Korean duty free: A special report Look out early next month for Martin Moodie’s comprehensive on location round-up from the world’s biggest duty free market. It includes interviews with: • Lotte Duty Free CEO Kap Lee |

SOUTH KOREA/JAPAN. Despite widespread concerns within the Korean and Japanese travel retail sectors about the impact of China’s new ecommerce law introduced on 1 January, neither air traffic nor duty free sales have slowed in either country.

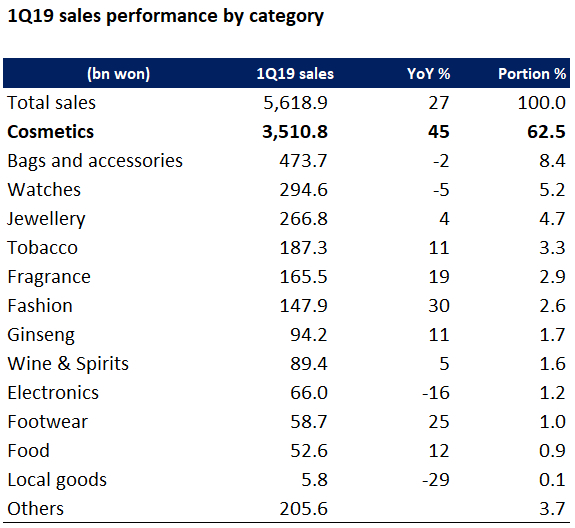

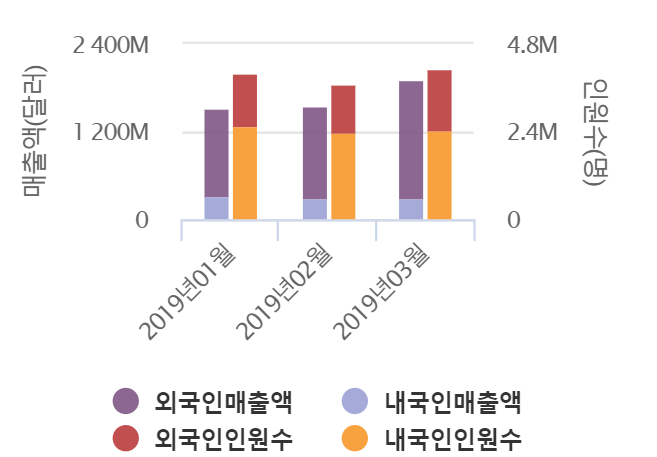

As reported, Korea’s duty free market – the world’s biggest – rose by 27% in the first quarter to KW5,618.9 billion (US$4.95 billion), according to industry sources.

That momentum has continued into 2019 with March a record-breaking month in both Korea and Japan. The latter saw a new monthly high for Chinese inbound traffic while duty free sales in Korea rose by 23% year-on-year to an all-time monthly peak of (US$1.9 billion), according to the Korea Duty Free Association.

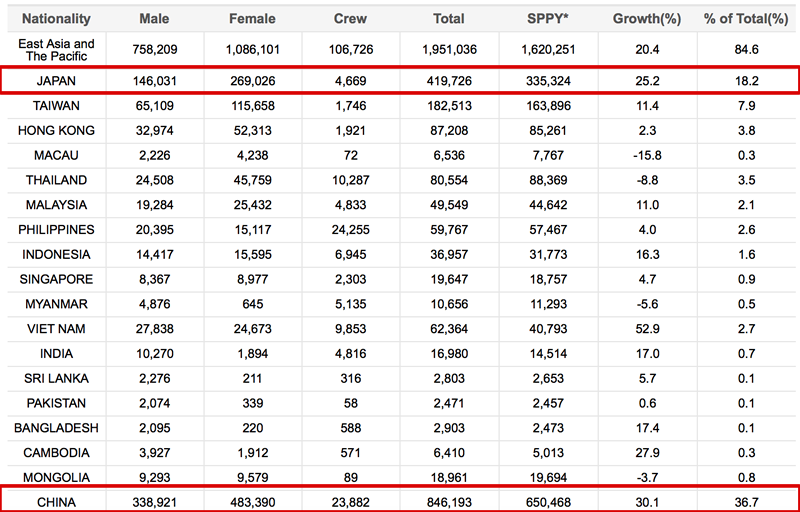

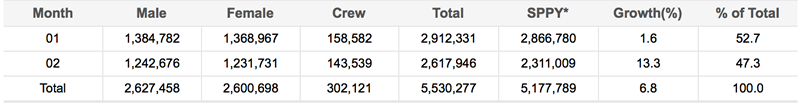

According to latest Japan National Tourism Organization (JNTO) figures, total inbound-tourist traffic in March grew 5.8% year-on-year to over 2.7 million. Five origin markets, including the US and UK, achieved monthly traffic record highs, while ten others including China and Taiwan hit record levels. Japan’s cherry-blossom season and the warmer than usual climate were key tourism drivers.

Optimism surrounds Xi Jinping visit

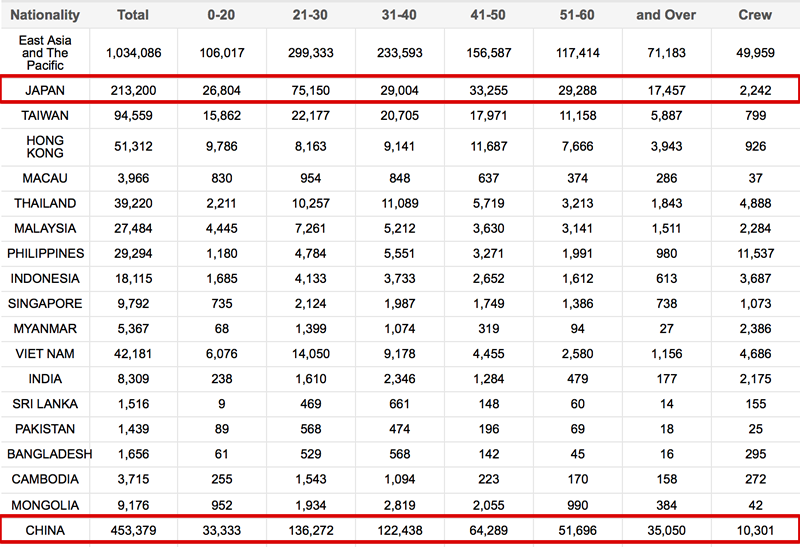

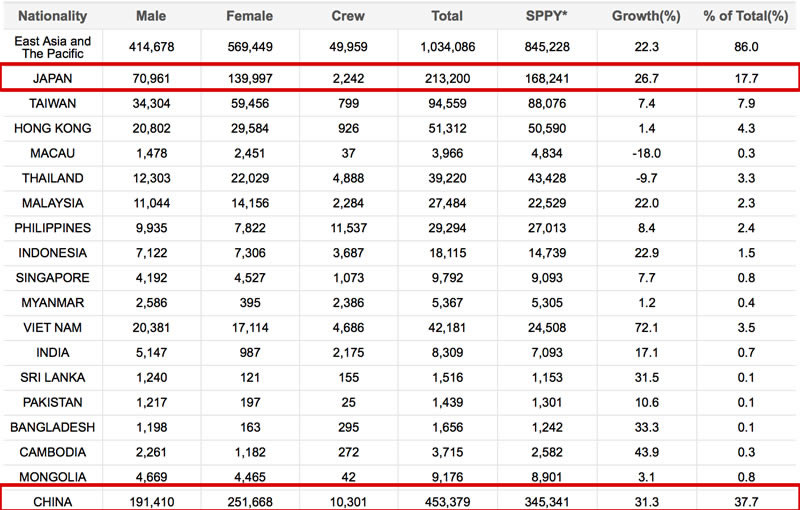

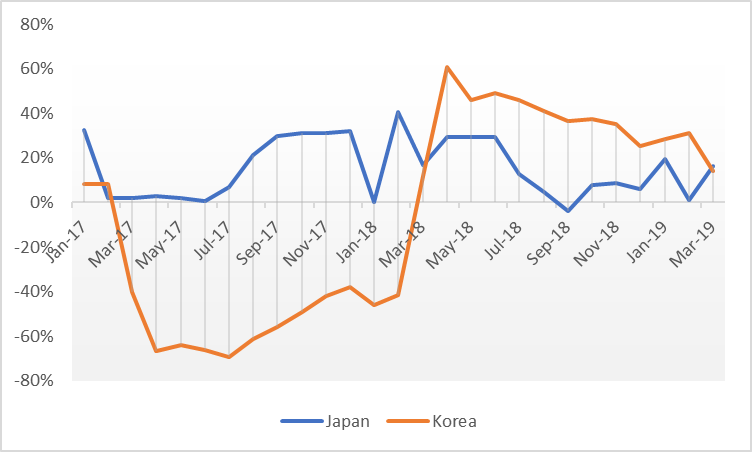

Chinese arrivals to Korea (see tables below) continue to recover following a protracted slump due to the eruption of the THAAD dispute between the two countries in March 2017. Although official figures for March are yet to be announced, the travel industry expects growth levels to be in line with January (28.7% year-on-year) and February (31%).

Although expectations are high that a visit by Chinese leader Xi Jinping in June may result in an easing of travel restrictions, many Korean tourism experts think cruise and package tours will not be continued this year. Despite the absence of an official directive by the Chinese government to regulate travel to Korea, packaged tour offerings by major travel operators and cruise ships disembarking in Korea were discontinued at the height of the THAAD row and have yet to resume.

Although expectations are high that a visit by Chinese leader Xi Jinping in June may result in an easing of travel restrictions, many Korean tourism experts think cruise and package tours will not be continued this year. Despite the absence of an official directive by the Chinese government to regulate travel to Korea, packaged tour offerings by major travel operators and cruise ships disembarking in Korea were discontinued at the height of the THAAD row and have yet to resume.

Chinese spending continues to outpace strong traffic growth to Japan and South Korea

Japanese travel retail: A special report Coming soon: Dermot Davitt’s comprehensive on location round-up from the fast-changing Japanese duty free market. It includes interviews with: • NAA Retailing President and CEO Toshiaki Kanzaki |

In South Korea, foreign customers are becoming ever more important for domestic and travel retailers afflicted by a decline in domestic spending and increased cannibalisation from online shopping. Spending by foreign travellers outpaced arrival growth rates in both 2018 and 1Q19 for both Japan and Korea with reseller (daigou) activity at record-high levels in both countries.

– Japan: Spending by foreign travellers increased by 25.8% year-on-year to a record ¥339.6 billion in 2018. This outpaced inbound tourist growth of 8.7%.

– South Korea: Duty free sales grew 35% year-on-year in 2018, well ahead of the 15/1% rise in inbound traffic.

According to JNTO, total inbound-tourist expenditures in 1Q19 reached ¥1,118 billion, up 0.5% year-on-year. Shopping remains the greatest contributor, accounting for 34.7% of total spending though figures released by JNTO show total expenditure on shopping declined 2.1% year-on-year.

Daigou business still flourishing in both countries but taking revised shape

However, the JNTO figures are based on surveys of traditional Chinese tourists and fail to reflect the growth of sales to daigou resellers. Japanese department stores saw record spending by overseas visitors in 1Q19 with Chinese tourists flocking to Japan for the Lunar New Year. Chinese resellers continued to purchase Japanese cosmetics products heavily despite the implementation of the new ecommerce law.

As reported, cosmetics were the key to the Korea market’s vibrant Q1 performance, with the category posting a 45% rise year-on-year and accounting for 62.5% of total duty free sales. Chinese nationals accounted for 76.7% of total sales in the Korean market in the first quarter.

Resellers continue to act as the main driver to growth in Korea’s duty free industry with spending per person (21.9% in March) outpacing duty free traffic growth (0.9%). The spread between duty free traffic growth and spend per person widened to 21 p.p. in March 2019, up from 10.3% in January.

It appears that China’s new EC law has failed to decrease reseller activity in both Korea and Japan with foreigner spending continuing to grow in both countries. Hotel Shilla (parent of The Shilla Duty Free) explains that sales to individual resellers have declined but sales to corporate resellers who have registered business licences have grown sharply to fill in any gaps (sales portion by corporate and individual resellers 2018 20:80, 1Q19 40:60).

Lotte and Shilla prosper downtown

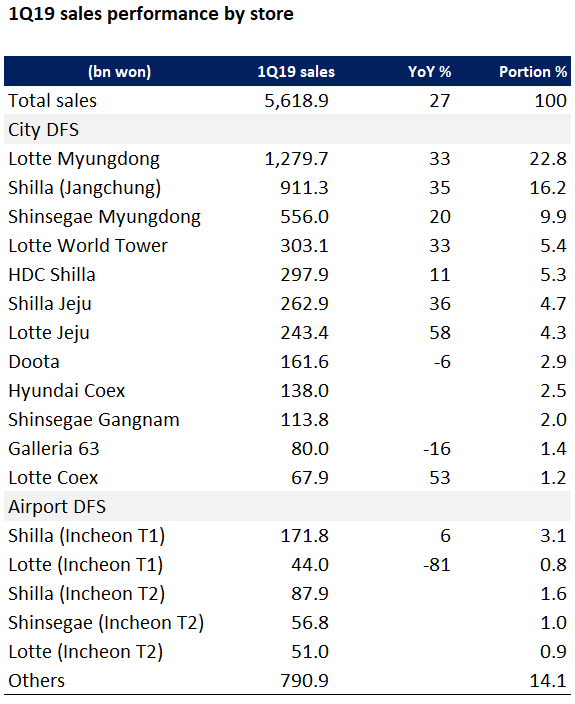

As reported, Lotte Duty Free’s flagship store in Myeong-dong/Myungdong turned in a rip-roaring performance with sales rising 33% to KW1,297.7 billion in the first quarter.

The Shilla Duty Free, coming off a record 2018, also posted a big double-digit gain, with Q1 sales up by 35.2%.