SOUTH KOREA/CHINA. Duty free tenders at two of Asia’s most important airports, Incheon International and Beijing Capital International, close this week, with the results set to have a major bearing on North Asia’s travel retail competitive landscape in coming years.

Bids for the Incheon International Airport Terminal 2 duty free contract close in two stages – today at 18.00 (5 April) with Incheon International Airport Corporation (IIAC) and a day later with Korea Customs Service (KCS).

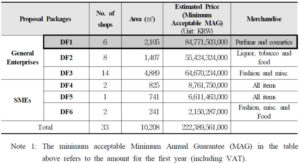

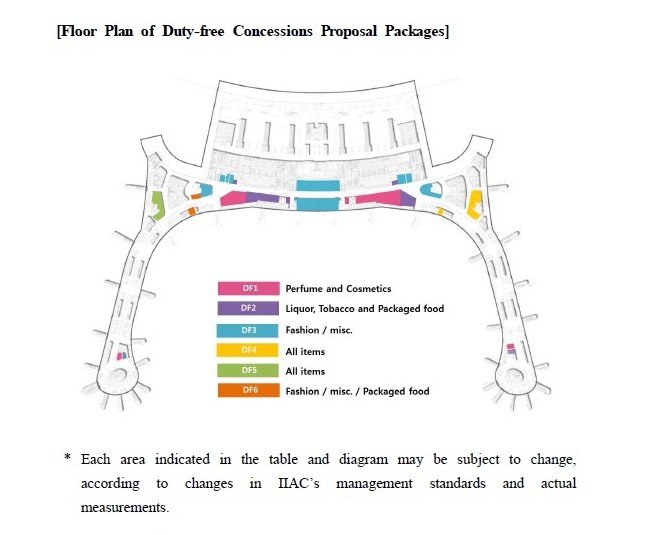

As reported, the long-awaited T2 tender is being conducted on an unprecedented two-stage basis, following a major dispute between the IIAC and KCS over how bids should be judged. That row was resolved in early February with an agreement between the two parties to hold a two-tier assessment. This involves IIAC first judging bids on all six licences (three for big players, three for small & medium enterprises) based on a 60% technical and 40% financial weighting.

IIAC is to recommend two players for each licence with KCS deciding the outright winners based on its own scoring system, including contribution to small & medium enterprises.

While KCS will make the final awards, IIAC’s evaluation is likely to prove key.

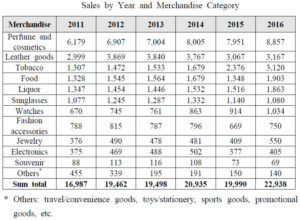

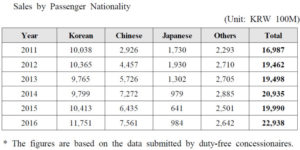

According to our colleagues at KDF News in South Korea, with which The Moodie Davitt Report works closely, confirmed local bidders include Lotte Duty Free, The Shilla Duty Free, Shinsegae Duty Free and Galleria Duty Free (Hanwha). They may be joined by international players such as DFS or King Power International, which bid last time around, though as always it seems difficult for a foreign company to win here.

For the dedicated SME concessions, KDF believes the local bidders include SM Duty Free, City Duty Free and Entas Duty Free. Another strong possibility is the Dufry ThomasJulie partnership, which is classified as an SME at Gimhae International Airport in Busan, South Korea’s second city.

We’ll bring you details as soon as possible.

BEIJING BIDS CLOSE

Meanwhile, the two duty free retail tenders at Beijing Capital International Airport Terminals 2 and 3, issued on 24 February, close tomorrow April 6. The whole business is currently run by Sunrise Duty Free but that could change following M&T talks between China Duty Free Group and Sunrise.

Meanwhile, the two duty free retail tenders at Beijing Capital International Airport Terminals 2 and 3, issued on 24 February, close tomorrow April 6. The whole business is currently run by Sunrise Duty Free but that could change following M&T talks between China Duty Free Group and Sunrise.

As revealed by The Moodie Davitt Report, CDFG parent company China International Travel Service Corporation issued a statement late last month on the anticipated merger. It said: “The cooperation [between CDFG and Sunrise Duty Free -Ed] is pending for internal and external decision-making and approval procedures by related parties, and if CDFG becomes a winning bidder [in the Beijing Capital International Airport duty free tender] and cooperates with Sunrise China, which is currently subject to significant uncertainties.”

How the Beijing Capital contracts are allocated remains to be seen (there will likely be other bidders) but it seems likely that in an elegant ‘Chinese solution’ to a long-standing rivalry, CDFG will be very much a joint part of the airport duty free operation going forward.

We have a variety of options that will ensure you reach the widest, most high-quality concessionaire/retailer/operator base in the industry – globally and immediately.

Similarly The Moodie Davitt Report is the only international business intelligence service and industry media to cover all airport consumer services, revenue generating and otherwise. We embrace all airport non-aeronautical revenues, including property, passenger lounges, car parking, hotels, hospital and other medical facilities, the Internet, advertising and related revenue streams.

Please send relevant material, including images, to Martin Moodie at Martin@MoodieDavittReport.com for instant, quality global coverage.

All such stories are consolidated in our popular Tender News section (see home page dropdown menu) that has been running since 2003.