete. The offer features four categories under the headings of ‘Côte D’Azur essentials, French essentials, trend-setting items and airport essentials’. Already open are duty free and fashion multi-brand stores – and just days ago the first Kooples branded store in the airport world opened in T2.

Among other highlights, Salvatore Ferragamo opens in May, Hour Passion in June and Hermès in September. The T2 F&B offer will be rounded out soon. It includes a second Joe & The Juice (one is already open in T1), a Champagne bar, a Jamie’s Italian and the first Petrossian unit at a European airport. Later, in Q1 2018, Estivale will open, a collaboration with Michelin starred chef Mauro Colagreco.

Soete said: “By year end we’ll have 68 shops and restaurants. It’s not only about retail. F&B is really key too and is performing well (sales +31% year-on-year) in T1 following our upgrades.”

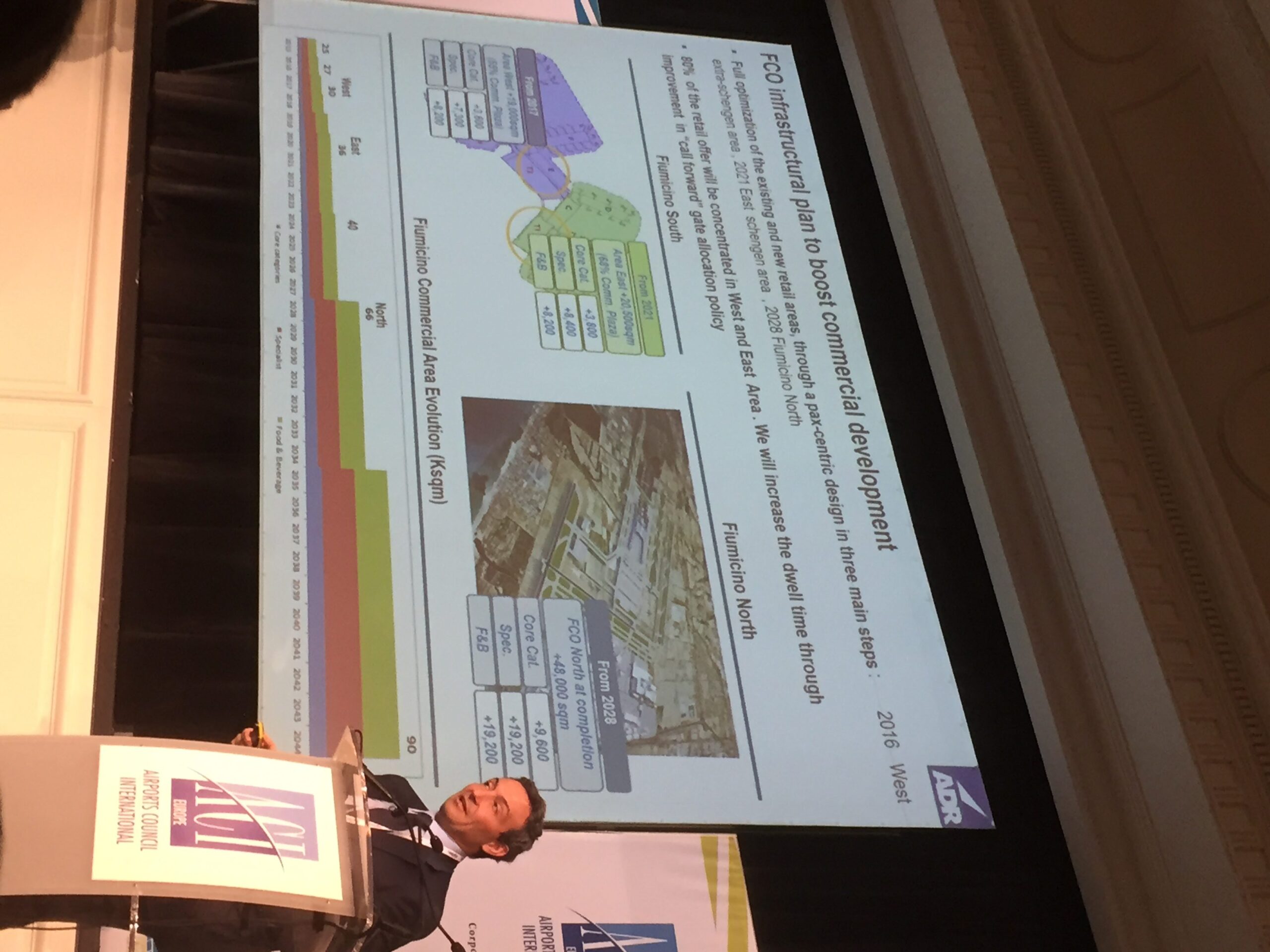

In another compelling address, Aeroporti di Roma CEO Ugo de Carolis outlined the impact of the new Rome Fiumicino Avancorpo Terminal E development. As reported, this features a lower floor housing fashion and Made in Italy zones, and an upper floor focus on F&B.

In the new area the commercial results have been impressive, with per passenger spend rising by +29% year to date. Core category duty free is up by +20% as a result of the opening, speciality retail by +45% and F&B by +13%.

Other plans include a new Schengen zone and from later this year the new Area West, which will add 19,000sq m including 55% of this space for commercial.

De Carolis said: “The numbers are good and we are looking at improving them further. We will do this with new digital tools and more around the passenger experience.”

In a vibrant contribution to the same session, HMSHost International CEO Walter Seib delivered a core message: “Eating is the new shopping.” He urged airports to consider how consumer habits are evolving and the need for a more rounded offer.

He noted how consumers are changing, citing three big recent trends: One is a move towards full service restaurants; another is speed – “time is the currency of the future” – while affordability and availability is the other key trend.

“In F&B today we see a shift to meaningful food,” said Seib. “People want to reconnect and F&B can be one of the vehicles to reconnect using value and taste. The future will include engagement-driven concepts and meaningful experiences.”

But, he added: “Even with new drivers we still plan airports in the same way as we did in the past. We don’t allocate space according to new consumer behaviour and definitely not enough F&B. Let’s rethink this. I say this often: every consumer has the choice not to buy but we don’t have a P&L line that says ‘lost sales’.”

Seib concluded on a striking note: “I’d like to advocate ‘reverse thinking’. We need to adapt to a new reality. A comfort zone is a beautiful place but nothing ever grows there.”

Lagardère Travel Retail Chief Business Officer Ambroise Fondeur asked whether walk-through stores are the ideal formats for airport retail development.

Citing recent openings from the company, he noted that Aelia Duty Free sales at Nice T1 has shown +30% growth since its opening last year, and sales have leapt by +60% in the newly opened T2 store. At London Luton Airport sales have risen by +37%, at Rome Airport they are up by double digits, with spend per passenger also up by sharply at each of these airports.

Fondeur said: “Walk-throughs help growth but the format itself is not enough. There are some golden rules.

“One, we need ‘upstream’ collaboration between airport and retailer. This means advance space planning in appropriate sizes to the airport, efficient circulation paths, plus the need for a breathing area before the store opens.

“Two, we need to de-stress the passenger by giving them information on how much time they have. That is especially important in walk-throughs, where we show the time to gate and flight screens.

“Third, we should expose 100% of passengers to 100% of the categories; within this, adjacencies between categories need adapting airport by airport.

“Fourth, the quality of retail execution is key. We don’t believe in walk-throughs per se but we believe in excitement for shoppers. Our objective is retail excitement, from appealing design to digital assets to facilitation and care.

“Finally, it means good interaction with the staff and memorable customer service.”

He sounded some warnings about walk-through, admitting that not every traveller wants to be exposed to retail. “It can be an aggressive format for the passengers. Also, it is not for all airports and needs right-sizing in each. It works best when all categories are [within easy reach]. These stores are also more costly to operate – walk-throughs mean more staff than you have in in-line stores. Yes, sales and margins grow but the capex is higher than in other formats.”

Earlier, introducing the day, ACI Europe Director General Olivier Jankovec outlined the state of the industry in Europe with a breezy, engaging address. He noted that airlines were aggressively adding capacity to the market, helping the region’s airports break through the two billion passenger mark in 2016. This was led by EU states in the region (+6.7%).

Jankovec said: “The forecast is very good for 2017, with +8.9% growth already in January. This is down to the global and the European economy growing strongly, with the low price of oil helping airlines add capacity to the market. We may be at the top of the cycle though and we see geopolitical risk, with Brexit and a new administration in the USA. That all has an impact on aviation. Other risks are safety and security. Terror plays its part, but the risk is that [individual events] affect passenger confidence more widely.”

Other factors will impact the market, added Jankovec. “Low-cost airlines continue to be the big disruptor. LCCs are moving upmarket and are still taking share in the market, plus they are moving into long-haul now. We also see more consolidation among airlines.”

He noted increasing competition between airports, forced by LCCs and a growing share of the European market from the Gulf carriers. These factors will continue to redefine the consumer base, he noted.

“Airports need to become more agile and address shifting consumer behaviour. Europe’s airports are re-strategising, and moving into the digital age. They are changing the narrative to create experiences, and to create brand equity around the airport.”

Another disruptive factor will be Brexit, which Jankovec said has the potential to “disrupt and destroy value in European aviation”.

He added: “This takes the UK out of the successful EU single aviation market. Risk factors include the sequencing of the negotiations – we simply won’t know what the new regime will be for many months, so there will be prolonged uncertainty. Also we cannot exclude a ‘cliff edge’ scenario, with no agreement until 2019 and a move back to bilateral restrictive arrangements. This is also a very politically charged negotiation so there will be trade-offs between sectors; nothing will be agreed until everything is agreed. There will be no fast track for aviation.”

Budapest Airport Head of Retail & Advertising and ACI Europe Commercial Forum Chairman Patrick Bohl noted why airlines see less value than other stakeholders in taking part in the industry Trinity.

He said: “Airlines connect hundreds of points together but airports only connect with the passenger at one. What is key is to ensure data exchange between airlines and airports. We need to negotiate to create a common platform with airlines to see what passengers’ special needs are and offer them services nobody else can. That is an advantage we have compared to the eBays and Googles.

“Also we need to talk about the entire journey. When we talk about walk-throughs or Sense of Place we don’t talk about security. Can we do more with music and lighting in these areas? We know that passengers who are happy with their security experience spend more in the shops but we do very little for them in that environment. What about customer-friendly uniforms or language training for staff in security? The mathematics change if you factor this into your Sense of Place and pull out all the stops on marketing and communications.”

Industry challenges

ETRC President Sarah Branquinho outlined some of the big industry challenges, from product labelling to Brexit.

She said: “Product labelling requirements have had a dramatic impact on packaging in our business. Liquor is next in line. Our solution is to use technological solutions, especially smart phone technology, to achieve the labelling requirements.

“Baggage restrictions are still a key concern and have become a global issue today. United Airlines is now charging for the use of overhead lockers. Some Middle East airlines have imposed a hand luggage weight limit, as low as 7kg. British Airways is now making announcements about including duty free purchases in hand luggage. We want airports to write into their agreements with airlines that they cannot restrict commercial activities. It is key.”

On tobacco, Branquinho noted that self service bans remain a threat while standardised packaging is now coming to many countries – and is a growing challenge to sales in duty free.

On Brexit, she reaffirmed how the ETRC is talking to legislators about a return to duty free sales between the UK and EU.

“There are 137 million air travellers going between the UK and EU each year, plus 40 million maritime passengers. ETRC shares ACI’s concerns over aviation and the single market but it’s also a fact that two years on from March 2017 the UK will become a ‘third country’ and one no longer subject to EU treaties. So passengers travelling from the EU to the UK will have the same rights to buy duty free as those travelling to Dubai or Los Angeles.

“We don’t wish to make a virtue of Brexit but as it is happening we want to make a return to duty free sales. EU legislation does not need changing but the UK rules do. With that in mind the UK Travel Retail Forum has started meeting politicians in the UK and Europe. We are working behind the scenes and we need the help of national associations.”

In a stirring keynote morning address, L’Oréal Travel Retail General Director, Global Client Management Richard Cymberg asked whether travel retail is a true global shop window.

Setting the context, he said: “Chinese travellers will double in number by 2023 but other nationalities will travel in greater numbers too. Our obsession at L’Oréal is to know them and serve them better. The in-depth analysis of these travellers allows us to create tailored services and experiences for them. That means travel retail exclusives for each nationality, supported by retail-tainment around Sense of Place, gifting and other activities.”

He added: “Travel retail is a strategic channel. It enhances the reputation of brands, it increases customer loyalty and it helps us recruit new consumers.

But the environment has changed. We see the democratisation of travel: more families, more retirees, more millennials, more people from emerging countries.

We are sitting on the comfortable mattress of passenger growth but won’t benefit unless we can propose an offer tailored to traveller needs and purchasing power, offering a great shopping experience and adapted service. We need new categories, more affordable brands and to capture new trends before they become obsolete; that means hair care, dermocosmetics and more affordable brands.”

Cymberg noted the importance of connectivity and digital tools but said that the industry has not yet taken advantage of these.

He asked a telling question: “Is the role of the airport shop shifting from store to showroom? It has not done so far but that danger exists. If we don’t react quickly enough and transform the airport from a place of constraints to a place of desirability, it will happen.”

In a neat line, he said: “Data is the new oil. Data-sharing can be a transformational element for the industry. We must be able to communicate with the traveller from the moment they book their ticket to boarding the plane, to orient their choices, to establish a dialogue and differentiate ourselves with other retail channels. We must win the battle of recruitment.”

He concluded: “Only 13% of travellers buy in the beauty category – the good news is the 87% who don’t buy yet so that means there is tremendous potential. Let’s not spoil it. Don’t leave it to the pure digital players who can pose a threat to our industry.”

In a strong session on capturing the next wave of opportunity, London Gatwick Airport Head of Retail Rachel Bulford said: “Gatwick’s daily footfall is 44,000 passengers in the summer peak, the same as many high street stores would welcome in a week. But footfall is only one element. Conversion and yield are key.”

Addressing that theme, M1nd-set CEO Peter Mohn outlined motivations among travellers to spend. The key reasons for people to visit a duty free shop are number one, price advantage, number two, gifting and three, pre-planned purchases.

“Of those who don’t visit the shop, the main factors are the lack of visible and appealing promotions and crucially, the perception of high prices. This is something the industry needs to work hard on. Many people travel on a limited budget and many also want to see more affordable products. 50% of trips are taken in Europe on low-cost carriers. These people have money to spend but are on a budget.

“Those who don’t buy cite high prices, the lack of interesting or new items, and no appealing promotions as the top three reasons. Millennials in particular want to be inspired in the shops. We need to increase the number of creative, inspiring products in the stores. Triggers for purchase include (the perception of) great value, exclusives and souvenir or gifting value.”

Luxottica Group Head of Global Channels Francis Gros noted the strong performance of sunglasses and its contribution to the total store. “By giving the category the space and care it deserves, we can accelerate the growth of the business.”

He offered some excellent numbers on spend per head in sunglasses and some targets for the future.

“We want to raise spend per departing passenger on sunglasses from €0.25 in 2015 to €0.46 by 2020, with best in class levels today at €1.12.

“Where these figures are high, such at London Gatwick, we have multiple stores, across sunglasses departments, stand-alone stores, HPP pop-ups plus boutiques It’s about how you can animate the category best.”

Dufry Divisional Chief Executive Officer UK, Central and Eastern Europe Eugenio Andrades delivered a superb and insightful presentation on the challenge of maintaining and raising average spend.

He noted the industry’s positive historic figures, saying that from 2005 to 2016 passenger traffic had surged, as had sales and spend – but in the past three years spend per head has slipped.

“Why has that happened?” he asked. “Foreign exchange plays one part. It impacts price perception and reality. Passengers are thinking about their home currency – if that is perceived as strong they feel like spending more. There is also the LCC boom. It is here to stay and it generates more passengers but these passengers spend around -15% less than those on traditional airlines. Plus you have factors such as dwell time and luggage restrictions on LCCs.

“We also know that regulatory factors from the 2007 liquids ban to tobacco to labelling and now the electronics ban are not helping us. We also see changing demographics and frequency of travel, plus an increase in travel to and from the EU versus non-EU destinations. And we know that non-EU spend per head is 2.5 to 3 times higher than spend among EU passengers.”

He addressed how Dufry is tackling these challenges. “We need to better understand the customer; train staff and provide them with the latest selling tools; use omni-channel and the digital experience and provide new experiences through digital innovation.

“We need to tackle the passenger along the whole journey and retain their interest later; they must be part of value chain.

“The focus must be on product differentiation, value for money and a strong Sense of Place. Let’s improve the customer experience, with omni-channel communication throughout the journey. Let’s reinvent how airport stakeholders work together and include airlines as part of value chain. And we need to assess the contractual framework, one that is adapted to new and changing market realities.”

The ACI Europe event concludes on Wednesday. Next year it will be hosted in Tel Aviv by the Israel Airports Authority.