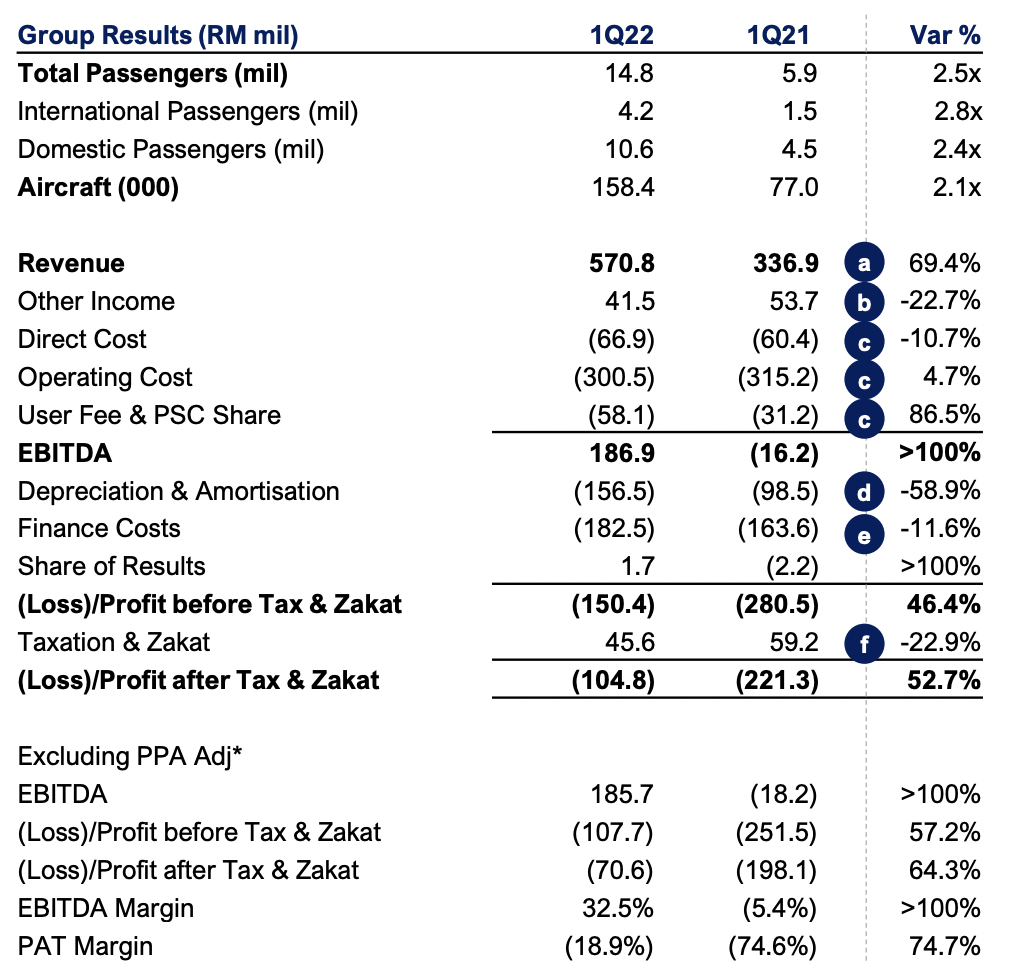

MALAYSIA. Malaysia Airports has reported a sharp recovery in traffic and revenues in Q1 2022, with reduced losses in the period. Passenger traffic more than doubled to 14.8 million group-wide and revenues climbed by +69.4% to RM570.8 million (US$130.4 million).

EBITDA leapt to RM186.9 million (US$42.7 million) compared to a modest RM16.2 million a year earlier, with losses narrowing by -52.7% to RM104.8 million (US$23.9 million).

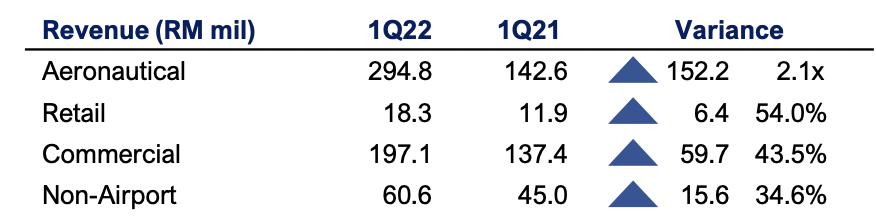

Non-aeronautical income rose by +44.3% to RM215.4 million (US$49.2 million), aided by higher royalties and retail revenue. This in turn was due to an increase in international passenger traffic which led to higher commercial income.

Encouraging traffic recovery at Istanbul Sabiha Gokcen International Airport (SGIA) was a key contributor towards reducing the impact of the COVID-19 pandemic on earnings. EBITDA for the Turkey operations doubled (+104.1%) to RM208.3 million. At 6.4 million in Q1, SGIA posted the highest quarterly passenger volume since April 2020. In Malaysia, passenger traffic rose by five times year-on-year to 8.3 million in the quarter. Malaysia’s Vaccinated Travel Lane schemes with Singapore and Thailand and the resumption of Umrah services helped ease international travel restrictions, and contributed to the increase.

In Malaysia, passenger traffic rose by five times year-on-year to 8.3 million in the quarter. Malaysia’s Vaccinated Travel Lane schemes with Singapore and Thailand and the resumption of Umrah services helped ease international travel restrictions, and contributed to the increase.

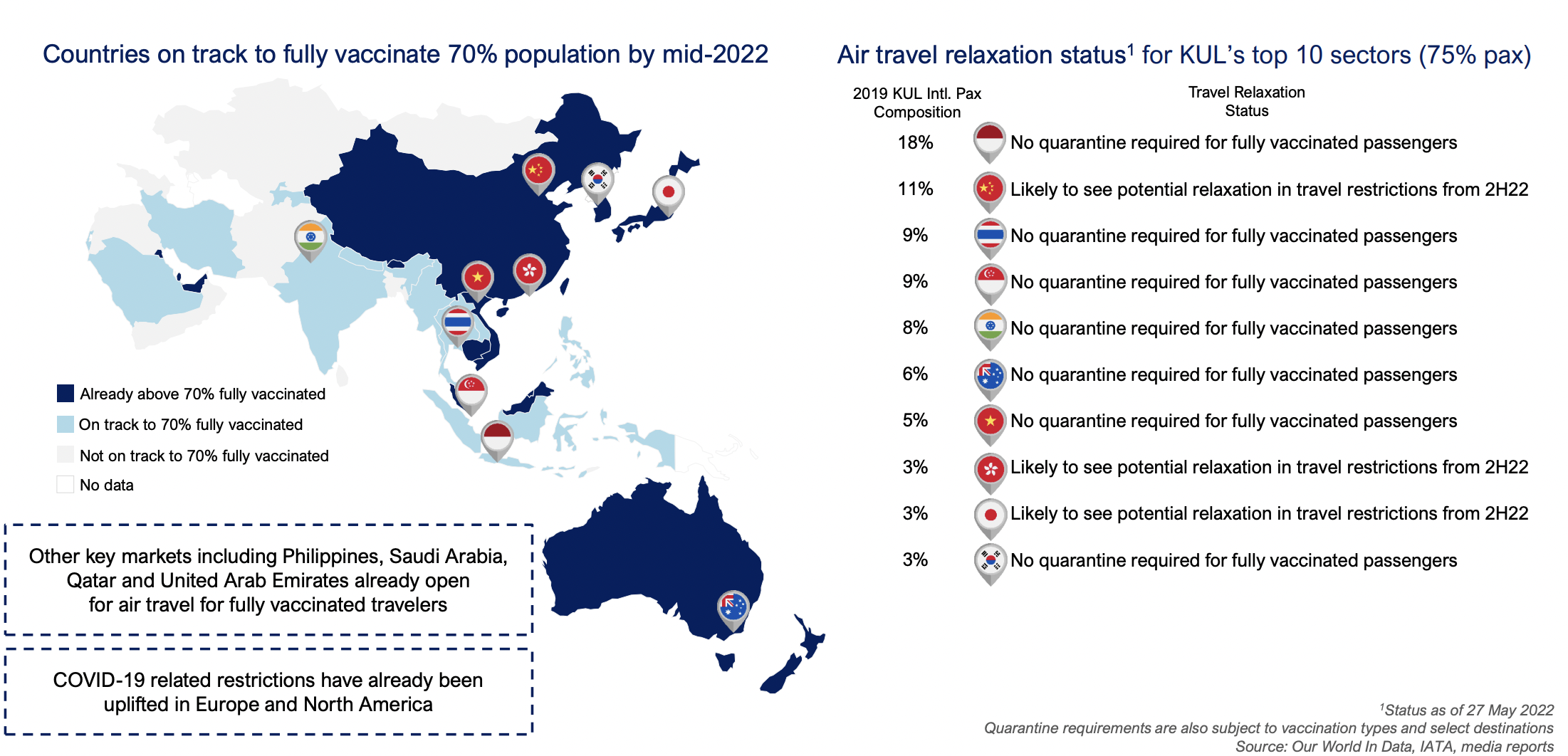

Malaysia’s full relaxation on border restrictions for vaccinated travellers in the second quarter led to daily average international passenger numbers in May 2022 reaching 33,407 or 20% of May 2019 levels. The opening of regional markets in North Asia with reciprocal relaxation from H2 “will spur further recovery” noted Malaysia Airports.

The company cited the much-reduced daily revenue at KLIA and klia2 compared to 2019, though revenue per ticket has remained robust.

Among the big openings planned (see chart) are a new Satellite Terminal Duty Free Emporium in H2 2022/H1 2023, a new Duty Free Emporium in the Contact Pier, plus a BurgerKing in H2 (part of Eraman’s drive to expand its F&B presence). Further duty free expansion is planned for Penang and Kota Kinabalu airports in 2023.