Moodie Davitt snapshot: Hotel Shilla fourth quarter results – Travel retail division posts 38% year-on-year increase in revenues – Offshore business nears breakeven point – Operating profit falls well short of market expectations – Airport revenues rise 49.7%; downtown up 31% – Korean performance boosted by T2 opening and return of Chinese travellers and daigou trade – Introduction of new Chinese e-commerce law presents uncertain outlook – Shilla expects strong Q1 with Lunar New Year boost and stabilisation of overseas airport operations Source: The Moodie Davitt Report |

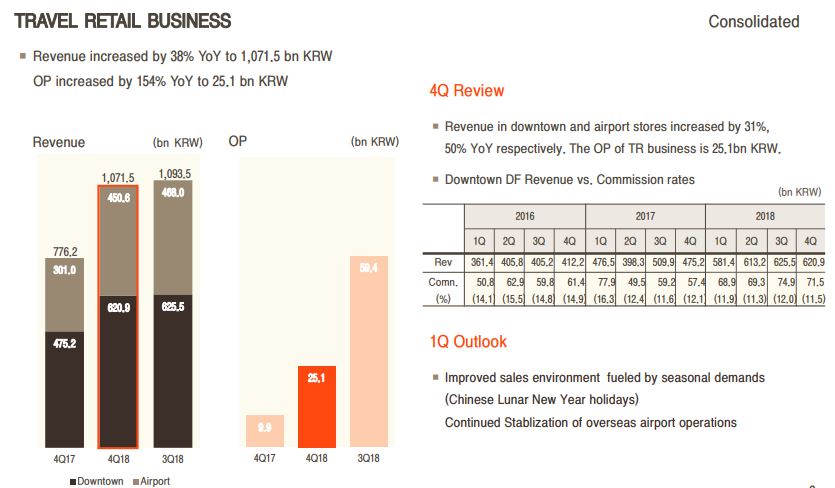

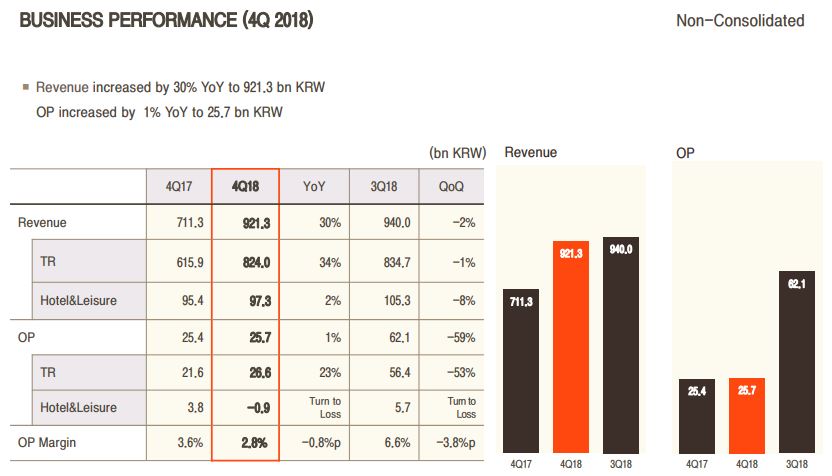

SOUTH KOREA. Hotel Shilla’s travel retail division The Shilla Duty Free recorded a 38% year-on-year increase in consolidated revenues in the fourth quarter of 2018, to KRW1,071.5 billion (US$958 million).

The consolidated figure includes the retailer’s Korean and offshore duty free business.

Operating profit in the division rose by 154% to KRW25.1 billion (US$22.4 million). However, a one-off impairment loss of KRW50 billion (US$44.7 billion), relating to a company loan to Dongwha Duty Free, prompted a net loss of KRW21 billion (US$18.8 million) for the quarter.

Operating profit disappoints

Operating profit of KRW26.6 billion (US$23.8 million) for the company’s Korean business fell short of market expectations. Local sources attributed this to heavy concession fees at Incheon International Airport Terminal 1 and start-up investment costs for Seoul Gimpo Airport (opened on 9 January this year).

One analyst told The Moodie Davitt Report: “Results were way below expectations with inventory clearing and higher rent fees bogging down profitability.”

The inventory clearing was linked to the desire by Korean retailers to move stock ahead of China’s introduction of a new e-commerce law on 1 January (see below for more details).

The company’s airport duty free business, spurred by the opening of Incheon International Airport T2 on 18 January 2018, delivered a 49.7% revenue rise, to KRW450.6 billion (US$403 million). In downtown duty free, revenues rose 31%, to KRW620.9 billion (US$555.2 million).

Extrapolating the overseas performance from the two sets of results, shows that The Shilla Duty Free’s offshore business (Changi, Hong Kong and Macau airports and Phuket and Tokyo downtown) posted sales of KRW247.5 billion (US$221.2 million). The overseas stores recorded an operating loss of KRW1.5 billion (US$1.34 million) – a sharp improvement on the KRW11.7 billion (US$104.6 million) loss in the same period a year earlier but down on the breakeven point reached in Q3.

The average tour agency commission rate in the Korean downtown business (see chart below) eased slightly year-on-year, from 12.1% in the fourth quarter of 2017 to 11.5% in the same period of 2018.

What next for the daigou business?

Shilla was buoyed by the continued recovery in Chinese tourism to South Korea as the THAAD dispute eased. At top-line level it was also boosted by the booming daigou (shuttle trader) phenomenon that dominated Korean duty free throughout 2018.

This trade involves hundreds of thousands of Chinese shoppers purchasing Korean and international duty free goods for customers in Mainland China at well below prevailing Chinese domestic prices and then reselling them.

The impact of the Chinese government’s new e-commerce law introduced at the beginning of 2019, which was designed in part to crack down on the daigou trade, remains to be seen. Some analysts have warned of a tough environment for South Korea’s duty free sector in 2019. Others believe that after a short blip, daigou traders drawn by the big price differential between Korean duty free and China domestic, will find a way to respark the unofficial channel.

Shilla though predicted an improved sales environment for the travel retail business in the first quarter fuelled by seasonal demands, and particularly the Lunar New Year holiday. The retailer also said its overseas airport operations would continue to stabilise.