|

“The focus for 2016 has been to drive organic growth, to generate cash to deleverage, and to integrate the WDF business.” |

Julián Díaz CEO Dufry |

INTERNATIONAL. Dufry Group today hailed a sharp upturn in organic growth and continued recovery in some key markets as it revealed nine-month results to 30 September.

Turnover increased by +39.4% in the first nine months to reach CHF5,877.2 million (US$6.05 billion) as the impact of last year’s acquisition of World Duty Free continued to feed through into its results.

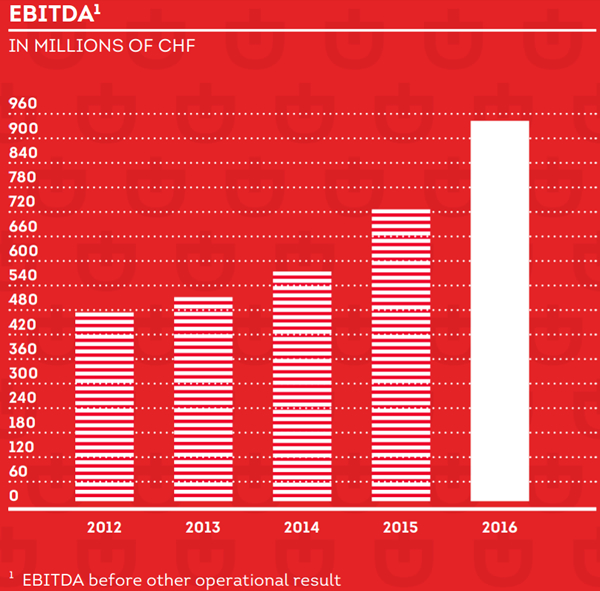

EBITDA was CHF685.4 million (US$706 million), +34.9% higher compared to the first nine months of 2015.

Changes in scope, which include the acquisition of World Duty Free (WDF), added +42.0% to turnover growth, while the foreign exchange impact stood at +0.6%. Net new concessions contributed 0.6 percentage points to the organic growth (including WDF) and +0.8% on a reported basis.

Crucially, Dufry accelerated organic growth (including WDF) to +1.3% in the third quarter, compared to a performance of -2.9% in the second quarter.

Most of its divisions have had either a stable or improved performance in Q3, noted the company.

In Europe, Spain continued its “strong performance” driven by increasing passenger numbers. Performance also accelerated in the UK, positively affected by the weakening of the British Pound, while locations exposed to Russian consumers, Turkey in particular, continued to be hit by the reduced number of tourists. Brazil had a “distinct performance improvement” as the Brazilian Real recovered over the quarter and even appreciated against the US Dollar from August.

By September Dufry had opened over 27,000sq m of gross new commercial space, which includes the expansion of its operations in Cambodia (1,500sq m), Macau (600sq m) and Lima (2,000sq m), among others. In Brazil, operations in Rio de Janeiro have been revamped and the commercial space more than doubled to 11,800sq m, including the addition of five new shops.

Dufry has signed agreements for an additional 26,800sq m of retail space, which is expected to open throughout the remainder of 2016 and 2017.

Dufry Group CEO Julián Díaz said: “The focus for 2016 has been to drive organic growth, to generate cash to deleverage, and to integrate the WDF business. Now at the end of the third quarter, we have delivered on all the points.

“During the third quarter, our initiatives have begun to show positive results. We saw a distinct improvement in the business which finally brought organic growth of 1.3% back to positive territory. As to the growth drivers, major contributions came from Spain, with its ongoing good performance, and the UK showing increasing sales since the devaluation of the GB Pound. Last but not least, we had a clear improvement in the performance of Brazil. The year-on-year strengthening of the Brazilian Real versus the US Dollar has given back the purchasing power Brazilians were lacking in the past three years.

“In terms of generating cash and deleveraging, we continued to have a strong financial performance with a substantial growth in free cash flow generation and a further reduction of our debt levels. Since the beginning of the year, our net debt reduced by almost CHF400 million.

“The integration of World Duty Free continues on track. On the cost side, we already completed most initiatives and we have implemented yearly efficiencies of CHF59 million, which is at the upper end of the estimated range of CHF50-60 million. With respect to the gross margin synergies we are currently finalising the implementation and synergies will build up [through] 2017. We confirm the total of CHF105 million synergies, which will sequentially be reflected in the financials over the coming quarter and in 2017.

“This set of results represents in many ways the strengths of Dufry’s business model, from the turning point to a positive organic growth, to the substantial deleverage achieved in the quarter and the well-advanced implementation of synergies of the World Duty Free integration. Should current conditions and trends remain unchanged, we would expect a further improvement in the next quarters.”

Performance by region: Southern Europe and Africa

Turnover reached CHF 1,319.3 million in the first nine months of 2016, from CHF 894.5 million one year before. Spain continued to grow strongly and operations in France also performed well. The business in Turkey was negatively impacted by the decline in tourist numbers, especially Russians. Greece held up well and posted a low single digit sales decline.

UK, Central and Eastern Europe

Turnover grew to CHF 1,576.6 million in the year to September, versus CHF 867.9 million in the same period in 2015, while the underlying growth in the division was +0.8%. Business in the UK accelerated in the third quarter, positively impacted by the weakening of the British Pound. Other operations in Europe, such as Finland and Switzerland, had positive performances. Operations in Russia and other Eastern European locations remained in negative territory, but with improving trends.

Asia, Middle East and Australia

Turnover amounted to CHF569.4 million in the first nine months of 2016, from CHF439.6 million in the same period in 2015. Underlying growth in the division was flat. Performance in the Middle East was good, as was the case in India. In Asia, South Korea continued to see double-digit sales growth, mitigating some Asian locations where a lower spend from Chinese consumers was seen.

Latin America

Turnover climbed to CHF1,116.9 million in the first nine months of 2016 versus CHF 1,013.4 million one year earlier. The underlying performance in the region was negative at -6.7% in the nine months, to which the third quarter contributed a positive +2.1%. In Central America and the Caribbean, most operations confirmed their positive performance, including Mexico and most of the Caribbean. In South America, Brazil continued to improve by turning positive in Q3 and recording double-digit growth in September. Peru and Chile also performed well in the third quarter. While Argentina reported a slight improvement, it remained overall in negative territory.

North America

Turnover reached CHF1,245.2 million in the first nine months of 2016 from CHF968.0 million in the previous year. Underlying growth reached +3.8% in the nine months, while in Q3 it reached +4.7%. Duty-paid formats such as Hudson continued their strong performance, noted the company. On the duty free side, the stronger US Dollar positively affected operations in Canada and had the opposite effect in the USA.

Key financials

Key financials

Gross profit margin improved by 30 basis points and reached 58.4% in the first nine months of 2016, versus 58.1% in the same period last year. The improvement was mainly driven by the synergies from the Nuance integration and constitutes what Dufry claimed was “a remarkable result”, considering that the reduced contribution of the Turkish operation impacted the gross profit margin by 40 basis points.

As noted, EBITDA grew by +34.9% and reached CHF685.4 million in the first nine months of 2016. EBITDA margin stood at 11.7% in the first nine months of 2016, which includes synergies from the Nuance acquisition.

EBIT grew by +44.3% and reached CHF193.6 million in the first nine months. Depreciation, as a percentage of turnover, remained practically flat at 2.0% in the nine months, compared to 2.1% in the previous year. Amortization reached CHF91.8 million in the third quarter of 2016, slightly lower compared to the second quarter 2016 (CHF 96.7 million). Linearization was CHF -45.3 million in the first nine months of 2016, and CHF 7.5 million (positive) for the third quarter. Finally, other operational results (net) reached CHF -42.9 million, mainly due to restructuring related costs, as well as opening costs of new projects.

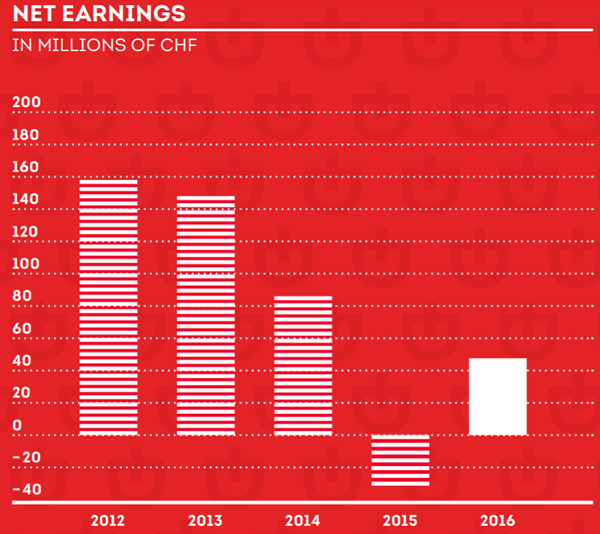

Net earnings to equity holders were CHF +0.2 million in the first nine months of 2016, compared to CHF -37.3million in the previous year. Financial results reached CHF53.1 million in the third quarter of 2016, close to the CHF48.1 million reported in Q2.

Cash earnings grew by +83.9% in the first nine months of 2016 and reached CHF244.5 million versus CHF132.9 million last year. The respective Cash EPS increased to CHF4.55, from CHF3.08 in the first nine months of 2015. In the third quarter 2016, Cash EPS more than doubled to CHF2.86 from CHF1.17 in Q3 2015.

Cash earnings grew by +83.9% in the first nine months of 2016 and reached CHF244.5 million versus CHF132.9 million last year. The respective Cash EPS increased to CHF4.55, from CHF3.08 in the first nine months of 2015. In the third quarter 2016, Cash EPS more than doubled to CHF2.86 from CHF1.17 in Q3 2015.

Free cash flow before interest increased by +64.1% and reached CHF535.7 million in the first nine months of 2016, compared to CHF326.4 million in the same period in 2015. Capex for the nine months to September 2016 amounted to CHF197.6 million.

Dufry continued to deleverage in the third quarter and net debt was reduced to CHF3,566.1 million at the end of September, CHF389.9 million lower than at the end of December 2015 (CHF3,955.9 million). The main covenant, net debt/adjusted EBITDA, reduced to 3.72x as per 30 September 2016 from 3.92x at the end of December 2015.

As part of its financing strategy, Dufry decided to call in advance its US$500 million Senior Notes with maturity in 2020. The repayment planned for 2 December 2016 will allow further improvement in its the debt structure and reduce interest costs going forward, it said.