Korean duty free: A special report Look out in coming weeks for Martin Moodie’s comprehensive on location round-up from the world’s biggest duty free market. It includes interviews with: • Lotte Duty Free CEO Kap Lee |

SOUTH KOREA. Duty free sales rose by 23% year-on-year in March to an all-time monthly high of (US$1.9 billion) according to the Korea Duty Free Association.

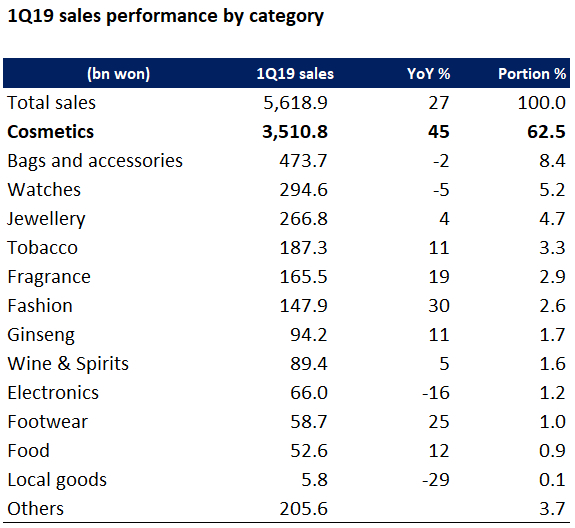

The March performance spurred a 27% first-quarter rise to KW5,618.9 billion (US$4.95 billion), according to industry sources.

“March 2019 duty free sales represent the highest-ever amount by month and dispel market concerns of a slowdown and any negative impact from China’s new ecommerce law,” a leading Korean equity analyst told The Moodie Davitt Report.

As reported, the law was introduced on 1 January with the intention of maximising domestic consumption. Many had expected a sharp fall in daigou purchases in South Korea as a result but early indications are that apart from a modest slowdown in early January there has been no impact on Korean duty free, at least for beauty products whose sales are booming.

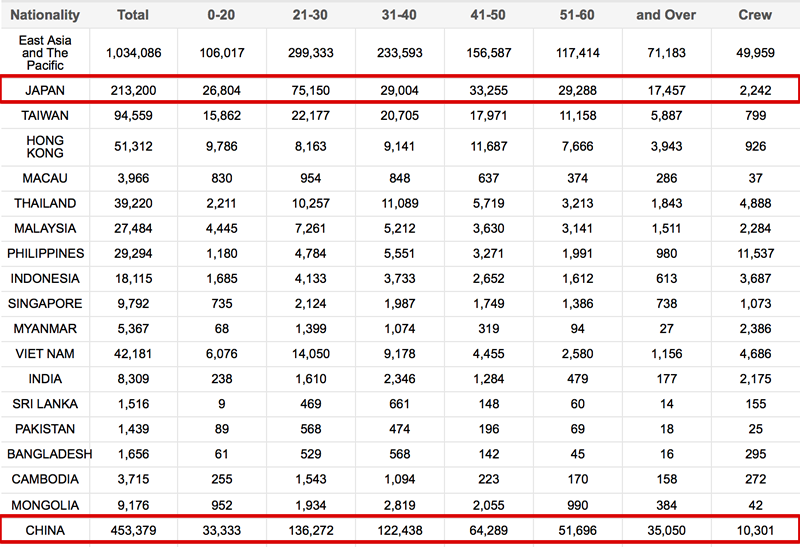

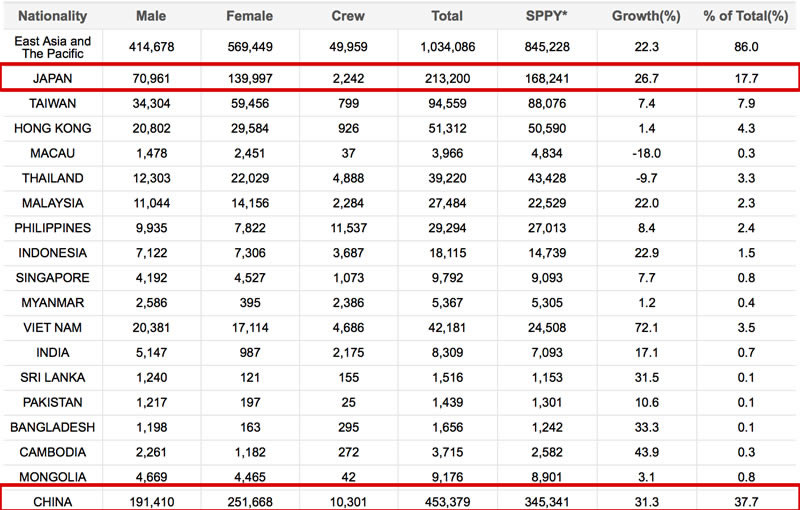

Underlining that conclusion, spend per person by foreign shoppers (principally Chinese visitors who account for over 75% of downtown duty free spending) rocketed by +20% in March, building on strong gains in January and February. Chinese consumers generated nearly 77% of duty free revenues in the first quarter, more than double their share of total visitor arrivals to South Korea (see Korea Tourism Organization tables below).

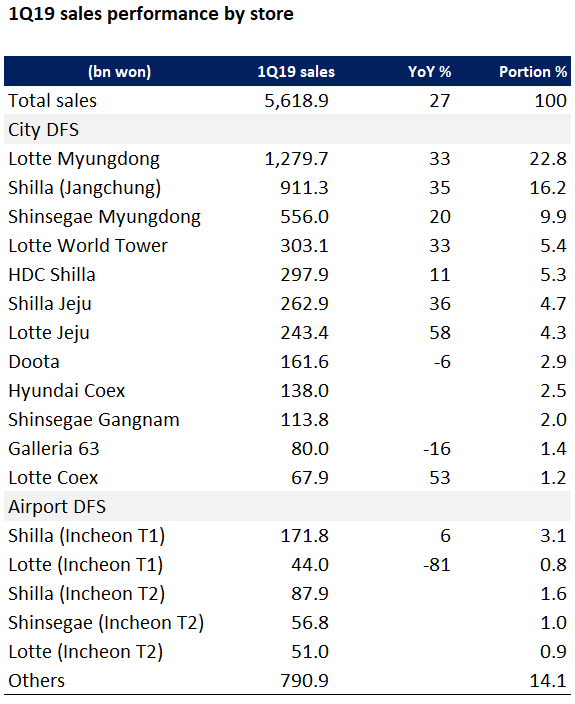

Other drivers of the record March performance were big downtown duty fee increases in Seoul (+28.8%), and Jeju (+24.4%) and downtown duty free nationwide (+28.2%). Airport duty free sales grew by a modest 1.5% in the month.

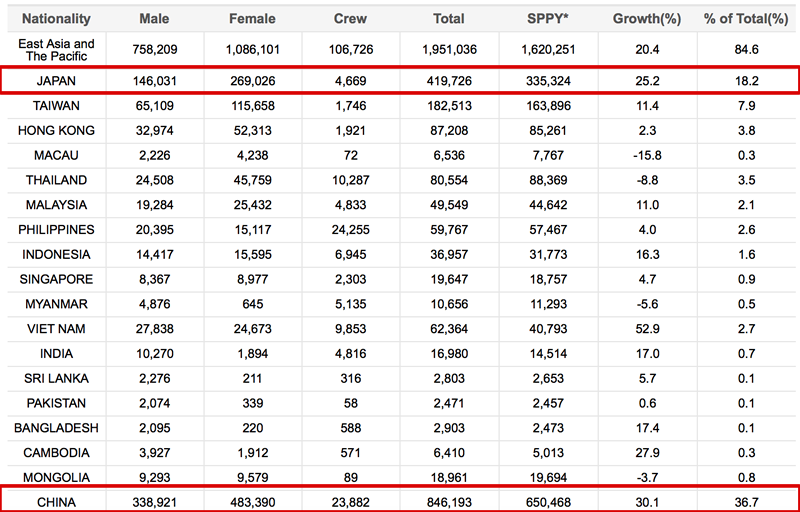

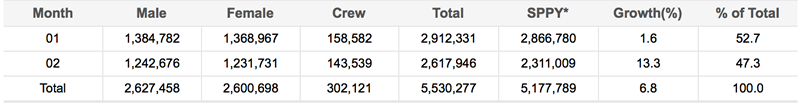

As reported, Chinese arrivals to South Korea increased 30% year-on-year in January and February (see charts below) to 846,193 a 36.7% share of total visitors. Japanese visitor numbers rose by an encouraging 25.2% in the same period to 419,726, an 18.2% share. Departures by Korean nationals – the other main contributor to Korean duty free – increased by 6.8% over the first two months to 5,530,277.

First-quarter beauty boom

Cosmetics sales (driven by daigou traders) rocketed by 45% in the first quarter (see tables below) and accounted for an overwhelming 62.5% of total revenue. Handbags and accessories (perhaps more likely to have been affected by the Chinese ecommerce law) posted a 2% drop, generating an 8.4% share, while watches declined by 8% (a 5.2% share).

Lotte Duty Free’s flagship store in Myeong-dong/Myungdong turned in a rip-roaring performance with sales rising 33% to KW1,297.7 billion in the first quarter. The Shilla Duty Free also posted a strong double-digit gain, with sales up by 35.2%. Galleria 63, rumoured to be for sale, slumped 16%.