Full-year 2018 net sales at global eyewear group Safilo slumped by 4% at constant exchange rates (and 7% at current exchange rates). All regions except Asia Pacific experienced a downturn.

Full-year 2018 net sales at global eyewear group Safilo slumped by 4% at constant exchange rates (and 7% at current exchange rates). All regions except Asia Pacific experienced a downturn.

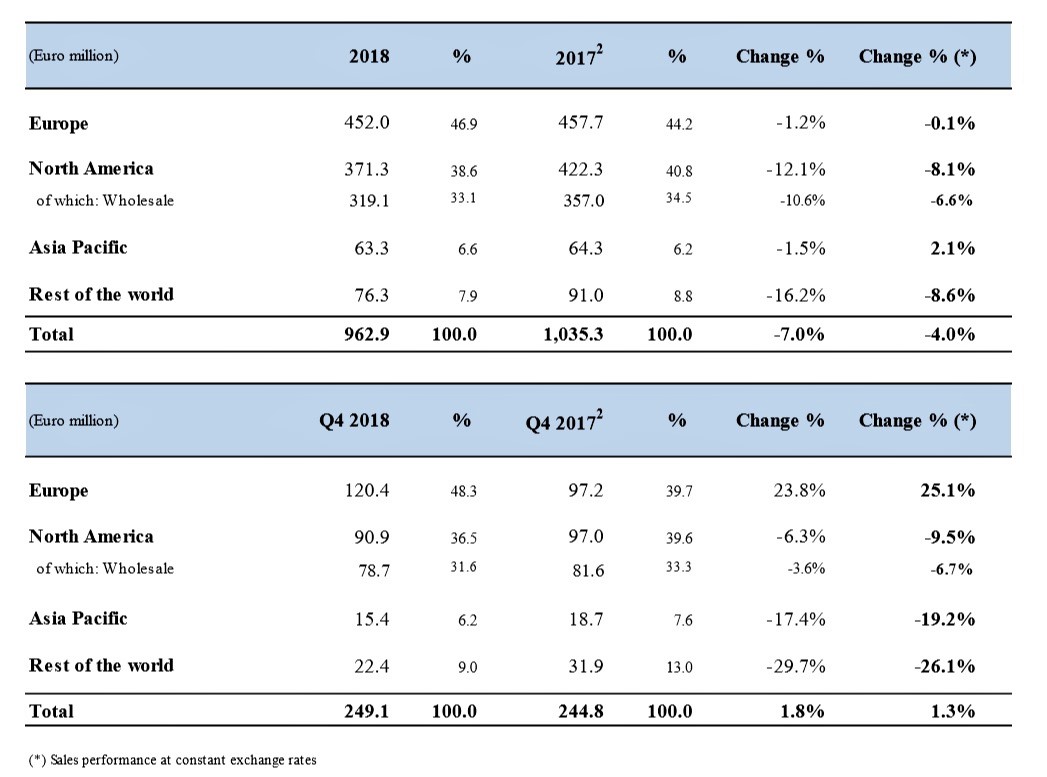

Preliminary results show that the Milan-listed company – whose licensed brands in travel retail include Boss, Dior, Fendi, Givenchy, Jimmy Choo, Marc Jacobs and Tommy Hilfiger – generated revenue of €962.9 million (US$1,099 million) for the year ended 31 December, 2018.

This was down from €1,035.3 million (US$1,182 million) in 2017, while in 2016 sales were €1,252.9 million. Not since 2004 has the company recorded sales below €1 billion.

According to Safilo the 2018 performance “is substantially in line with the expectation formulated by the group on net sales for the year”.

By region, Europe – with a 46.9% share of revenue – was essentially flat (down 0.1%). North America, which has a 38.6% share, declined by 8.1%. Asia Pacific, with a share of 6.6%, grew by 2.1%, and the rest of the world, accounting for 7.9% of revenue, was down by 8.6% (see table above).

Final quarter offers a reprieve, as does travel retail

While the full-year result was negative, the final quarter of 2018 suggested a possible change of fortunes. Sales in the core region of Europe increased by 25.1%, driving a 1.3% increase for the period.

It should be noted that a production agreement with luxury goods group Kering is reported within the Europe geographical area. Europe excluding this business declined by 4.5% at constant exchange rates in the full-year 2018, and grew by 9.8% in the fourth quarter.

Safilo executed a cost-savings programme in the second half of 2018 as part of a wider 2020 Group Business Plan to regain momentum. Among its goals is to put more focus on its own brands such as Carrera, Polaroid, and Safilo; accelerate growth in the premium and contemporary segments; drive the optical business; grow in emerging markets; and launch an omnichannel strategy. The company believes that with this multi-prong approach it will be back to growth from 2019-2020.

Across Safilo’s divisions, duty free and travel retail has been the best performing and the company has earmarked it for development. An acceleration plan is in place for the channel over the next three years in order to drive even faster growth.