SOUTH KOREA. The slump in Chinese visitor arrivals to South Korea continued to ease in December. Chinese arrivals were down -37.9% year-on-year in December to 332,474, representing 29.3% of the total.

Although this is a poor result in isolation, it continues the improvement seen in November (-42.1% to 299,247) amid an apparent resolution to the THAAD anti-missile system dispute between the two countries. It is also significantly better than the successive -66.6%, -64.1%, -66.4%, -69.3%, -61.2%, -56.1% and -49.3% monthly declines from April onwards.

South Korean duty free retailers claim to have been particularly hard hit by the fall in Chinese tourism. In 2016, Chinese visitors accounted for 46.8% of total arrivals but near 70% of duty free spending.

As Korean Duty Free Association figures showed though, the South Korean duty free market posted a +20.7% sales increase last year to a record US$12.8 billion despite the collapse in Chinese tourism.

The apparent contradiction is explained by the daigou (shuttle trader) phenomenon that reached new, often frenzied heights last year – as average spend per person from foreign customers rose +69% year-on-year.

In August, the excellent Chinese travel and luxury report Jing Daily (with whom The Moodie Davitt Report works closely) ran a hard-hitting report entitled, ‘Korean Duty-Free Shop Sales Increase Due to Illegal Daigou Shoppers’.

The article said: “The [March] ban on tourist groups allowed independent daigou shoppers to dominate the gray market, many of them leveraging social media to take requests online and travel to duty free stores with a specific purpose in mind.”

It continued: “Duty free shops are also willing to pay a high cost to work with KOLs in China to maximise those marketing messages. But fearful of the political impact, many of the KOLs turned down the tempting offers, leaving daigou to become the last straw for duty free stores.”

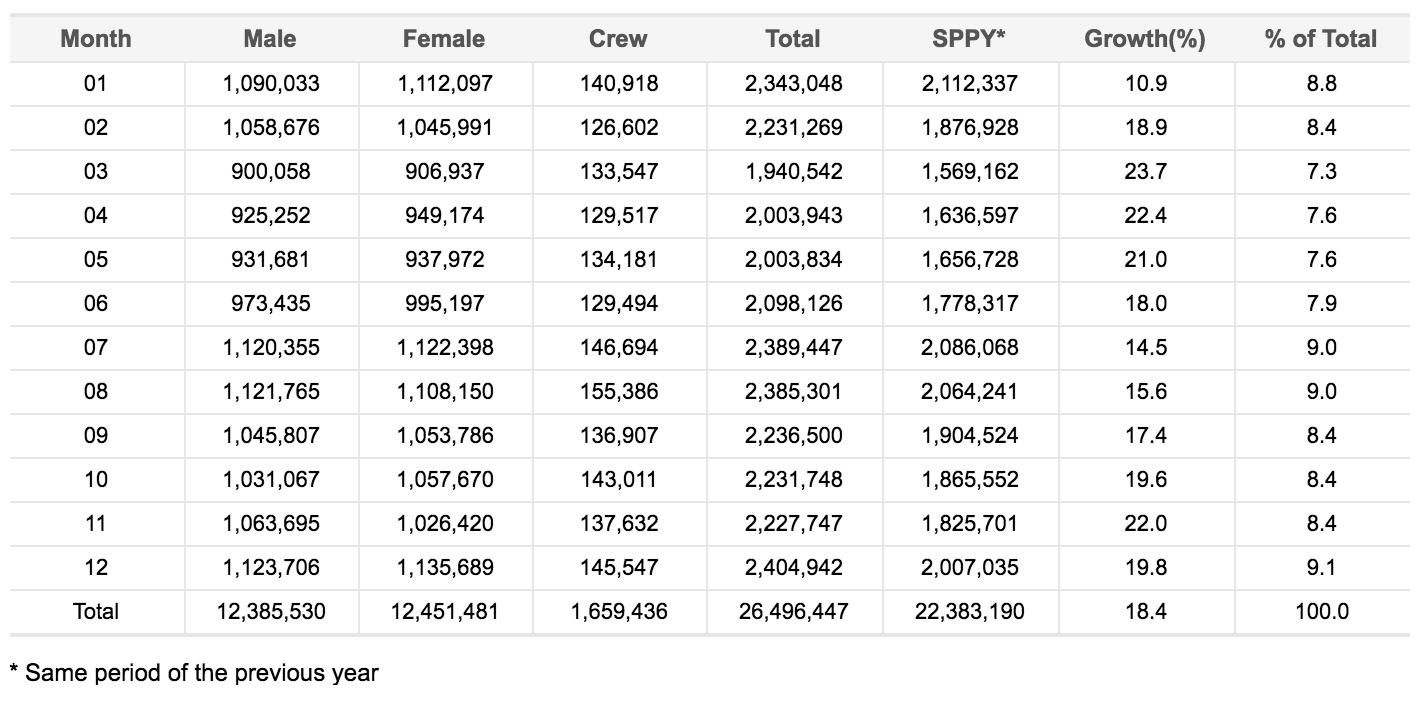

Japanese arrivals were down -1.8% in December to 193,705, while Korean departures maintained their robust 2017 performance with a +19.8% rise to 2,404,942.

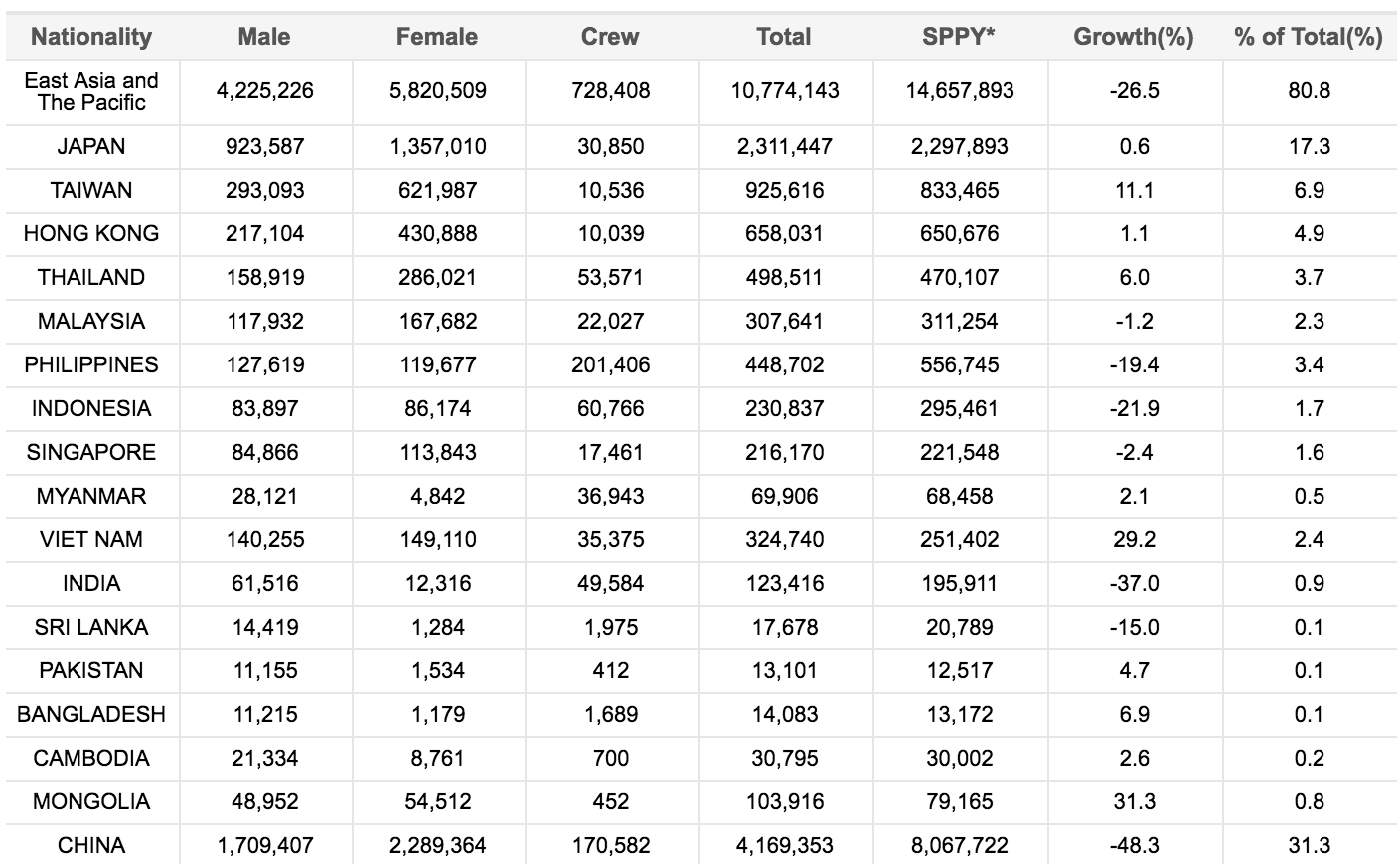

Korean departures rose +18.4% in 2017, while Chinese arrivals fell -48.3% and Japanese arrivals edged ahead by +0.6%.