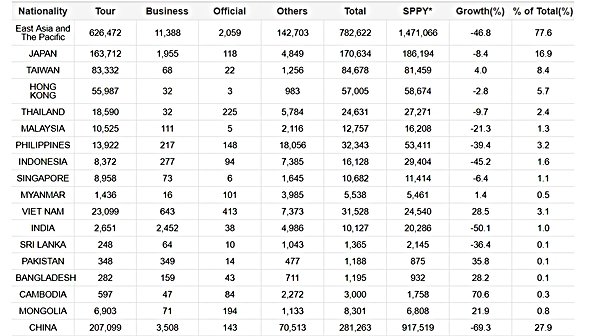

SOUTH KOREA. Chinese visitor arrivals to South Korea continued their alarming slump in July – plummeting by -69.3% year-on-year to 281,263, according to Korea Tourism Organization statistics.

SOUTH KOREA. Chinese visitor arrivals to South Korea continued their alarming slump in July – plummeting by -69.3% year-on-year to 281,263, according to Korea Tourism Organization statistics.

The market collapse is being driven by the THAAD dispute between South Korea and China. As reported, South Korea’s decision to deploy the US defence system infuriated the Chinese government and led to a backlash against Korean companies.

The tourism and travel retail sectors, heavily dependent on Chinese visitors, have been calamitously affected. On 15 March China imposed a ban on group tours to South Korea, leading to a -40% year-on-year fall in Chinese arrivals in March, a drastic -66.6% decline in April, a -64.1% slump in May, a -66.4% decrease in June and now the year’s worst monthly result.

Chinese arrivals in July represented just 27.9% of all visitor arrivals. This compares to a 53.9% share in July 2016, a percentage that grows much higher (65-70%) in terms of share of duty free purchasing.

The industry’s troubles were reflected in sector giant Lotte Duty Free’s operating loss of KW29.7 billion (US$26.1 million) for the second quarter ended 30 June – its first quarterly loss since the SARS crisis of 2003.

Other crucial factors to have hurt retailer profitability this year include a 20-fold increase in the duty free licence annuity (from 0.05% to 1% of turnover), punishing concession fees at Incheon International Airport and a heavy proliferation of duty free licences.

For the first seven months of 2017, Chinese arrivals were down by -46.5% year-on-year to 2,534,178.

Nor did Korean travel retailers find any solace in the performance of the sector’s second-most important foreign visitor group, the Japanese. Arrivals by Japanese fell by -8.4% in July to 170,634, a 16.9% share of total visitors. For the first seven months though, Japanese arrivals increased by +4.2% to 1,277,918.

More positively, Korean departures climbed by +14.5% in July to 2,389,447, and +18.0% in the first seven months to 15,010,209.