Fashion luxury group Michael Kors Holdings Limited is to acquire Italian luxury fashion house Gianni Versace for approximately US$2.12 billion in a deal that is set to close in the first calendar quarter of 2019. The company will also rename as Capri Holdings Limited when the acquisition completes.

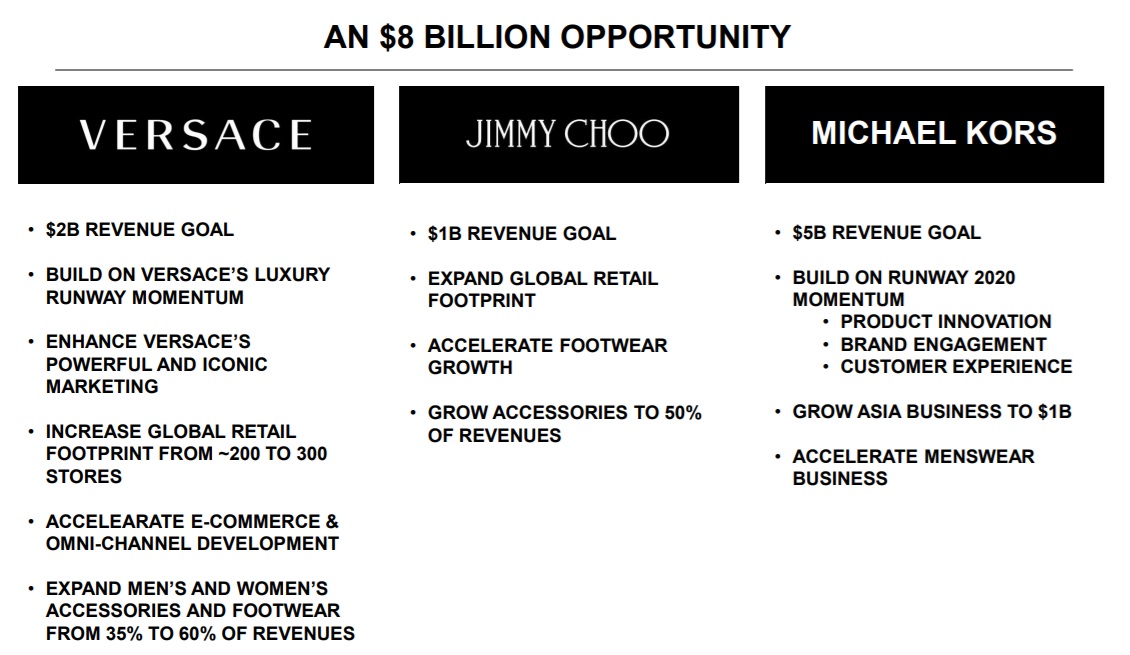

The expected benefits for Michael Kors Holdings include the expansion of the global luxury group to include three iconic founder-led brands (Michael Kors, Jimmy Choo and Versace) and an opportunity to grow the group’s revenue to US$8.0 billion in the long-term. The deal will also diversify the company’s geographical footprint to be less Americas-centric; and create long-term operational synergies.

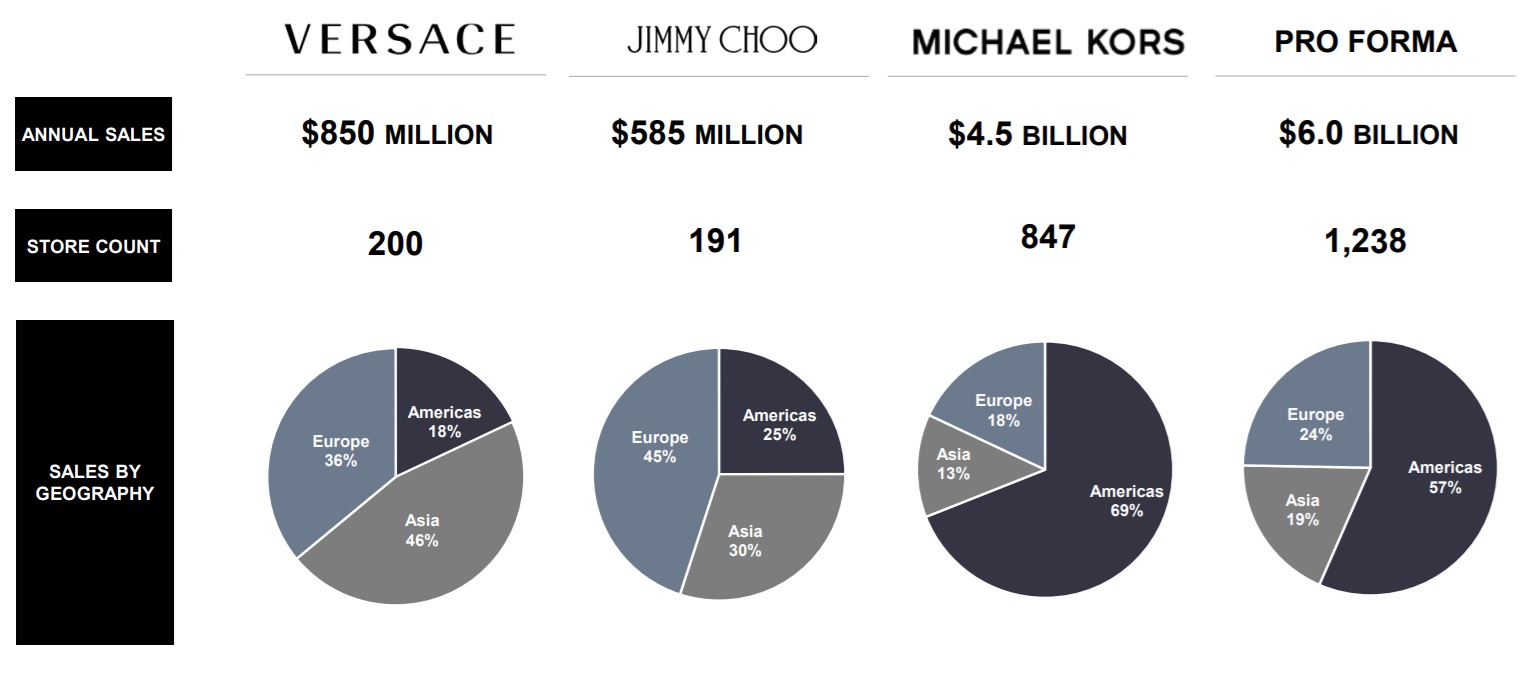

Today the three brands have pro forma sales of US$6 billion and a geographical split of 66% Americas, 23% Europe and 11% Asia. Thanks to Versace’s Asian weighting this split is expected to become more balanced at 57% Americas, 24% Europe, and 19% Asia.

Versace brings Asian promise

According to Jing Daily (an information-sharing partner with The Moodie Davitt Report) the acquisition comes at a time when both companies are making “aggressive, strategic and savvy pushes into the lucrative Chinese market. Their merger could change the luxury landscape in both China and the broader fashion industry” the on-line title said.

The deal also opens up travel retail opportunities given that one of the key strategic plans for reaching the US$8.0 billion target is to increase Versace men’s and women’s accessories and footwear from 35% to 60% of revenue, and to grow Jimmy Choo accessories to 50% of that business.

Michael Kors Holdings Chairman and CEO John D. Idol, said: “The acquisition of Versace is an important milestone for our group. Versace was founded in 1978. For over 40 years, it has represented the epitome of Italian fashion luxury. We are excited to have Versace as part of our family of luxury brands, and we are committed to investing in its growth. With the full resources of our group, we believe that Versace will grow to over US$2.0 billion in revenues.”

Versace currently has annual sales of US$850 million compared with US$4.5 billion from the Michael Kors brand.

Idol added: “I am thrilled to have the opportunity to work with Donatella on Versace’s next chapter of growth.” Donatella Versace added: “This is a very exciting moment for Versace. It has been more than 20 years since I took over the company along with my brother Santo and daughter Allegra. I am proud that Versace remains very strong in both fashion and modern culture.”

The three family members will become shareholders in Capri Holdings. “This demonstrates our belief in the long-term success of Versace and commitment to this new global fashion luxury group,” Donatella said.

The new company name is inspired by the Italian island long-recognised as a luxury destination. Its three-rock formation is also symbolic of each of the three founder-led brands in the new group.

Versace’s management team will continue to be led by CEO Jonathan Akeroyd. He said: “Since I joined Versace over two years ago, our focus has been on leveraging the company’s heritage and strong brand recognition worldwide, which has allowed us to experience significant growth in all regions.”