Leading drinks group Diageo today reported preliminary full-year results to 30 June, with net sales increasing by +8.3% year-on-year to £12.7 billion. Operating profit of £3.7 billion surged by +74.6%.

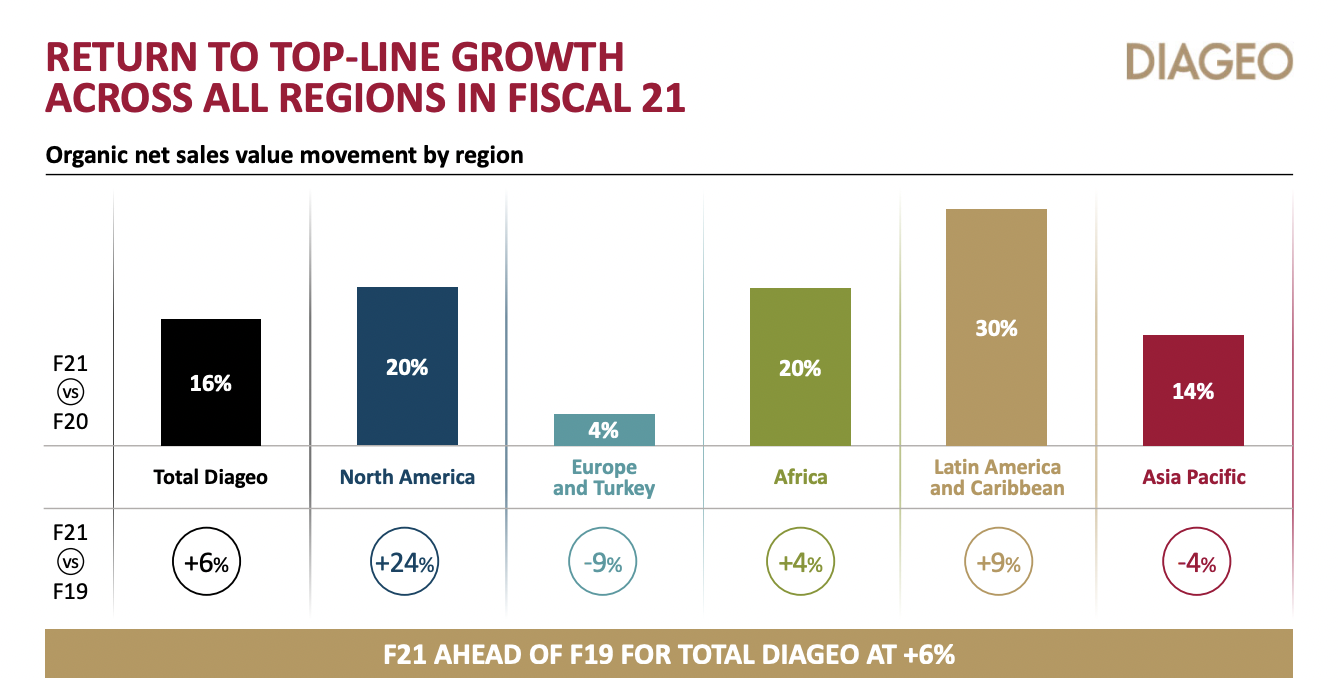

Organic net sales growth reached +16%, with the group’s largest and most profitable market, North America, posting organic growth of +20% year-on-year. Europe benefited from strong consumer demand in the off‐trade channel and the gradual recovery of the on‐trade channel in certain markets. Volatility remains high in some key markets, including India, while travel retail (sales -62% year-on-year) remains “heavily impacted by ongoing restrictions on global travel,” said the company.

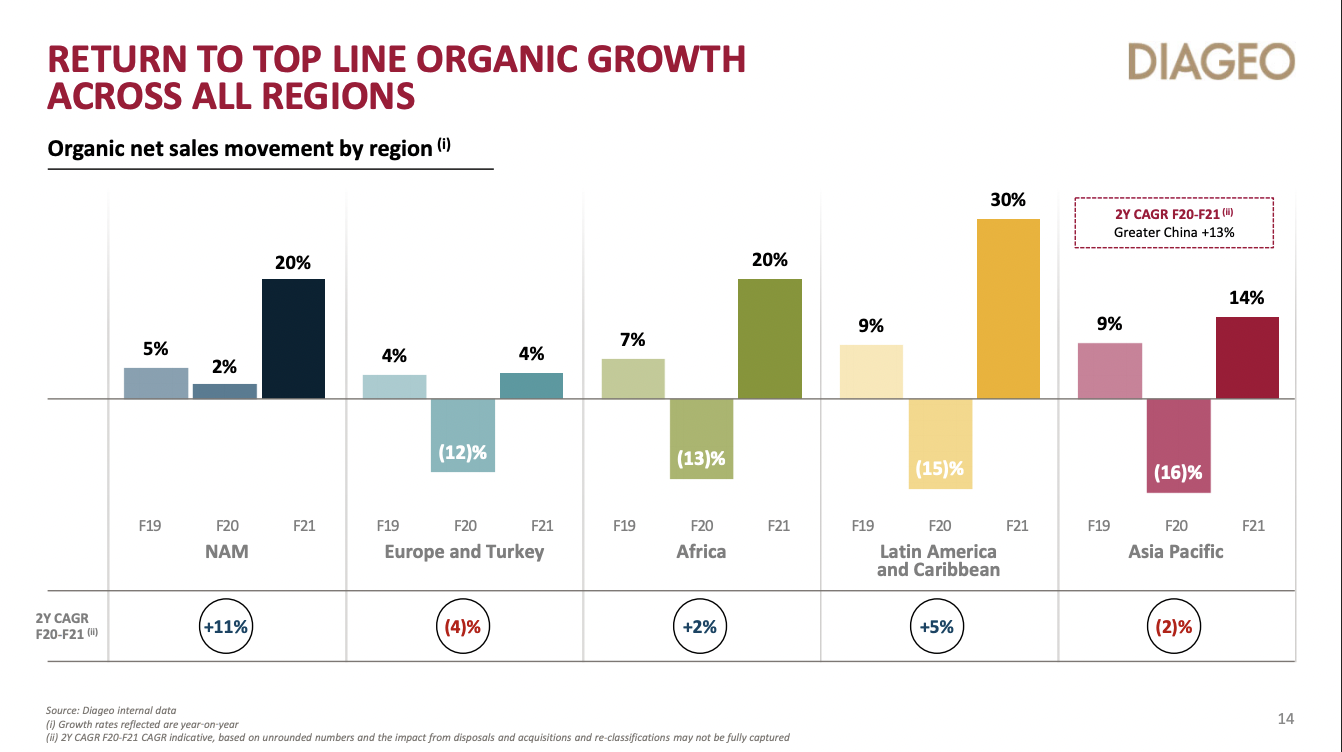

Three of Diageo’s five regions (North America, Africa and Latin America and Caribbean) closed the year with organic net sales above fiscal 2019 on a constant basis.

North America organic net sales growth of +20% represents an +11% two year CAGR compared to fiscal 2019. In US spirits, the company’s biggest market in North America, organic net sales growth was ahead of depletions growth by around five percentage points.

In Europe and Turkey, organic net sales grew +4% with spirits and ready to drink growing double digits while beer declined -21%. Northern Europe, Great Britain and Turkey saw strong recovery while Ireland organic net sales declined due to higher exposure to the on‐trade. Travel retail in Europe declined -56%, reflecting the continued restrictions on international travel.

In Africa, organic net sales grew +20% with all markets (excluding travel retail) growing despite restrictions. Beer organic net sales grew +19% mainly driven by Guinness and Malta Guinness. Spirits organic net sales grew +21% mainly driven by consumer demand for mainstream spirits.

Latin America and Caribbean organic net sales increased +30% with all markets growing (excluding travel retail). Scotch had a strong recovery growing +30% with strong double‐digit growth across Johnnie Walker, Buchanan’s and primary Scotches. Travel retail declined -63%.

In Asia Pacific, organic net sales grew +14%, following a -16% decline in fiscal 2020, driven by strong recovery in Greater China and Australia. The Asia and Middle East travel retail business continued to be “impacted significantly”. In fiscal 2021, Diageo’s business in Greater China grew +38% supported by strong growth in Chinese white spirits and Scotch.

By category, Scotch grew +15% with all regions growing versus fiscal 2020. Johnnie Walker, Buchanan’s, Scotch malts and primary Scotch posted a strong recovery with net sales growing double digits. Scotch also benefited from strong premiumisation trends in US spirits and some markets in Latin America and Caribbean and Asia Pacific.

Vodka grew in all regions except Asia Pacific. Smirnoff net sales grew +5% driven by flavours. Ketel One was flat and Cîroc grew +26% driven mainly by the US business.

Gin grew +14% with double‐digit growth in Europe, Africa and Latin America and Caribbean. Tanqueray and Gordon’s both grew double digits. Tequila grew +79% on top of a +25% growth in fiscal 2020. It now constitutes 8% of Diageo’s net sales. Growth was mainly driven by the strong performance of Don Julio and Casamigos in North America. Both brands gained significant market share in the US spirits category.

Diageo highlighted the role of ecommerce in driving sales. In its results announcement today, it said: “By increasing the visibility and ease of purchase for our brands online, we have driven strong performance with some of our largest ecommerce customers. Diageo remains number one in spirits retail sales on Amazon in Europe, number one in spirits retail sales on Drizly in the US and, in China, we’ve maintained our leadership in whisky on Tmall. As well as building on our partnerships with e‐retailers and traditional trade channels, we are developing our own ecommerce channels. In fiscal 21, we launched nine new sites, bringing the total to 28.”