EUROPE. Airport passenger traffic in Europe grew by +1.7% in November, but this marked a further deceleration over the preceding months, Airports Council International (ACI) Europe said.

Aircraft movements decreased for the second month in a row, at -2.3% (a -0.5% drop was recorded in October).

“The deceleration of passenger traffic at Europe’s airports is mainly focused on the EU market – and it reflects both supply and demand pressures building up,” commented ACI Europe Director General Olivier Jankovec.

“Airlines bankruptcies have resulted in capacity being taken out of the market, along with airlines generally limiting their growth due to a focus on yields and risk aversion as well as the continued grounding of the 737MAX. Industrial action notably in Germany only added to these pressures in November.”

He added: “The going is progressively getting tougher across the airport industry – especially for smaller regional airports. 55% of them lost traffic in November, compared to 39% for the rest of the industry. The current difficulties of Flybe – Europe’s largest regional airline – both underline the fragility of regional air connectivity and the vital role it plays for cohesion given that other transport modes very often do not provide viable alternatives.”

Passenger traffic at non-EU airports increased by +3.2% at non-EU airports in November, ACI Europe reported. The month brought double-digit increases at airports in North Macedonia, Serbia, Ukraine, Belarus, Albania, Israel and Armenia – as well as more moderate growth at those in Bosnia & Herzegovina, Montenegro, Moldova, Turkey and Russia.

The best performers among capital and larger non-EU airports were: Skopje (+15.3%), Belgrade (+14.6%), Kyiv Boryspil (+14.4%), Moscow Vnukovo (+13.2%), Tel Aviv (+13.1%), Antalya (+10.9%), Istanbul Sabiha Gökçen (+10.2%) and Yerevan (+10%).

Conversely, passenger traffic fell sharply in Iceland (-30.8%) due to the fallout of the collapse of WOW Air and other airlines’ capacity adjustments. Airports in Georgia (-6.2%) and Norway (-2.6%) also experienced declining volumes, while Swiss airports reported flat growth (+0.1%).

Passenger traffic at EU airports increased by +1.3% in November, contrasting sharply with growth registered last year for the same month (+6.7%).

Hungary, Poland, Croatia and Luxembourg were the only EU markets where airports achieved double-digit growth, while those in Portugal, Austria, Bulgaria, Romania, the Czech Republic, the Baltic States, Cyprus and Malta grew at a lower “but still dynamic” pace (above +6%), according to ACI Europe.

Airports in Slovenia, Sweden, Slovakia, Germany, Denmark, the UK and Ireland saw passenger traffic fall – and those in Greece, the Netherlands and Finland registered only marginal gains. The demise of Aigle Azur, XL Airways, Adria Airways and Thomas Cook in September 2019 especially hit Ljubljana (-27%), East Midlands (-10.3%), Glasgow (-6.1%), Paris Orly (-4.7%) and Birmingham (-1.6%), ACI Europe noted.

Among capital and larger EU airports, the top performers were: Budapest (+14.4%), Warsaw (+13.4%), Luxembourg (+11%), Vienna (+9.1%), Lisbon (+9.4%) and Malta (+8.3%).

Passenger traffic at the ‘Majors’ (top five European airports) stood at +1.7% – exactly the European average. Istanbul Airport saw +6.5% growth, followed by Paris Charles de Gaulle (+3.3%) and London Heathrow (+2.0%). Amsterdam Schiphol (+0.3%) and Frankfurt (-3.4%) underperformed, with the latter being hit by strikes at Lufthansa.

Smaller regional airports (with less than 5 million passengers per annum) continued a negative trend, with a decrease in passenger traffic of -0.9%. Among smaller regional airports, the highest increases came from: Dubrovnik (+113.9.7%), Mostar (+63.3%), Nis (+58.8%), Kharkiv (+58.5%), Kutaisi (+50.5%) and Zadar (+46.4%). Among larger ones (more than 5 million passengers), Krakow (+23.9%), Bordeaux (+17.6%), Nantes (+12.9%), Sochi (+12.7%) and Marseille (+10%) came on top.

Group top performers

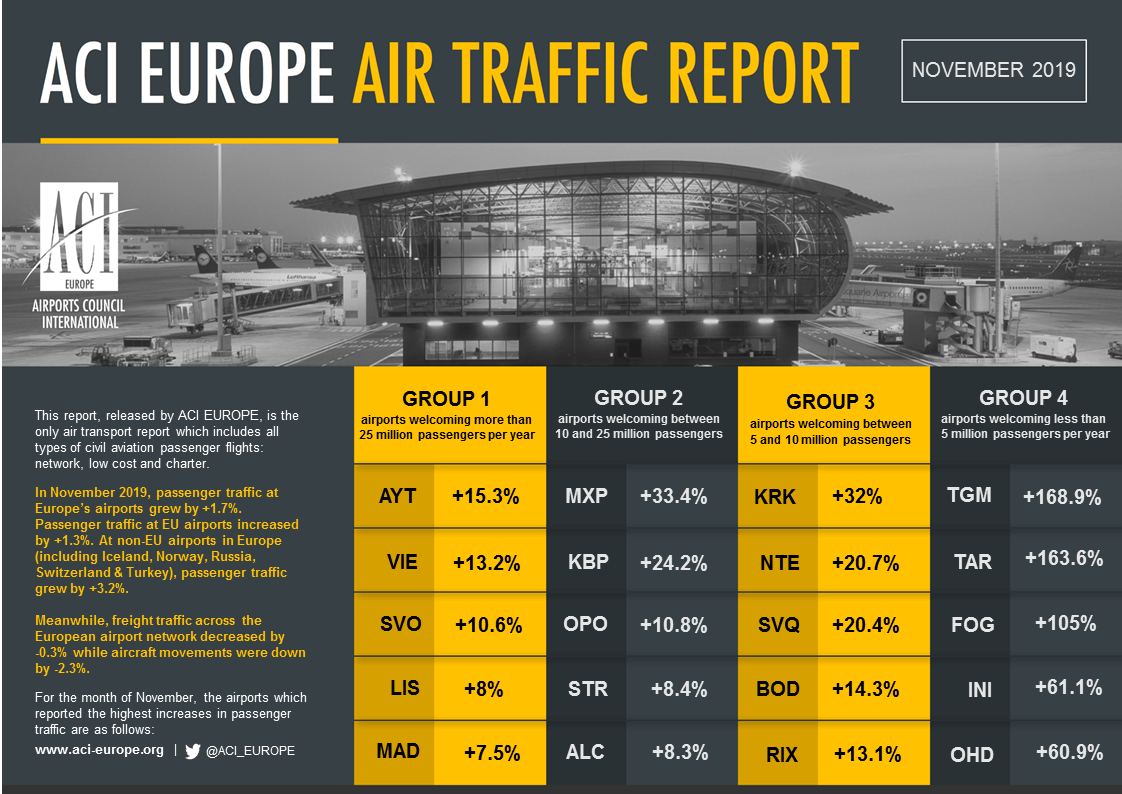

In November, airports with more than 25 million passengers per year (Group 1), 10-25 million (Group 2), 5-10 million passengers (Group 3) and under 5 million passengers per year (Group 4) reported an average adjustments of +1.3%, +2.4%, +3.1% and +0.3% respectively.

Under this measure, the airports that reported the highest year-on-year increases in passenger traffic during November 2019 were:

GROUP 1: Antalya (+10.9%), Istanbul Sabiha Gökçen (+10.2%), Lisbon (+9.4%), Vienna (+9.1%), Moscow Domodedovo & Barcelona (+6.7%)

GROUP 2: Kyiv Boryspil & Budapest (+14.4%), Warsaw (+13.4%), Moscow Vnukovo (+13.2%), Tel Aviv (+13.1%), Milan Bergamo (+9.7%)

GROUP 3: Krakow (+23.9%), Bordeaux (+17.6%), Belgrade (+14.6%), Nantes (+12.9%) and Sochi (+12.7%)

GROUP 4: Pardubice (+12920.8%), Ohrid (+239.5%), Dubrovnik (+113.9%), Mostar (+63.3%) and Nis (+58.8%)