INTERNATIONAL. Reinforcing the industry’s sustainability credentials to a new generation of consumers, and assessing how to inform and educate the traveller base about wines & spirits were among the key themes discussed at two Tax Free World Association (TFWA) webinars last week.

These featured speakers from Gebr. Heinemann, Harding+, Diageo, Brown-Forman, Masi Agricola, Duty Free Global and PI Insight.

The online event, held on 25 and 26 October, was moderated by TFWA Managing Director John Rimmer and drinks writer and editor Olly Wehring. It examined the current state of the wines & spirits market in travel retail, including what the latest data says about global trends and customer behaviour, perceptions and purchasing decisions in the sector.

Gebr Heinemann Head of Category Management Liquor, Tobacco, Confectionery Lars Ziehn said brands must differentiate between the customer who is educated and experienced, and the customer who is looking for help and information.

He said: “We have to improve our guidance in the shop, not only with our staff explaining what the product is and educating them but also to optimise our navigation within the categories, showing what our top sellers are and why are they are interesting. Every brand has a story to tell and we have to bring that to the shop floor, better than today.

“That is why we are enhancing our customer experience. We are testing several things to see what works best, to implement in our shops. For example, with the Diageo Global Travel & Middle East Whisky Lounge at Frankfurt Airport. or recognising the trend in tequila by giving it more prominence on the shop floor, with an assortment of higher priced tequila and travel retail exclusives.

“We need to look at the personal experience as a whole, the stories you take home and tell your friends, why you bought it, what makes the product so special, this is what we need to keep an eye on.”

On how brand owners can help educate staff on the shop floor to better inform consumers, Ziehn said Gebr Heinemann’s training process is intense, involving category knowledge learning.

Regarding digital and mobile communications, Ziehn said consumers want a sophisticated ecommerce experience, so the retailer is working on a web shop on its app which is convenient and time-saving. Gebr. Heinemann is also investing in start-ups (via its Gharage division), and has recently begun working with Duffle at Copenhagen Airport.

“There is a lot of potential in targeting passengers at the airport before they start their journey with the right content, i.e. a quiz about gin, options for pre-order, pick-up on arrival. We are also investing in Amber Island exploring the metaworld on building the whisky community. It’s a big playing field but we are trying to learn what is best.”

Other speakers on day one included travel retail data & insight provider Pi Insight. Managing Director Stephen Hillam spoke about its Recovery Series reports last year, when PI interviewed over 2,300 European duty free shoppers who purchased alcohol.

He said as the European post-pandemic recovery continues, it is seeing change in how the duty free alcohol shopper is browsing, and what customers want from the category. He said 42% were looking for products to purchase for themselves, 38% were purchasing something to share 30% were and purchasing for someone else.

Hillam said: “We have a shopper who has a distinct profile, purposeful mindset and occasion-based purchase in mind, who is also heavily open to influence when in the store.

“There are different ways in which we can shape that purchasing behaviour, offering a value service in three core areas; new initiatives; product launches and new editions. These all drive a high level of interest. However this has now developed into an expectation, with 81% of shoppers expecting duty free exclusives to be an important part of their duty free experience. They are looking toward this channel more and more when travelling, with 63% more likely to buy a product if it is a duty free exclusive.”

Masi Agricola Export & Travel Retail Sales Director Pier Giuseppe Torresani, a member of the Fine Wines Alliance formed recently in Cannes, spoke about the China opportunity.

He noted that the space left by Australian wine brands following the raising of Chinese tariffs last year had presented an opportunity for others.

Torresani said: “We are seeing phenomenal sales in recent years as well as benefiting from the opening in Hainan, a new destination for Chinese tourists, with a strong interest in top luxury wines.

“In travel retail our presence in China is recent but combined with Hainan and the domestic market in China where we have been installed for the last 30 years, we saw an interesting development in the last year, in the premium offer that is the driver of our growth. I think we benefited a lot from the situation in Australia, which was one of the biggest players in the wine category in China.”

On day two, Brown-Forman Marketing Director Global Travel Retail Stéphane Morizet said that the company was seeing footfall rising in Europe and America and talked about some initiatives it presented in Cannes, including its Jack Daniel’s American single malt travel exclusive.

Morizet said there were certain areas Brown-Forman was focusing on to communicate with travellers, including ecommerce, personalisation, digitalisation, virtual reality and loyalty programmes.

He said: “We know everyone wants to embrace the power of pre-ordering now. That is a growing part of the convenience trend and now we can better identify travellers and understand their profiles based on data. We can also use our customer channels, our key stakeholders have their own apps and we can utilise that.”

Recent campaigns include a pop-up lounge sensory experience with Woodford Reserve at Paris Charles De Gaulle Airport and Jack Daniel’s campaign ‘Make it Count’, across TV, social media, out-of-home and print advertising platforms.

Diageo Global Travel Marketing & Innovation Director Dafydd Pugh Williams spoke about the importance of non-alcoholic drinks and how this is becoming a growth category in itself. He noted that six out of seven consumers have purchased non-alcoholic drinks despite being alcohol drinkers.

Diageo launched its Tanqueray 0.0% in 2021, creating an immersive passenger activation titled Lounge 0.0% at Heathrow Airport Terminal 5. it challenged passengers to test their DrinkiQ, empowering them with the knowledge to make positive drinking choices, and the company again highlighted this drive at TFWA World Exhibition in Cannes recently.

Williams said: “Whereas in the past you may have had a beer in the evening because you are watching the football. [Now] maybe you have got an early meeting in the morning, or the gym, and that occasion still becomes an adult drinking occasion but a non-alcoholic beverage may play an increasing role in that space.

“Ten years ago, it would have been more about respecting Dry January but [abstaining from alcohol] is a lot more mainstream now, and even as people buy drinks for other people, that round is not going to look the same anymore. There will be some people drinking alcohol and some people not drinking alcohol within the same group.

“We know we need to act differently if we want to drive consumption and campaigns like DrinkiQ make it more accessible and engaging for consumers. What’s important for us is liquid integrity so that the non-alcoholic drink tastes the same as the alcoholic drink. There are huge opportunities in the future. We need to think about the final finished drink rather than the spirit itself.

“The sophistication of it sets it apart as a non-alcoholic drink and it’s more enticing to drink that at a party rather than order a coffee or a soft drink. Also being a big brand gives that reassurance of quality.”

Duty Free Global Owner and Commercial Director Barry Geoghegan agreed that digital campaigns are vital in driving sales. A company’s sustainability credentials, he added, have to live up to a certain level that resonates with the consumer.

He said: “Many people think airports look the same. There has to be a catalyst to draw consumers in, otherwise they are going to go to F&B. We need to put sustainable products and travel retail exclusives front and centre of the store and entice passengers in because quite frankly we need to recruit the younger generation.

“You and I grew up in an era where travel retail and duty free were part of the travel experience. It’s in our DNA, but there are other markets that don’t have the same exposure that we had to travel retail and we need to educate people that there is value. We need to employ the real triggers that motivate people to buy.

“The sustainable conversation is clear for all to hear. It’s difficult to communicate that in terms of production but one of the simplest ways is to have a product that is touch and feel. For example a Frugalpack Frugal bottle like Silent Pool Distillers which is five times lighter than glass and tactile. Those type of activation areas need to be close to the entrance of the stores.

“Yes, you need the big brands to draw passengers in too but you also need to show things differently such as craft and theatre, making it attractive to the younger generation who don’t have that duty free culture that we were raised with.

“We know we have got to communicate things digitally. The phone is an extension of people’s arms nowadays. We’ve got to understand that communication is not just about a beautiful store layout and QR codes but there are other things. Through data sharing, we can target those consumers in an effective way that doesn’t serve them irrelevant messages but messages that they consider to be on-trend and in their repertoire of brands and portfolio. Someone needs to champion it and we need to be in it together.”

In conclusion, Geoghegan said he was envious of the time cruise players such as Harding+ can spend with travellers on a cruise ship and how they can share that data with their clients.

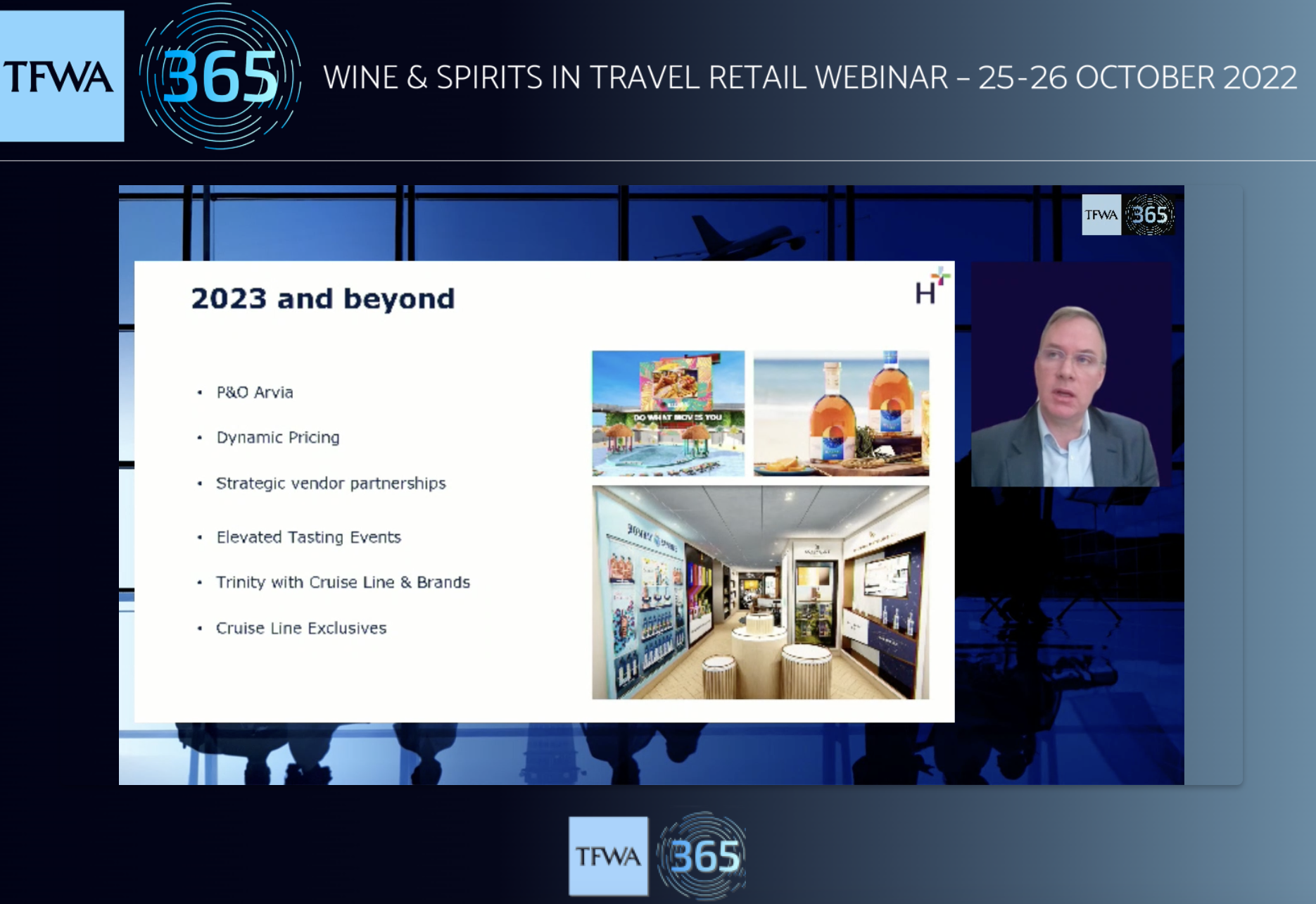

Harding+ Chief Commercial Officer Matthew Hodges had spoken on day one, explaining that the amount of time cruise retail has with guests is seven to 14 days or even longer. This gives the retailer a full spectrum of time-sensitive selling, or repeated visits to a store to understand a range.

Hodges said: “One of the interesting things about the cruise channel is how quickly it has returned to growth. We are growing faster than we ever have and we are already a considerably bigger business than we were pre-pandemic, which is really exciting.

“We are the equivalent of three large airports in terms of access to consumers and we have the ability to spend quality time with them while they are on holiday, when they are in a relaxed state of mind, looking for fun.

“We are part of the guest experience onboard and so everything we do is competing with the theatre, the F&B offer, or the shore excursions, so we know we have to be entertaining.

“Harding+ is a premium business and the liquor business is also premiumising onboard. Some of the new cruise line partnerships allow us to experiment with higher price point products and we have had real success of driving the number of transactions, spend per passenger per day and the average selling price has increased. So we know there is a premiumisation opportunity across the fleet.

“We know that when a brand comes onboard and works with us, we get an immediate impact on sales. There is no substitute for someone from a brand coming onboard and really explaining the history and the latest information about the brand.

“We would like to see brands come to us with a clear strategy in mind of whom they want to target, how they want to target them and then bring that package of support alongside. We can work together to identify the right ship, the right passengers and we can work together on how to bring that to life. For example, Cotswolds Distillery is doing very well and House of Somrus cream liqueur is partnering with us on our Carnival Cruise Line ships. There is also Marabelle gin by Salcombe Distilling Company, which is distilled onboard.

“We are increasingly focusing on data, combining that with our own sales information. We have been looking at five million lines of data across an entire fleet to understand our guest demographics, what they purchase, and this is helping us to design our promotional programme. We are keen to share as much data as possible. In the past the industry struggled with this, but we want to play a more open approach to data sharing.”