UK. Retail revenue rose by an “outstanding” 8.6% at Heathrow Airport in 2018 to £716 million (US$933 million), outstripping passenger growth of 2.7% to a record-breaking 80.1 million.

Retail revenue per passenger, a key indicator of commercial performance, rose 5.8% to £8.94. Heathrow defines retail revenue as concession income from duty free and other retailers, food & beverage operators, car parking and other services.

Adjusted EBITDA climbed 4.4% to £1,837 million (US$2,394 million).

Describing the retail performance as “outstanding”, Heathrow Airport said that its passengers had responded strongly to several successful retail initiatives.

“We are seeing more passengers participating in our retail offering with each spending more on average,” the airport company said. “As a result of these dynamics, total revenues were almost £3 billion, up 3% compared to 2017.”

The company added, “Retail revenue growth was strong across all revenue streams with retail concessions reflecting higher passenger numbers as well as our ‘call to gate’ initiative which increases passenger dwell time in the departure lounge.

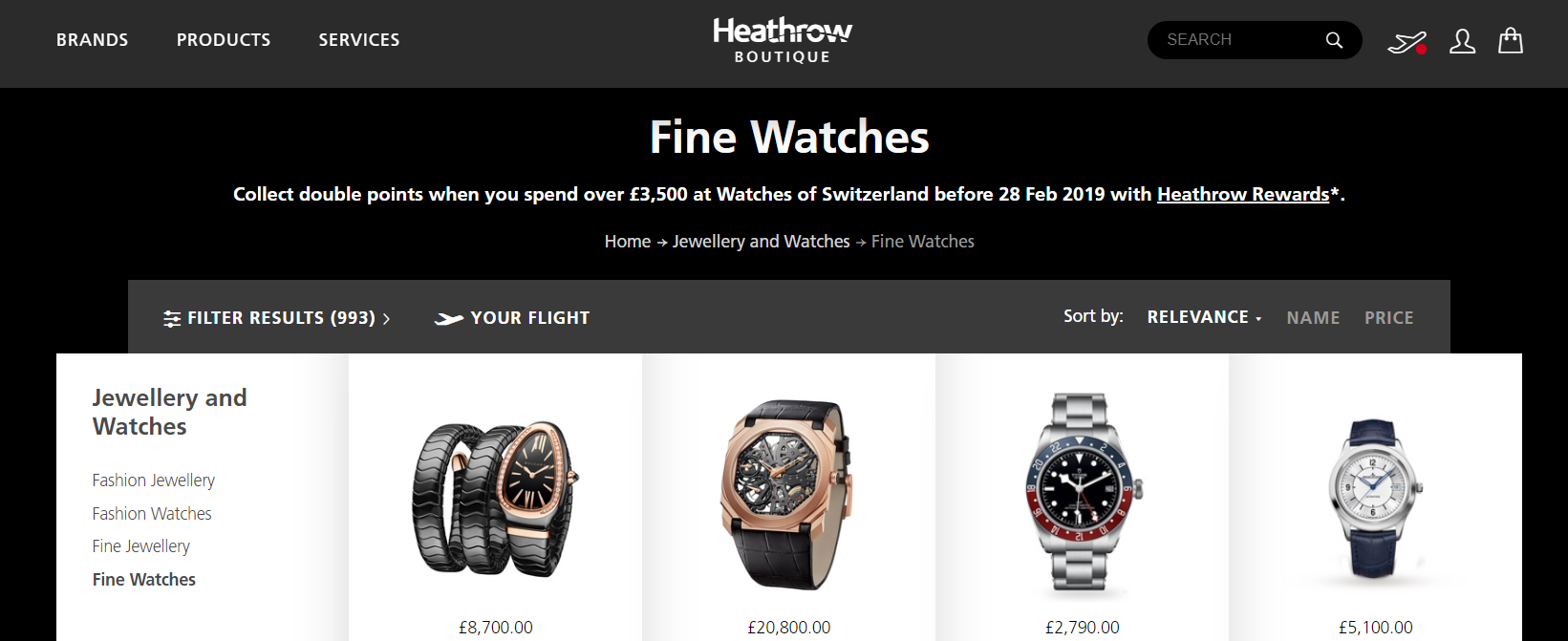

“Retail concessions were additionally boosted by the roll-out of new digital capability on Heathrow Boutique [the enhanced digital marketplace developed in partnership with Kian Gould’s global technology service provider AOE -Ed], allowing customers to reserve and collect their shopping, with 52 brands now offering this service. Catering also benefitted from the call to gate initiative, and strong performance in the year was further enhanced by refurbishments in Terminals 3 and 5, as well as Grab & Go offerings for passengers to take meals on flights.

“Other retail reflects a significant increase in advertising income from improved utilisation of advertising spaces.”

Retail openings in the period included Anya Hindmarsh (Terminal 5) and Pink and Mulberry (Terminal 4). Advertising (driven by airport partner JCDecaux) also performed strongly, Heathrow said.

Heathrow Chief Executive Officer John Holland-Kaye said: “2018 was the best-ever year at Heathrow. We were voted best airport in Western Europe by passengers, while continuing to drive down costs. We improved safety and closed our gender pay gap. We were named ‘Responsible Business of the Year’ and won an overwhelming parliamentary majority in support of Heathrow expansion.

“We remain on track to open the new runway in 2026. I am very proud of the outstanding work of 76,000 colleagues across the airport, who are delivering for Britain.”

In a key boost for retail, Heathrow doubled its Chinese connections in 2018, adding six new cities including Europe’s only flight to Shenzhen.

Note: Click here for the first interview with Heathrow Airport’s new Retail Director Fraser Brown, published earlier this month. He notes, “We are continuing to see strong retail growth at Heathrow and we hope this will continue into 2019 as we look to optimise our retail offer, from smaller pop-ups to more significant developments.”