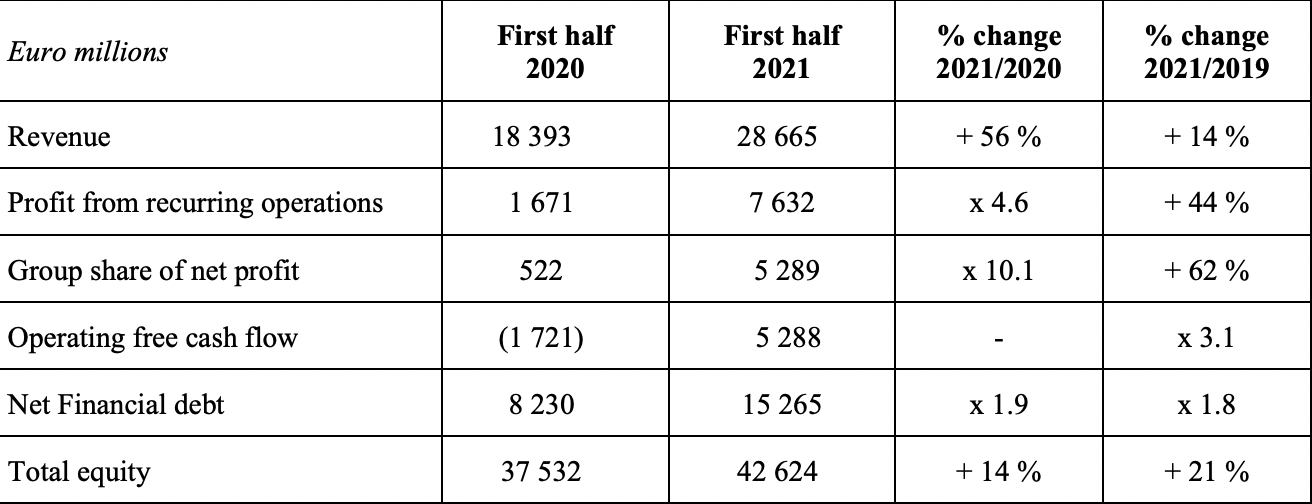

FRANCE/INTERNATIONAL. Luxury goods group LVMH Moët Hennessy Louis Vuitton today reported revenue of €28.7 billion in the first half of 2021, up by +56% compared to the same period in 2020. Profit from recurring operations was €7,632 million for the half, up by +44% compared to the first half of 2019 and more than four times higher than in the same period in 2020.

Organic revenue growth was up +53% compared to 2020 and +11% compared to the same period in 2019. The performance reflected accelerated growth in Q2, which saw organic revenue increase by +14% compared to +8% in the first quarter.

The company said that the half marked “a return to strong growth momentum after a severely disrupted year in 2020 resulting from the global pandemic”.

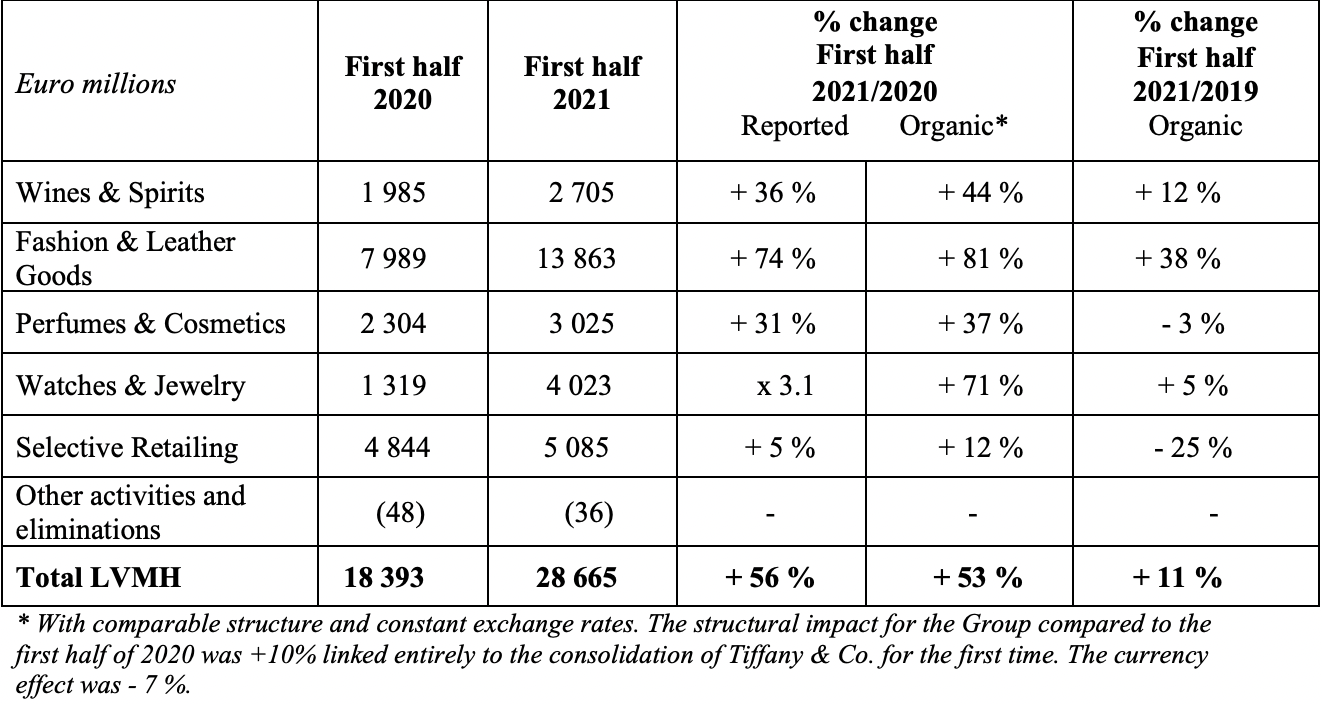

The Selective Retailing division, which includes DFS – the company jointly held by LVMH and Robert Miller (the company’s Co-Founder) – along with Sephora and Starboard Cruise Services, reported a +12% rise in organic revenue year-on-year, but the figure was down -25% compared to 2019.

LVMH said: “DFS continued to be impacted by the lack of recovery in international travel to most destinations. Following an ambitious renovation programme, faithful to the history of this flagship store and maintaining high environmental standards, the reopening of La Samaritaine on June 23 was an historic success.” [A special report on the opening of La Samaritaine will follow soon; see below].

Highlights of the period included surging growth for the Fashion & Leathergoods division, which reported organic revenue growth of +81% in the first half compared to the same period in 2020. Organic revenue growth compared to the first half of 2019 was +38%. Profit from recurring operations was up +74% compared to the first half of 2019 and represents more than three times that of 2020.

Highlights of the period included surging growth for the Fashion & Leathergoods division, which reported organic revenue growth of +81% in the first half compared to the same period in 2020. Organic revenue growth compared to the first half of 2019 was +38%. Profit from recurring operations was up +74% compared to the first half of 2019 and represents more than three times that of 2020.

Louis Vuitton delivered a “remarkable performance” and maintained its profitability at an “exceptional level”. Christian Dior, Celine, Fendi, Marc Jacobs and Loewe also performed well.

The Wines & Spirits business group recorded organic revenue growth of +44% year-on-year, while profit from recurring operations was up +20%. Champagne volumes rose +10% compared to the first half of 2019, driven by momentum in Europe and the US. Hennessy Cognac volumes increased by +6% compared to 2019, limited by supply constraints. China, which was the first market to have been impacted by the pandemic in early 2020, experienced a strong rebound in the first half while demand in the US held up well.

The Perfumes & Cosmetics business group recorded organic revenue growth of +37% year-on-year in the first half. Organic revenue was down -3% compared to the first half of 2019. Profit from recurring operations was up +1% compared to the first half of 2019.

The group noted that its major brands “maintained a policy of selective distribution, unlike many competitors who have increased their proportion of discounted sales or sales in parallel networks, as a means of supporting their revenues”.

LVMH said its beauty brands are benefiting from online sales, partially offsetting the impact of the suspension of international travel. Parfums Christian Dior enjoyed “a strong acceleration” in its business with local customers, extending the recovery that began at the end of 2020. Guerlain showed “very positive momentum, driven by skincare”. Parfums Givenchy has gained market share while Fresh confirmed its presence in ultra-premium skincare, noted LVMH. Maison Francis Kurkdjian continues to post “remarkable growth”, added the company.

The Watches & Jewelry business group recorded organic revenue growth of +71% in the first half and +5% compared to the same period in 2019 (excluding Tiffany). Profit from recurring operations was up +122% compared to the first half of 2019 and +27% excluding the effect of the integration of Tiffany. The first half saw the integration of Tiffany, while Bvlgari saw “good growth in jewellery”.

Group Chairman and CEO Bernard Arnault said: “LVMH has enjoyed an excellent half-year and is reaping the benefits of having continued to innovate and invest in its businesses throughout the pandemic despite being in the midst of a global crisis. The creativity, the high-quality and enduring nature of our products and the sense of responsibility that drives us, have been critical in enabling us to successfully withstand the effects of the pandemic; they will remain firmly embedded in all our Maisons, thereby ensuring their continued desirability.

“Highlights from the first half include the integration of the Maison Tiffany and the inauguration of La Samaritaine after an ambitious renovation programme. Within the current context, as we emerge from the health crisis and see a recovery in the global economy, I believe that LVMH is in an excellent position to continue to grow and further strengthen our lead in the global luxury market in 2021. As France is the principal recruitment area and the country of origin of many of our products, the growth of LVMH benefits the country today, and even more tomorrow, with all our Maisons being proud to make their contributions.”

Special celebratory eZine

Look out for our special edition of The Moodie Davitt Spotlight Series eZine dedicated to Samaritaine Paris Pont-Neuf by DFS, including an exclusive interview with Chairman and CEO Benjamin Vuchot. For details contact Martin Moodie at Martin@MoodieDavittReport.com