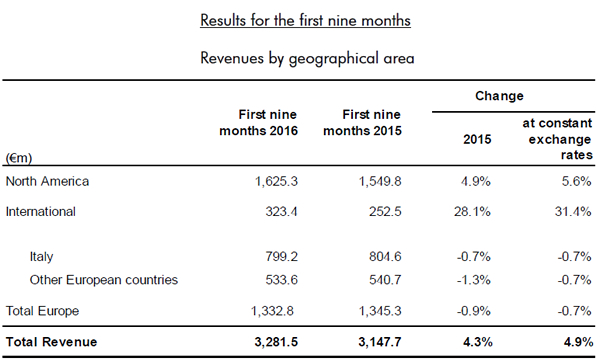

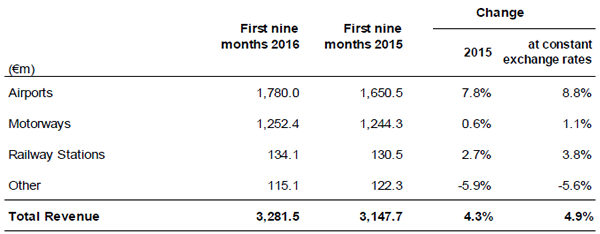

INTERNATIONAL. Autogrill Group today reported consolidated nine-month revenues of €3,281.5 million, a rise of +4.3% year-on-year (+4.9% at constant exchange rates). EBITDA climbed by a healthy +11.4% (+12.1% at constant rates) to €320.2 million.

Net profits leapt by +73.6% (+75.1% at constant rates) to €97.6 million. This was driven partly by capital gains from disposals of the group’s French railway station business, but also by sharp margin improvements across the world, said Autogrill.

The revenue figures were buoyed by “an excellent performance” at airports in North America and by the International division, said the company.

The +4.3% increase (or €133.8 million) was the result of like-for-like growth of +2.8%, a positive balance between new openings and closures of +2.5% and a net reduction of -0.8% generated from the disposals of the US Retail division and the French railway station business and the acquisition of Concession Management Services (CMS), which runs stores at Los Angeles and Las Vegas airports. Its figures were included for around one month in the latest interim accounts. The effect of Euro conversion of sales in other currencies (mainly US Dollars) had a negative impact of -0.7%, while the different calendar (leap year and reporting year) had a positive effect of +0.4%.

Sales in the airport channel rose +7.8% (+8.8% at constant rates) in the nine months. This was driven by higher revenues in North American airports and strong growth in Northern Europe and Asia, which also benefited from new openings in 2015 and 2016.

In the International division, Autogrill secured a number of new contracts in the airport channel. In Europe, it disposed of its French railway station operations and negotiated the sale (completed in November) of its motorway service areas in The Netherlands, which included hotel business which was deemed non-core. As recently reported, HMSHost re-entered the airport convenience sector by completing its acquisition of Stellar Partners in October.

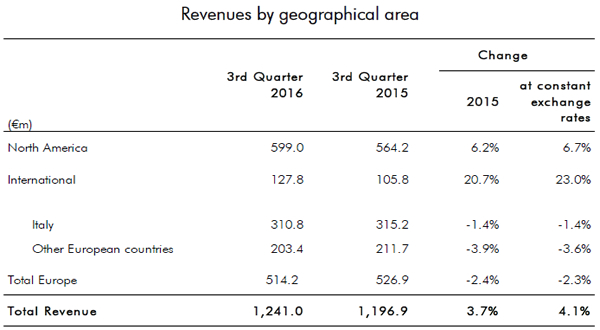

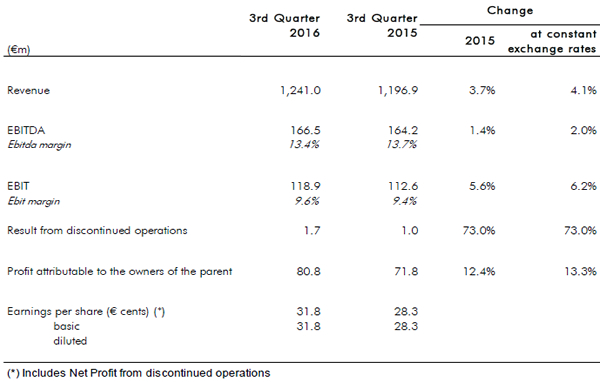

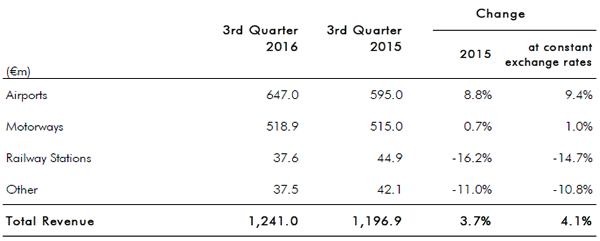

Consolidated revenues in Q3 2016 amounted to €1,241 million, up +3.7% (+4.1% at constant rates) year-on-year. Sales in the airport channel were up +8.8% (up 9.4% at constant rates), driven mainly by the revenue performance in airports in the USA, Northern Europe and Asia.

Consolidated EBITDA in Q3 amounted to €166.5 million, up +1.4% (+2.0% at constant rates) on the same period in 2015, with a ratio to revenues of 13.4% (13.7% in Q3 2015). The lower margin was mainly due to rising labour costs, in line with the trend being seen across the US foodservice and retail sectors, noted the company. It also incurred start-up costs and a number of inefficiencies in connection with recent new contracts in Northern Europe and Asia, it said.

Q3 net profits for the shareholders of the parent company amounted to €80.8 million, up by +12.4%, or +13.3% at constant rates.

HMSHost performance

HMSHost North America revenues in the first nine months amounted to US$1,814.2 million, up +6.1% (+5.5% at current rates) on the first nine months of 2015.

The rise was the result of like-for-like growth of +4.1% and a positive balance of new openings and closures (+1.8%). The transfer of the US Retail division and the acquisition of CMS in August 2016 had a negative net effect of -0.3%, while US Dollar conversion of sales in Canada had a negative effect of -0.6%.

Airport channel revenues were up +7% (+6.5% at current rates), with particularly marked growth in Q3. Healthy growth in average spend in both the USA and Canada was compounded by the widening of activities in certain airports (Houston and Toronto in particular), said the group.

HMSHost’s EBITDA in North America in the first nine months reached US$211.5 million, up +3.9% (+3.5% at current rates) on the same period in 2015.

EBITDA margin was 11.7%, substantially in line with 11.8% in the first nine months of the previous year. This stability was the result of two balancing trends: on one hand an improvement in the cost of sales due to lower raw material prices and efficiency initiatives launched in prior years. On the other, rising labour costs affected the entire foodservice sector, it said, with increases in the average hourly cost and in indirect charges.

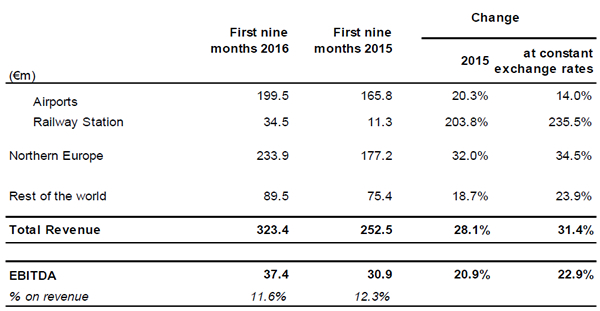

International division

Revenues in the International zone in the first nine months amounted to €323.4 million, up +31.4% on the same period in 2015 (+28,1% at current rates).

(The International region includes parts of Northern Europe (Amsterdam Airports, Dutch railway stations, the UK, Ireland, Sweden, Denmark, Finland and Norway) and the rest of the world, including United Arab Emirates, Turkey, Russia, India, Indonesia, Malaysia, Vietnam, Australia, New Zealand and China).

This sharp rise was the result of like-for-like growth of +10.2% and a positive balance of new openings and closures of +17.9%. The different calendar (leap year and reporting) had a positive impact of +3.3%, while the effect of Euro conversion of sales made in other currencies had a negative impact of -3.4%.

The +34.5% growth in revenues in Northern Europe (+32% at current rates) was due to an “excellent” performance at Amsterdam Airport Schiphol (driven by the increase in passenger traffic), entry to the railway station channel in The Netherlands and the widening of activities in the UK and Finland.

The +23.9% increase in revenues in the Rest of the world (+18.7% at current rates) reflects strong growth by operations in Vietnam (Ho Chi Minh City Airport in particular) and Bangalore and Hyderabad airports in India.

EBITDA in the International arm amounted to €37.4 million, up +22.9% on the same period a year earlier (+20.9% at current rates), due mainly to the effect of higher sales. The ratio to revenues fell from 12.3% in the first nine months of 2015 to 11.6%, reflecting inefficiencies in the start-up phase of operations in Dutch railway stations.

In the first 43 weeks of the year sales were up +4.3% (up +4.9% at constant rates) compared to the same period in 2015.

The group confirmed the guidance issued to the market. with revenues for full-year 2016 to be between €4,465 million and €4,565 million, EBITDA between €411 million and €426 million and capital expenditure of around 5% of revenues.