Nestlé International Travel Retail (NITR) has revealed an ambitious plan to drive sales of confectionery and the wider food category in global travel retail.

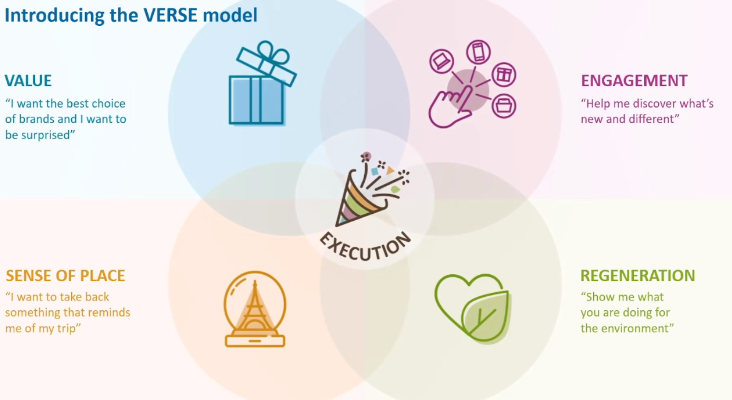

As reported, its VERSE (Value, Engagement, Regeneration, Sense of Place and Execution) strategy was outlined by NITR General Manager Stewart Dryburgh in a presentation and Q&A with The Moodie Davitt Report Founder & Chairman Martin Moodie at the Virtual Travel Retail Expo.

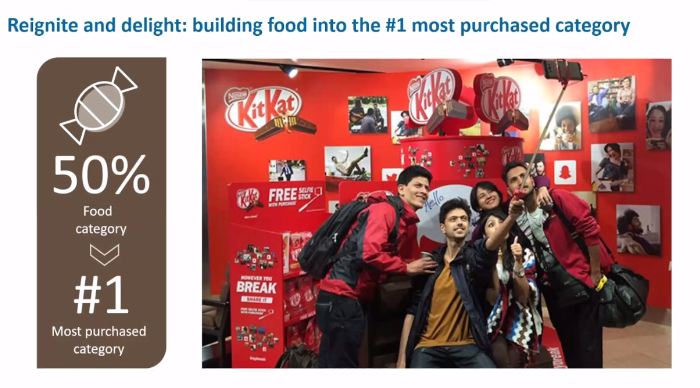

Dryburgh outlined key growth drivers of a brighter and better travel retail industry, explaining how through active collaboration with its retail partners, Nestlé aims to “reignite growth and delight passengers”. It mission is to have food products in 50% of all travel retail shopping baskets.

“There can be no doubt our industry is going through the most challenging period in its history,” Dryburgh said. “The good news is that the recovery is in progress; it may be slower than we want and geographically patchy, but the first green shoots are visible.

“We believe there are significant opportunities to accelerate that return to growth. Retail has never been more critical to airports and, according to a recent Bain/Castlepole study, is destined to become more than 50% of major airport revenues in the near future.”

Dryburgh pointed out that food and confectionery account for 30% of purchases and is the top cross-category driver.

“As a driver for growth, food can play an unparalleled role in our industry in terms of driving footfall and in terms of driving sales,” he said.

Dryburgh highlighted shifting consumer needs and expectations – “the necessity of giving shoppers what they want and need” – the demand for sustainable products and the emerging markets which present opportunities in the channel. Food products, he said, which are sustainable and deliver a true sense of place, are well positioned to meet these market changes.

To be 100% clear, confectionery was, is and will continue to be the beating heart of the food category – Nestlé International Travel Retail General Manager Stewart Dryburgh

Dryburgh highlighted the healthy growth of food in general in domestic markets and spotlighted the disparity between domestic and travel retail when it comes to confectionery.

“In domestic markets confectionery represents 7% of packaged food, whilst in travel retail it represents 77%. This not to say we’re over focused on confectionery, but that we have a major opportunity to exploit the growth potential of other segments in food,” he said.

“To be 100% clear, confectionery was, is and will continue to be the beating heart of the food category. But greater value creation can be achieved by taking other strongly growing segments within domestic markets and translating them into growth opportunities in travel retail.”

As the number one driver of cross category purchase, and the second most purchased category, Dryburgh believes food can play a leading role in both recruiting a new generation of shoppers and converting browsers to buyers.

“Our ambition is clear,” he said. “We aim to take food from the second place to the most purchased category in travel retail; a food item in half of all baskets by 2030.”

The VERSE model was developed to provide a pathway to shopper recruitment and meet this category growth ambition.

Value: “Price is what consumers pay, but value is more than price; it is the bundle of benefits that the consumer receives, encompassing not only great brands but also exclusive products, service, experiences and more. Value needs to be created for all stakeholders moving forwards,” Dryburgh said.

He highlighted the performance of Nido milk powder brand in the Middle East, as a “great testimonial to how propositions beyond confectionery have, for over more than 25 years, created value for all stakeholders in that region, turning a specific passenger segment into a regular shopper”. In the last decade, according to Dryburgh, sales of milk powder have totalled over US$370 million.

“Margins may not be as high as classic travel retail categories, but the key here question is: Is it better to have 50% of US$370 million or 65% of nothing?” Dryburgh asked.

He pointed out that other categories, such as biscuits and spreads, are available in travel retail and generate growth while other brands, such as Nescafé Roasting and Illuma, will unlock new opportunities.

Engagement: Dryburgh described engagement as critical in travel retail, stressing the need to adopt an end-to-end approach, an omnichannel experience, combining digital and physical experiences. “We must remember that over 55% of customers decide if they are are going to shop before they leave home and communicate pre-travel,” he said.

Regeneration: NITR launched its regeneration concept last month. “We all understand the importance of sustainability, but at its core regeneration is about going beyond sustainability and helping to protect, renew and restore,” Dryburgh said.

He highlighted PI insights 2020 Sustainability Research for TFWA indicating that sustainability impacts on purchase decision for 71% of travel retail consumers, while 78% are concerned about their impact on the environment.

According to Dryburgh, regeneration will be a concept that will “resonate with a whole new generation of shoppers who do not yet shop in travel retail”. He spotlighted the move to paper packaging for Smarties as a first step example which is generating significant growth in domestic markets.

Sense of Place: Dryburgh emphasised that this will remain a key to converting passengers to shoppers in travel retail. “Food can most definitely champion this best by delivering products and experiences with in-store theatre that capitalise on this core shopper purchase driver,” he said.

Execution: Dryburgh pointed out that execution is “what consumers see in-store and where initiatives become tangible”. “Flawless execution will be crucial to unlocking the growth opportunities that are available,” he added.

Dryburgh is adamant that the VERSE model can be applied to all categories within travel retail, to fuel not just category but industry growth. However, to realise the opportunity, Dryburgh said the channel needs to “reprioritise food, recognising it as one overarching category with three sub-categories, each of which has distinct roles.

“We must build on the dynamic core which is confectionery, strategically adding sub-sectors such as coffee and infant nutrition with the leading global brands to the fore. Additionally, by tactically exploiting the significant power of local food products we can add another layer of growth.

“There is so much opportunity out there, we just need to work together to harness the undoubted potential,” he concluded.