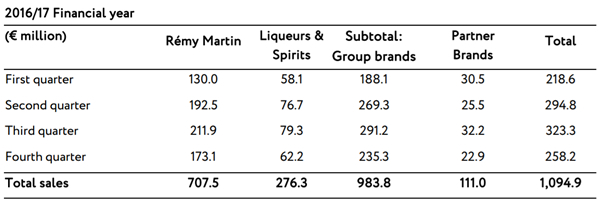

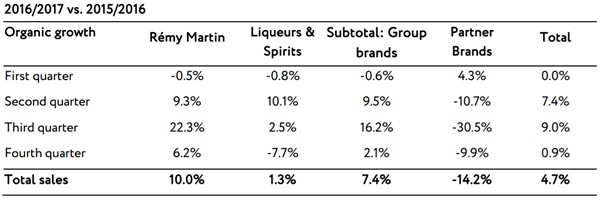

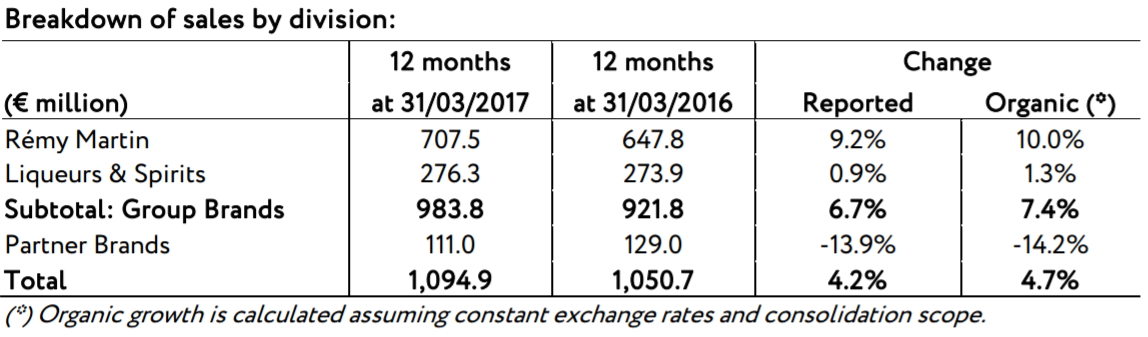

Rémy Cointreau generated sales of €1,094.9 million in the year ended 31 March 2017, a solid increase of +4.2% in reported terms (+4.7% organic).

This was driven by the Group Brands (up by +7.4% on an organic basis) and in particular by the House of Rémy Martin (+10.0%). The latter was buoyed by strong performances in Asia Pacific and the Americas.

Of the Rémy Martin performance, Rémy Cointreau noted: “In Asia Pacific, Greater China benefited from a sharp acceleration in private consumption and some improvement in travel retail sales, particularly in the second half of the year.”

In the Europe, Middle East & Africa region, the UK posted a good year and Russia returned to growth for the Cognac brand.

The company said today: “The strategy focused on the high-end products in the House’s portfolio generated results this year. While volumes increased +4.5%, mix and price effects added 5.5 growth points, notably through the following initiatives: the launch of Louis XIII Le Mathusalem, the opening of the Louis XIII store in Beijing, the Odyssée d’un Roi project, the launch of the new Rémy Martin XO and the Carte Blanche à Baptiste Loiseau limited edition.”

Organic growth in the Liqueurs & Spirits division (+1.3%) was negatively impacted by the deconsolidation of Passoa sales from 1 December 2016 (the brand is now managed by a joint venture under the control of Lucas Bols). This development “concealed strong growth by the division’s brands (+4%) over the period” the company claimed.

Cointreau’s growth was underpinned by performances in the USA and France as well as “new markets” including Greater China and Russia. Metaxa resumed growth in Russia/CIS and Greece and continued its momentum in Central Europe.

The slight dip in Mount Gay and St-Rémy sales resulted from a voluntary reduction in low-end volumes, part of the strategy to focus on the high-end products of the group’s brands, noted the company.

The Progressive Hebridean Distillers (Bruichladdich/Port Charlotte/Octomore/The Botanist) posted double-digit growth in 2016/17, with particularly strong momentum in its main markets (USA, Europe and travel retail).

Among Partner Brands, a -14.2% fall in organic sales was due to the end of the distribution agreement for the Piper Heidsieck and Charles Heidsieck Champagne brands in France, Belgium and travel retail. Sales of other partner brands had “strong momentum” in the EMEA region as well as in travel retail.