MALAYSIA. Duty free and duty paid operator Duty Free International, which runs the ZON Duty Free brand across airports, duty free zones, seaports, borders and other tourist destinations in Malaysia, has announced its financial results for the second quarter of financial year 2018 – posting a -5.5% decrease in revenue to RM148.3 million ($35.16 million).

DFI cited the implementation of a new Goods and Services Tax at border outlets and duty free zones from 1 January 2017 as the reason behind a drop in customer demand for certain products.

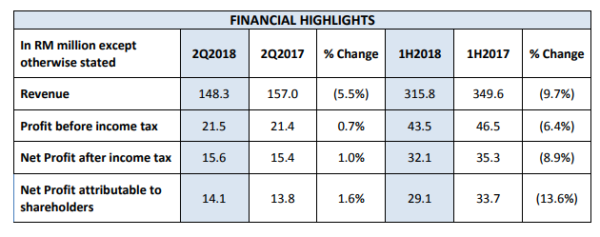

The Group recorded a profit before income tax of RM21.5 million ($5.1 million) for Q2 2018 (the three months ending 31 August), compared to RM21.4 million for Q2 2017 ($5.07 million) and net profit attributable to shareholders saw a +1.6% increase to RM14.1 million ($3.34 million) in Q2 2018 (Q2 2017: RM13.8 million/$3.27 million).

For Q2 2018, the Group declared a second interim dividend of 0.5 Singapore cents per share. For the first half of 2018, the Group reported a RM3 million ($0.71 million) or -6.4% decrease in profit before income tax to RM43.5 million ($10.31 million), which was mainly due to a decrease in revenue of -9.7% to RM315.8 million ($74.9 million) and net loss in foreign exchange of RM5.7 million ($1.35 million).

This was partially offset by lower financial expenses, lower transportation costs and a recognition of gain from changes in fair value of the call option amounting to RM7.5 million ($1.78 million) for the period under review.

“The Group’s operating environment continues to be a challenge with a competitive business environment and a volatile US Dollar to Malaysian Ringgit exchange rate. However, the Group will continue its efforts in identifying new market opportunities while keeping focused on its core business and broadening its customer base and products. Maintaining operational efficiency and cost control strategies will also help the Group to remain competitive and profitable for the remaining quarters of the financial year ending 28 February 2018,” DFI said in a statement.

Last year, Heinemann Asia Pacific purchased a 10% stake in DFZ Capital Berhad, a wholly-owned subsidiary of DFI, for €19.7 million in cash, with an option to increase its stake by another 15%.

SGX Mainboard listed Duty Free International Limited is the largest multi-channel duty free and duty paid retail group in Malaysia with more than 40 retail outlets