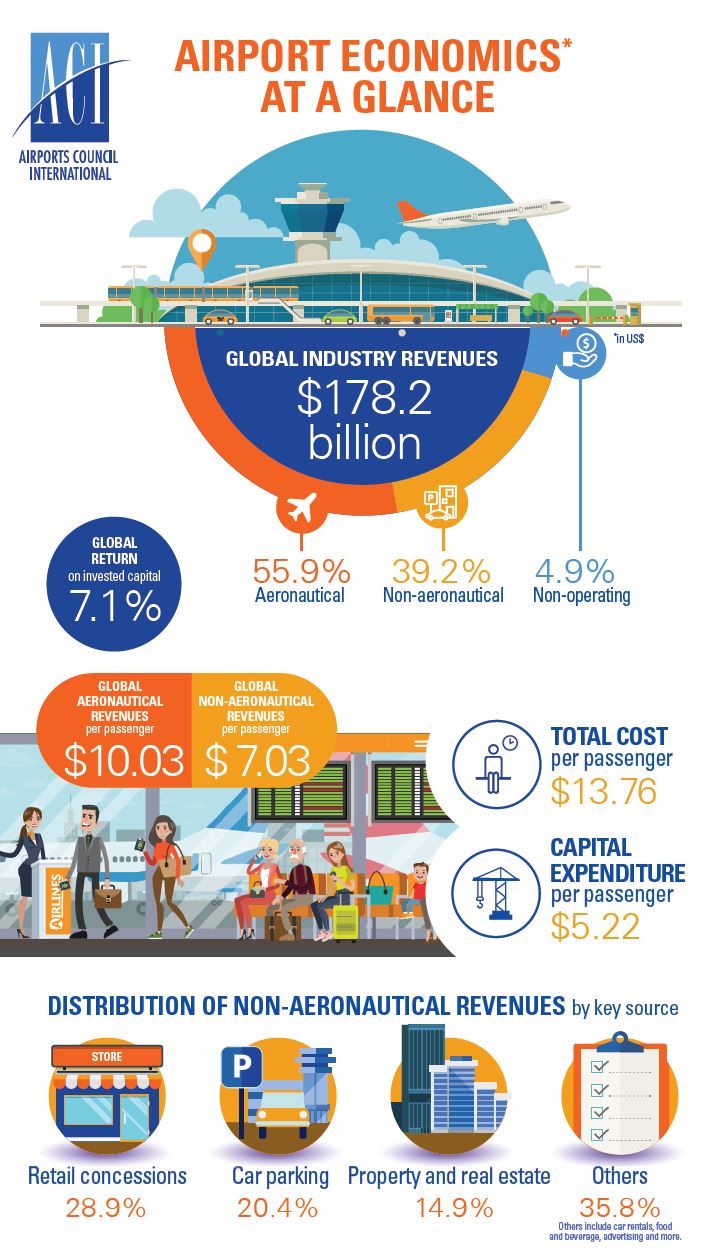

INTERNATIONAL. Airports Council International (ACI) World today published its annual Airport Economics Report, based on 2018 figures, with non-aeronautical revenues contributing 39.2% of all income to the sector.

ACI’s Economics Report found that global industry revenue grew by +4.3% to reach US$178.2 billion in the year, but that revenue per passenger declined by -1.7%. Non-aeronautical revenue per passenger dipped by -2.2% to US$7.03.

The Economics Report and ACI’s latest Key Performance Indicators analysis include financial data on developments in the airport business for 2018. They provide a snapshot of the industry before the COVID-19 pandemic.

The distribution of global revenues was:

- Aeronautical revenue: 55.9%

• Non-aeronautical revenue: 39.2%, and

• Non-operating revenue: 4.9%.

“The COVID-19 outbreak has resulted in an unprecedented and dramatic decline in air travel this year,” ACI World Director General Angela Gittens said. “Airport revenue generation and growth are directly linked to traffic levels and the global airport industry is expected to lose US$76 billion in 2020.

“Our Economics Report and KPIs show the immense value a healthy and successful airport industry provides to the global economy and illustrates why assistance and relief is needed for the sector to ensure essential operations and protect millions of jobs.

“Airports are facing difficult prospects right now because a significant proportion of airports’ costs—capital costs in particular—are fixed, leaving less of a cushion during a downturn, especially one of this unprecedented magnitude.

“As a significant portion of airport revenues goes to fund the much-needed capacity development once business as usual operations resume, any decrease in revenue may have a dramatic impact on airport development, and in turn on the airline business.

“This is because aviation is an interdependent and interconnected ecosystem, and, in order to stay afloat, it will require a coordinated and strategic response to overcome the unexpected difficulties and get back on track as soon as possible.”

Snapshot of key industry facts for the 2018 financial year:

• Global industry revenue year-over-year growth (2018/2017): +4.3%

• Global industry revenue: US$178.2 billion

• Revenue per passenger year-over-year growth (2018/2017): -1.7%

• Distribution of global revenues: aeronautical (55.9%), non-aeronautical (39.2%) and non-operating (4.9%)

• Global airport revenue per passenger: US$17.95

• Global aeronautical revenue per passenger: US$10.03

• Global non-aeronautical revenue per passenger: US$7.03

• Total cost per passenger: US$13.76

• Ratio of aircraft-related to passenger-related charges: 38:62

• Distribution of non-aeronautical revenue by key source: retail concessions (28.9%), car parking (20.4%) and property and real estate income or rent (14.9%)

• Operating expenses to capital costs ratio: 65.9% to 34.1%

• Largest operating expense categories: personnel expenses (33.9%) and contracted services (24.9%) • Global debt-to-EBITDA ratio: 4.48

• Global return on invested capital (ROIC): 7.1%.