SPAIN. Duty free and food & beverage both generated solid double-digit growth in 2016 for Spanish airports operator AENA.

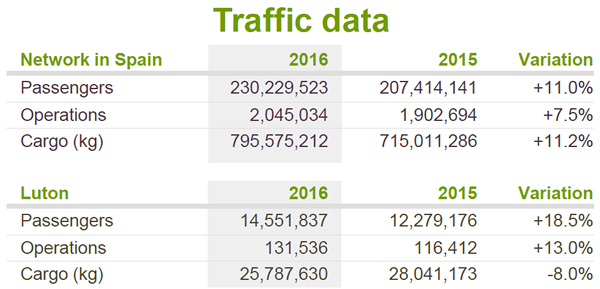

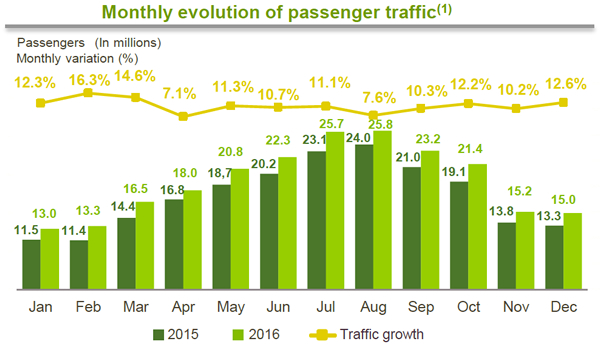

The increases were largely driven by a big hike in traffic (up +11% to 230.2 million) across all AENA’s Spanish airports.

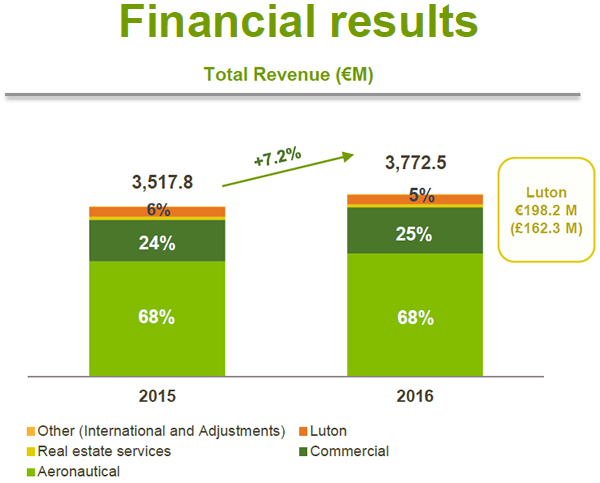

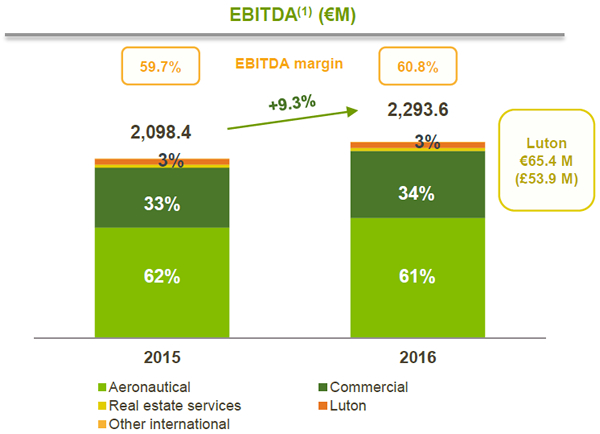

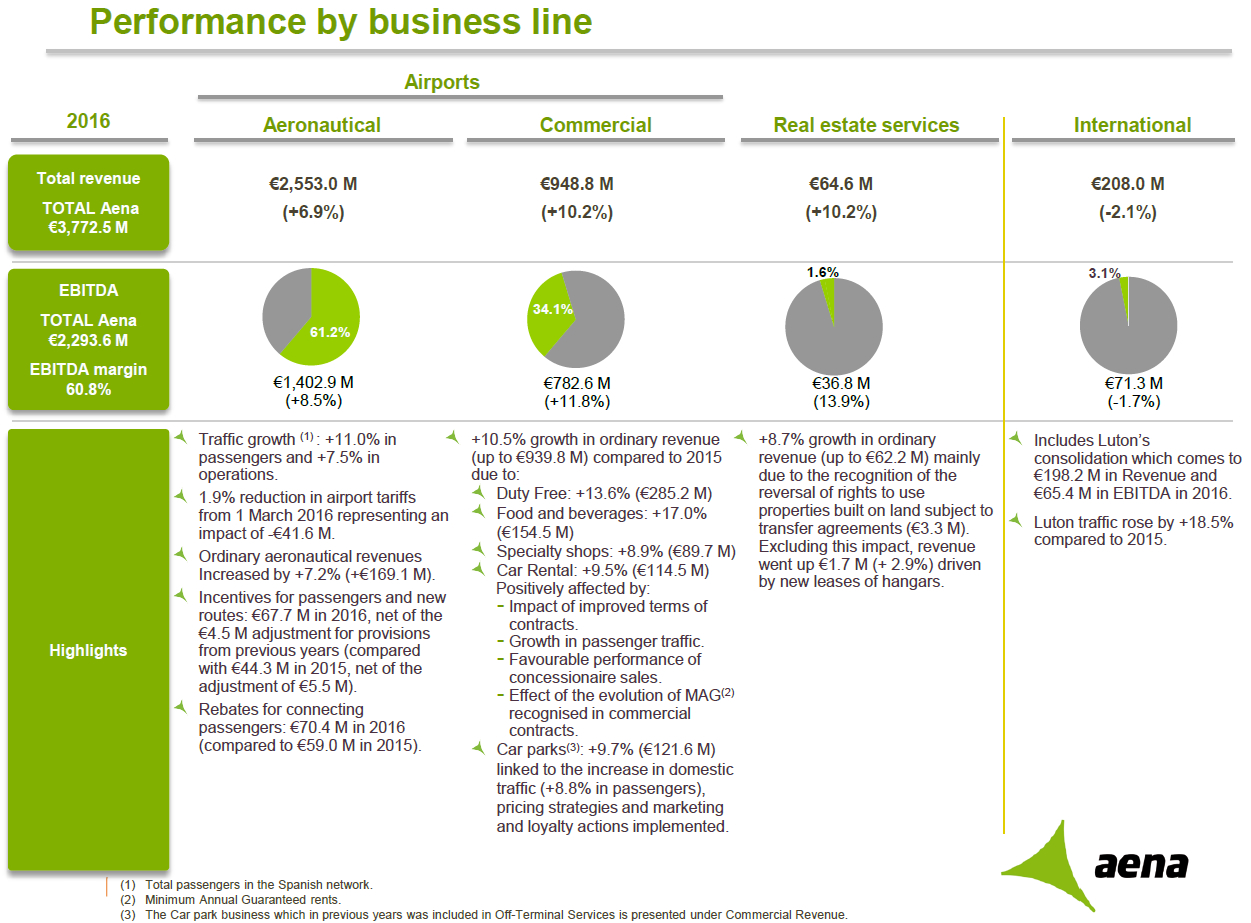

Income from duty free shops – run by Dufry in three lots and operated under the trading name of World Duty Free – saw a +13.6% increase to €285.2 million (US$302.2m), while F&B revenue soared by +17.0% to €154.5 million (US$163.7 million). This compares with total growth at the commercial services division of +10.5% to €939.8 million (US$995.8 million) in ordinary revenue.

AENA posted an +8.9% increase in revenue from speciality shops (see table below) to €89.7 million (US$94.5 million).

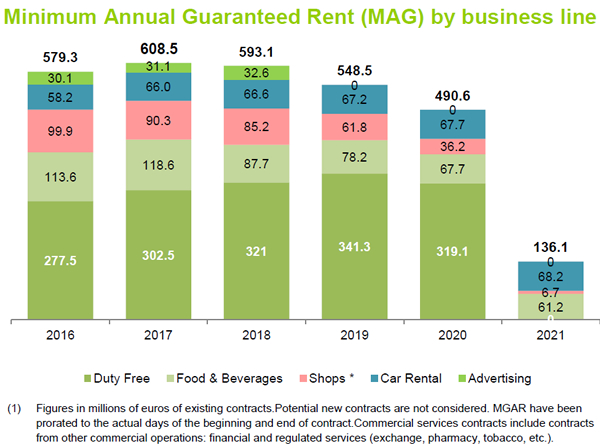

Commenting on its overall performance, AENA said: “The largest contribution to this increase comes from increased passenger traffic, growth in sales of commercial operators, better contractual terms, and the effect of the evolution of the Minimum Annual Guaranteed rents (MAG).” In the specific case of parking, growth of +9.7% to €121.6 million was linked to the increase in domestic traffic (+8.8%) together with successful pricing, marketing and loyalty strategies.

While the overall retail upsurge was strong due to traffic growth, Aena said that commercial revenue per passenger was flat at €4.10, “the same figure as last year”.

Key actions to maintain duty free sales

World Duty Free has 86 outlets at 26 AENA airports with a total area of approximately 45,000sq m. These stores generated 28.4% of AENA’s commercial revenue last year.

The airport operator cited several key actions in helping to keep spending levels on par with 2015. Among the most important were: price repositioning at Adolfo Suárez Madrid–Barajas and Barcelona–El Prat airports of 400 brand leaders in beauty, 70 in alcoholic beverages, with discounts of up to -20% “compared to mirror establishments”; increased promotions such as advertising campaigns and price-offs; exclusive travel retail releases such as the Cristiano Ronaldo fragrance at Madrid-Barajas; and the launch of a ‘Reserve & Collect’ service (booking online for pick-up in-store) and the RED loyalty programme.

F&B flies high as spend per head rises

According to AENA, the strong +17% performance from F&B was attributable to expanded 320-outlet offer implemented after some intense renovation work in recent years. This drove a growth in spend per passenger.

The airport group said: “We can cater for those passengers who have little time and want standard products with very fast service, through fast food in all ranges – burgers, sandwiches, sandwiches – ranging to those travellers who have more time and want to enjoy new experiences through ‘signature cuisine’.”

Among Aena’s F&B brands are mainstays such as McDonald’s and Burger King, Mas que Menos, Costa Coffee, Starbucks, Coffee Republic, Lavazza, Paul, Rodilla, as well as four restaurants with Michelin-star chefs: at Madrid-Barajas there is Kirei by Kabuki with Ricardo Sanz (in T1 and T4) and Gastrohub (T4) with Paco Roncero; while Barcelona-El Prat features Porta Gaig and GastroBar by Carles Gaig and Malaga-Costa del Sol offers Delibar with Dani Garcia.

Aena noted that catering tenders at airports in Fuerteventura (six outlets) and Ibiza (nine) will result in new outlets this year.

A word on Brexit…

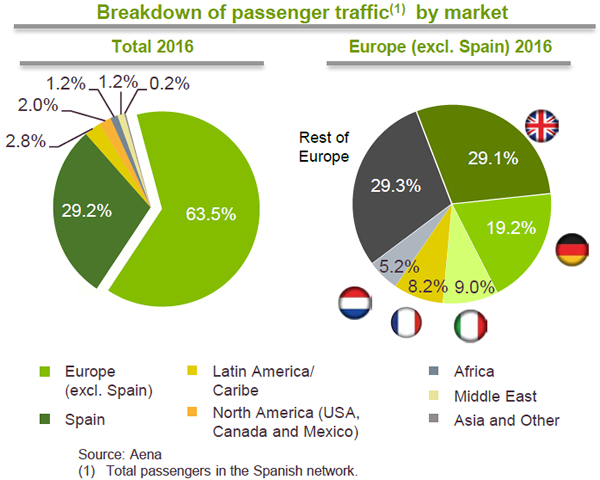

AENA noted how crucial the British traveller – as the top foreign nationality at its airports – is to its business. Commenting on traffic growth in Spain in January 2017 of +10.0% the airport operator said it reflected strong tourism growth which “has not been adversely affected by Brexit”.

In 2016, British passenger growth stood at +15.7% year-on-year (+5.7 million additional passengers) with no month posting an increase of less than +12.6%”. But while total numbers have increased since Brexit, spend per passenger by British travellers is “experiencing a downward trend”, AENA noted [a dynamic almost certainly driven by the Pound Sterling’s decline against the Euro since Brexit -Ed].