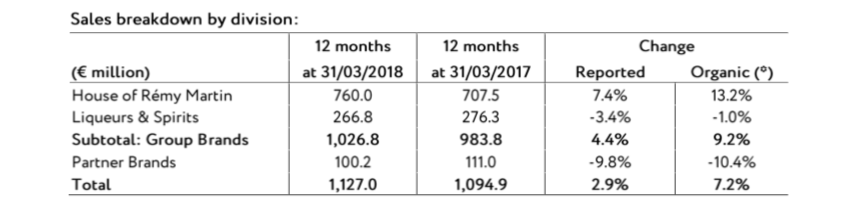

Rémy Cointreau generated €1.13 billion in sales in the 12 months to 31 March 2018, a reported rise of +2.9% year-on-year. In organic terms (at constant exchange rates and scope of consolidation), sales climbed +7.2%, thanks to strong Q4 momentum (+12.8%).

Growth in the full year was driven by the Group Brands (up +9.2% on an organic basis), particularly by the House of Rémy Martin (up +13.2% in organic sales, with volumes rising +6%). This was due to its momentum in Asia Pacific, notably in Greater China. Travel retail also contributed strongly, noted the group, as did the USA and Russia.

Adjusted for the deconsolidation of Passoã, Liqueurs & Spirits delivered +4% organic sales growth, with a contribution from all brands. The organic decline in Partner Brands (-10.4%) was driven by the end of third-party distribution contracts.

The House of Cointreau showed expansion in its newer markets (notably Greater China and Russia) and a good year in the USA amid “more moderate” market conditions. The brand is launching a new global communication campaign and intends to take advantage of the 70th anniversary of the Margarita’s creation this year (Cointreau was a key ingredient of the original recipe). Metaxa benefited from growth in travel retail among other factors, while the company said that the brand upscaling strategy related to Mount Gay and St-Rémy has moderated their growth.

The Progressive Hebridean Distillers recorded a sales increase, notably through The Botanist gin. Single malts Westland and Domaine des Hautes Glaces confirmed their “potential in their respective markets” said the group.

By region, Asia Pacific posted “remarkable growth” according to the group. This was led by Greater China, Singapore, Japan and the new subsidiary in Malaysia. The Americas region delivered “solid growth”, propelled by the USA and Canada. Business in the Europe, Middle East & Africa (EMEA) region, although adversely affected by the deconsolidation of Passoã, benefited from momentum in Russia, Central Europe and the UK.