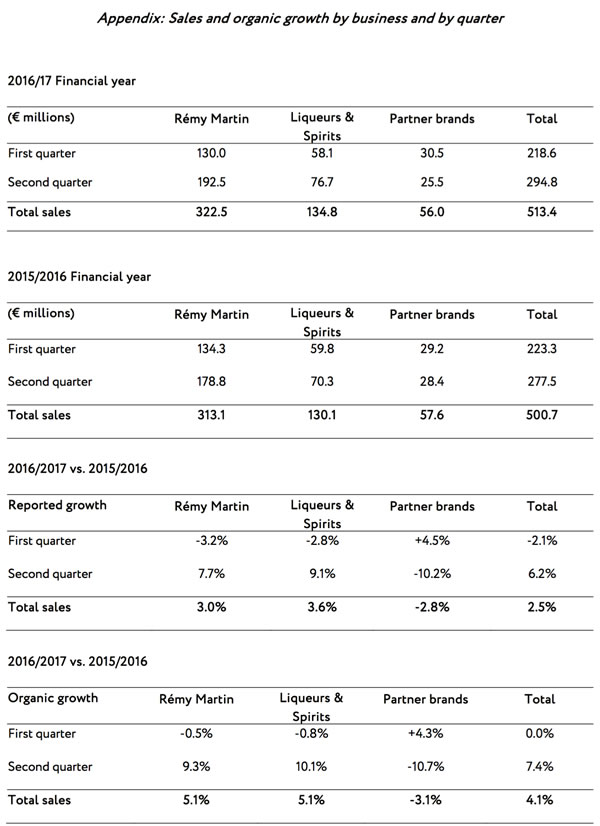

Rémy Cointreau has announced “solid” +4.1% organic sales growth to €513.4 million for the first half of its financial year from April until September 2016.

Rémy Cointreau has announced “solid” +4.1% organic sales growth to €513.4 million for the first half of its financial year from April until September 2016.

Reported growth was +2.5%.

In organic terms, sales were boosted by a strong second-quarter performance (+7.4%).

Rémy Cointreau said the good showing to end-September was driven by the Group’s brands, which grew by +5.1% in organic terms. A -3.1% contraction for partner brands was due to the end of the distribution agreement for the Charles Heidsieck and Piper Heidsieck Champagne brands in certain markets, the company stated.

The report indicated “remarkable” growth for the Americas and noted the particular success of the company’s brand portfolio in the USA.

Sales growth in Greater China, the UK, Russia and Australia also played a part in the Group’s solid performance over the period.

Rémy Martin posted a “robust” start for the year, with a +5.1% increase in organic sales terms driven by strong performances in the Americas and renewed growth in Greater China.

“The House’s superior qualities drove the expansion,” the company stated. 1738 Accord Royal continued to build on its success in the USA, and Louis XIII’s global momentum benefited from two major initiatives – the L’Odyssée d’un Roi project and the opening of its first store in Beijing.

In Liqueurs & Spirits, macroeconomic and technical factors were a drag on performances in 2015/16, but the category was back on track in the first half of 2016/17, especially on the core European and US markets, to achieve + 5.1% organic growth, Rémy Cointreau stated.

Cointreau enjoyed robust growth over the half, as end demand remained strong in the USA and continued to improve in France. The company said Cointreau was making “significant inroads” in Greater China.

Metaxa continued its return to growth on a combination of improved momentum in Russia/CIS, successful marketing activations in Germany and stable sales in Greece.

The dip in sales in Mount Gay and St-Rémy in the first part of the year reflected the upscaling process for these brands, which led to a volume decline in entry-level products. Islay Spirits (Bruichladdich/Port Charlotte/Octomore/The Botanist) continued to see double-digit growth in the first half, driven by their main markets in the USA, Europe and in travel retail.

A fall in sales for partner brands was attributed to the end of the distribution agreement for Piper Heidsieck and Charles Heidsieck champagnes in France, Belgium and in travel retail.

Sales of other partner brands continued to enjoy strong momentum in the EMEA (Europe, the Middle East and Africa) region.

Rémy Cointreau said the results were in line with the group’s forecasts and confirmed its guidance of growth in current operating profit over the 2016/17 fiscal year, assuming constant exchange rates and consolidation scope.