FRANCE. MSC Cruises went to great lengths to show its commitment to the travel retail channel at TFWA World Exhibition earlier this month. The family-owned company brought one of its biggest ships – the 5,179-passenger capacity MSC Seaview – to the Bay of Cannes so that exhibitors and partners could come aboard and explore the shopping offer.

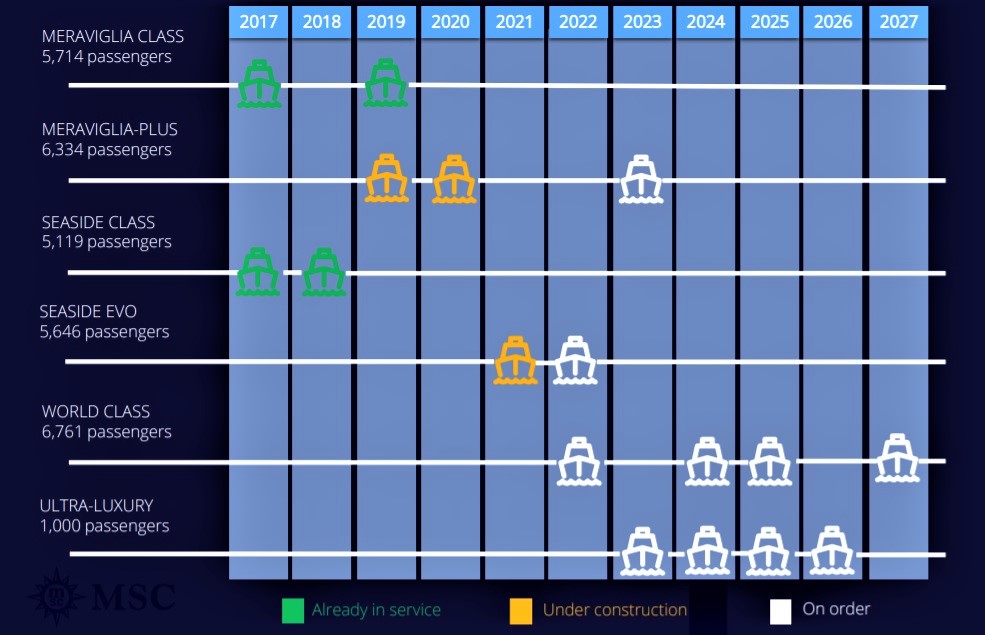

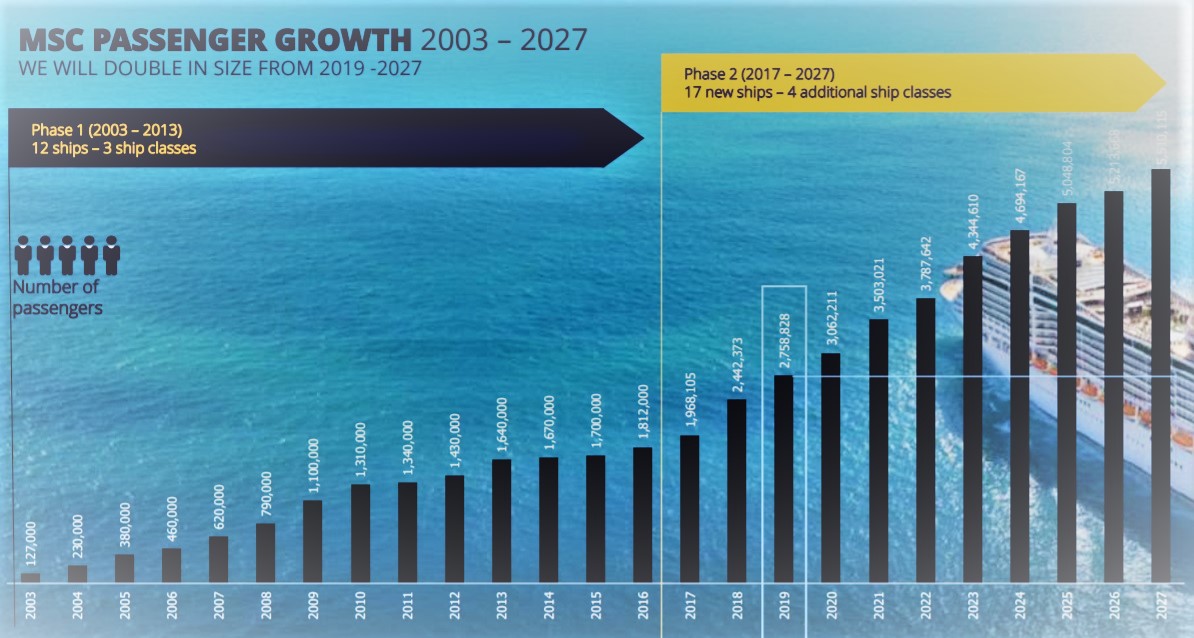

The aim was to show just how different the cruise retail experience is compared with airports, and to explain why those contrasts need to be recognised. Highlighting the differences is important for MSC Cruises given that it has, as we reported in July, set ambitious targets to triple capacity by 2027 with more than a dozen new ships coming on stream.

Getting the shopping experience exactly right is critical for the company. The day before the event, MSC Cruises Head of Retail Adrian Pittaway (below) spoke exclusively to The Moodie Davitt Report to explain why and how.

Kevin Rozario: There are only a handful of retail operators in this channel. Do you all talk to each other when it comes to developing the perfect retail offer?

Adrian Pittaway: That’s an interesting question. There are very few cruise retail operators, about five as concessionaires, and that means it’s easy to understand what everyone is doing. There are things that unite us and things that don’t. One that does is getting brand adaptability into the cruise market – this is crucial. If a brand applies an idea on one cruise ship, it can usually apply it across all of them, so the more that can be done collectively to support that is good.

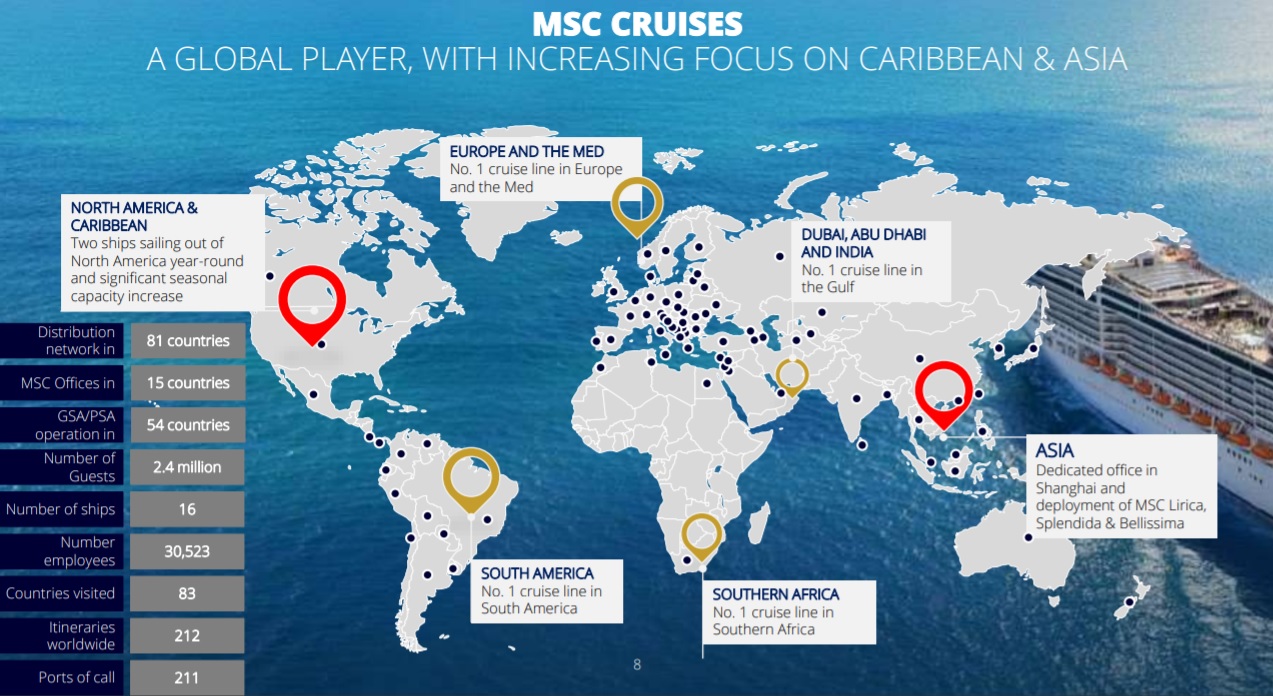

About 80% of the cruise industry is run out of Miami, driven by Carnival, Royal Caribbean and Norwegian and their sub-brands. From that perspective it is a very small, well connected industry. Ultimately we [MSC Cruises] are a little different to the others because we are not in concession tendering.

What do you mean by brand adaptability?

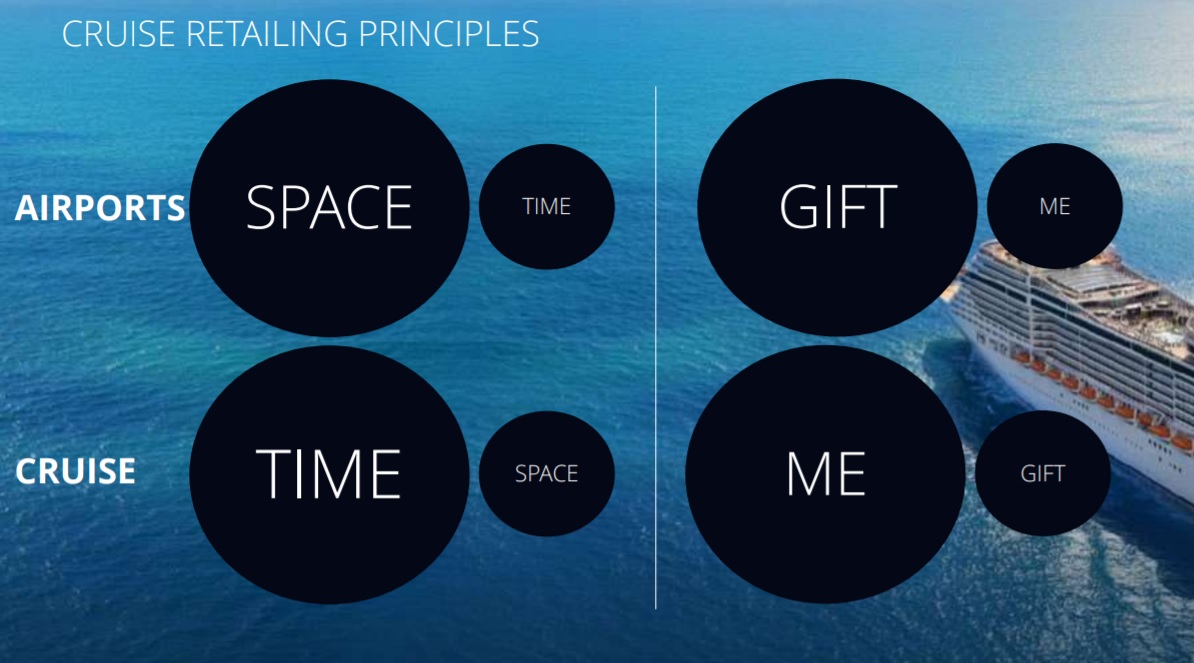

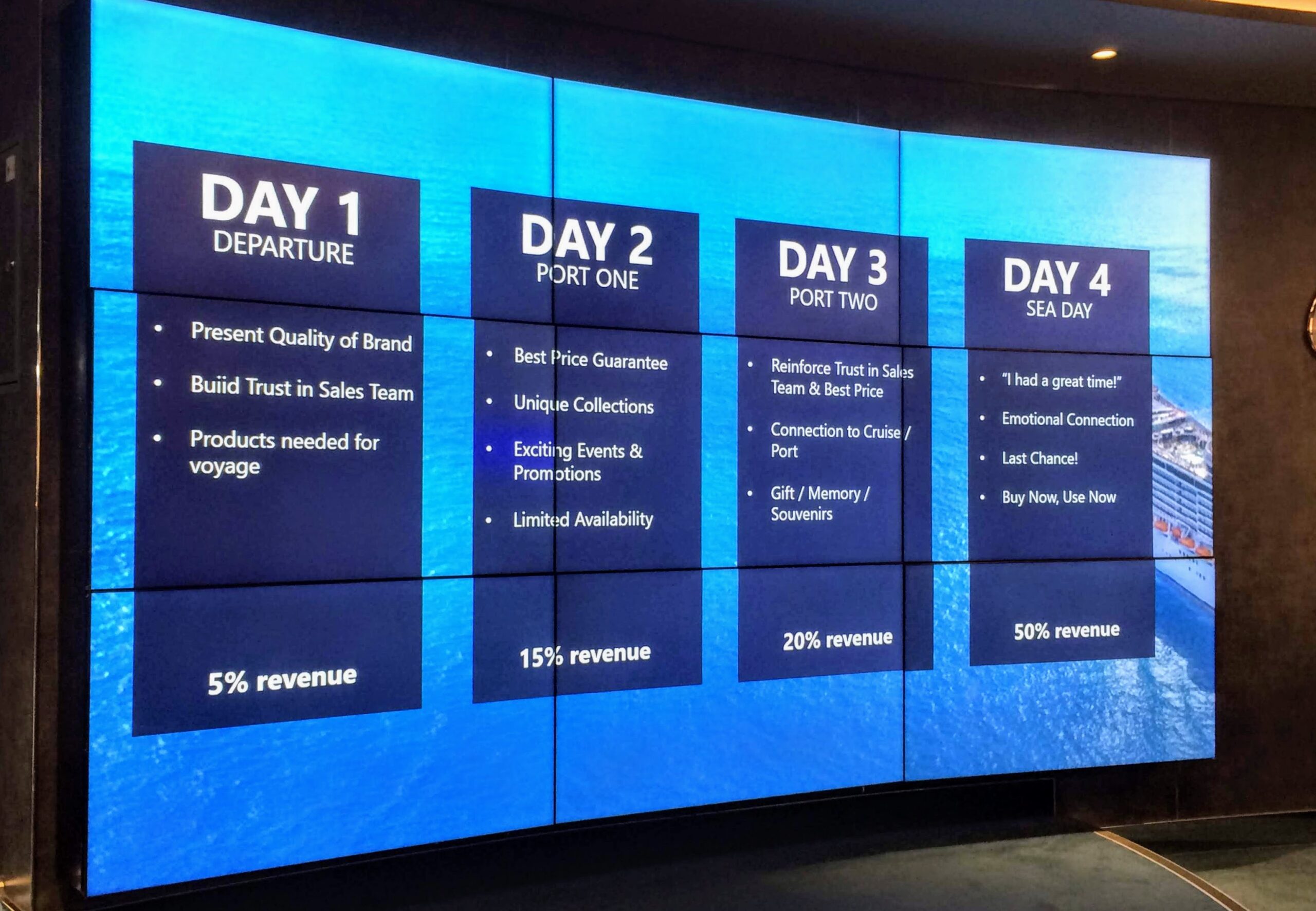

The cruise channel is less than 5% of the travel retail industry and the majority of the rest is the airport business. However, we are generally the opposite of airport retailing – there is not a lot of commonality between cruise and airport retail. We are a low-space footprint business but our customers have a lot of time. In airports there is a large amount of space but passengers have little time. Likewise we are not a gift-based channel (apart from Japan), unlike airports. About 70-80% of purchases are for self-consumption. So the motivations to buy – and the ways to sell – are different. We are a buy now, wear now, use now business. The brands that understand the channel are the most successful.

So brands need to change their mind-set to get onboard?

Our guests are with us for about seven days usually so the type of selling that we have is quite specific in what is an insanely complex business. Sales are very much based on human interaction and passengers rely on the knowledge of our sales teams. Trust is a major factor – people buy people not products on a cruise ship.

Is that why you focus so intensely on training?

Absolutely. The training and support that the brands and ourselves give to our staff has a return on investment that you can see straight away. When a brand does training on a ship sales can increase by 100% because it gives the team more confidence to sell those products.

If you said to me in ten years time will passengers be buying digitally, the answer is no. We are a business that if you are on a ship for seven days – 90% of our business is seven-day cruises – much of the buying decision for say a piece of jewellery is based on the relationship the passenger has with the store associate. Our team are living and breathing cruise ships 24/7 so the passion they have ensures a more intimate sales process compared to the airport environment.

Given that the ships are always on the move do brands come onboard much?

We encourage them to do so as often as possible. Cruise staff stay aboard for five to six months (and then change) so we need to invest continuously in training – it’s like painting of Forth Bridge. With Heinemann, our wholesale partner for P&C, we do a beauty seminar for our sales teams once a year where we try and bring all the brands. It’s an ongoing investment that has to be part of the business model – it’s a necessity not a luxury. If a brand is not able to bring their passion and knowledge to the ship they don’t do as well.

When brands visit the ships, can they visit anywhere or do you prefer specific ports?

We can do either, but it’s better to bring a training team onboard at an easy location such as Barcelona for example which is 20 minutes from the airport. Also at these bigger ports we can have four ships calling over the weekend so they can cover a lot of ground.

So when you are considering brands, their willingness to do these visits is important?

Yes. When we look at potential brands – and there are many looking at the cruise channel which have not yet committed – we present an honest and open picture of what cruise retailing is. It’s not an extension of the airport business or just another selling opportunity. It has to be thought-through, considered and adapted before engaging in it. If there is a naivety there, it rarely works.

How do you adapt the retail offer to the various nationalities you serve?

A good example is MSC Seaview. It was in the Mediterranean for six months but it will soon be in Brazil for the winter (their summer) with 100% Brazilian passengers onboard. It’s like taking Hamburg Airport and turning it into São Paulo Airport in 21 days by changing all the relevant ranging, assortments prices and brand choices. In this scenario what we look for is ‘connectivity’ – brands in Europe that we can also sell in South America with little adaptation.

In that case you need brands with international recognition and footprints?

Yes, and that’s my key criteria because we don’t have a huge amount of space. If I put a personalisation in, or a branded area, I need to be confident the payback works in any market where the ship is deployed. But we don’t necessarily ignore brands that have a strong regional focus either. For example we took on Foreo in China but we know they want to expand to other markets like Brazil and Mexico. So there is a development journey we can take with them.

What’s the next key retail development coming up for MSC Cruises?

In November we have the launch of MSC Grandiosa which has the largest retail area ever put on a cruise ship [around 1,200sq m]. We’re bringing eight new concepts to the market in terms of the way we sell some of our categories such as perfumery, fashion watches and luxury accessories. We have a retail design that is the ultimate in flexibility.

Flexible how?

We can send the ship to China, Brazil or North America at much shorter notice. We’ve enabled that by creating a dynamic, modular retail system that opens up the space to quickly changing the category mix and other elements. This is important because traditionally the cruise retail space footprint has been pretty inflexible.

In November, MSC Grandiosa will go to Brazil and that is really exciting for us because it is one of the best retail markets in the world in the cruise channel. Everyone talks about China but, for us, Brazil is as exciting as China – Brazilians are great consumers, they love to shop. This winter we will have four ships based there.

Finally can you give us a timeline for the launch schedule of your newest ships?

MSC Virtuosa, the sister ship to MSC Grandiosa, will come into service next October, and then in 2021 we’ll have the launch of MSC Seashore, another Seaside Evo class but which is longer and bigger with a more dynamic layout based on the learnings we’ve had with Seaside and Seaview. After that we will have the first World Class vessel launching in 2022 followed by our ultra-luxury ships in 2023 where we will use smaller, bespoke footprints.