LATIN AMERICA. Dufry and ferry retail concessionaire Bernabel Trading outlined the gradual progress of their respective store reopenings during a conference call organised by Latin American duty free association ASUTIL on Thursday. They underlined the key message that if consumers trust retailers’ sanitary procedures and feel safe in the store environment, then they will purchase.

Dufry Mexico Executive Director Alvaro Neto noted that the country was “unique in the world” as it was the only market where a ban on air traffic was not imposed, although travel was severely restricted due to flight suspensions to and from other places. The business fell away in March with a return in June, led by Cancún Airport, a key leisure destination, notably for US travellers. Between 1 and 3 July, most other airports in Mexico reopened.

“Cancún Airport was an important opening,” said Neto. “It was a test laboratory where we could harmonise Dufry sanitary procedures with those of the Ministry of Health and ICAO (the International Civil Aviation Organization).”

Business was slow to start in June, he said, but hit 25% of prior year levels in July, led by sales of liquor & tobacco and a strong promotional campaign to sell off long-held stock. “More hotels opened in July and we have had more visitors from Canada and even Europe.”

Other tourism-driven airports such as Guadalajara have also recovered well, with progress slower in business travel destinations such as Mexico City to date. The company expects further improvement once restrictions from other Latin American countries ease.

“So far, duty paid is doing better than duty free [with domestic travel recovering faster than international -Ed], the product mix is basically same and we have focused our strategy around a lot of promotions,” said Neto.

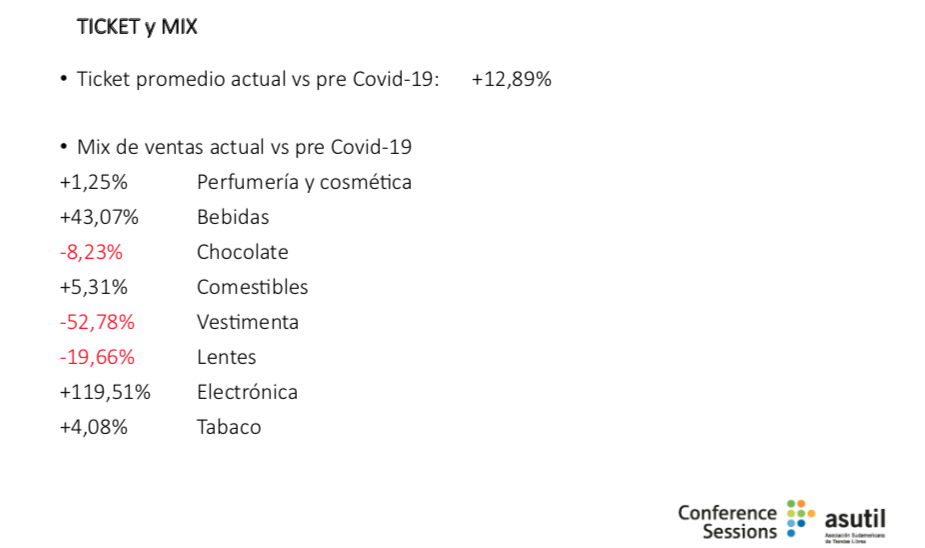

Bernabel Trading Director Martin Laffitte took attendees through the updated protocols for travelling on the Buquebus ferries that ply the River Plate between Montevideo in Uruguay and Buenos Aires in Argentina. He added that average transaction values had increased over +12% from pre-COVID-19 times because those who purchase do so with confidence due to the strict testing and sanitary regime onboard.

The rules for travel are stringent: passengers going to Uruguay must have completed a negative test before embarking, they must stay seven days in the country and then can move around after having another test. The ferries also have testing procedures onboard.

The ships began sailing again with duty free open from 19 June. In the shops there should be no more than one person for every 5sq m of space so only around 60-70 people are permitted to enter at any one time. Entrances and exits are separate so people do not gather at the same point.

In addition, shoppers are advised to maintain a 1.5m distance between each other and upon entry, everyone gets a basket, which is disinfected once they leave the store. There are hand gel dispensers for sanitisation in every part of the store and travellers are requested to rub their hands using the gel before they touch any merchandise.

Upon payment, there are is 1.5m of floor area between shoppers outlined on the floor. Transactions can still be made using cash but the retailer promotes cashless payment.

Once the ferry arrives in port, special cleaning procedures are taken and there is a sanitary protocol that all staff must also follow.

Among the new elements to be introduced onboard are small mobile carts that can go around the ship and sell to people in their seats. Bernabel is also optimising the shopping web page to communicate offers before and during the trip. Other communications include flyers that promote discounts.

Laffitte said: “People are confident due to the testing. They know that they are in a healthy, sanitary area. We feel people are more self-indulgent as they are out of quarantine or lockdown space. Now, 78% of passengers go to the store, such is their confidence, and all of these buy something.”

That has resulted in the average ticket rising by +12.89% compared to pre-COVID-19 times. Although spending on some categories has slipped, such as confectionery (-8%) and P&C is only up by +1.25%, liquor has surged by +43%. This is because most passengers heading for Uruguay are resident there. As they cannot buy in bars or restaurants, they stock up on drinks for their homes, said Laffitte.

ASUTIL Secretary-General José Luis Donagaray said: “We see in Uruguay, as in Mexico, that people approve of the sanitary measures in the stores and that engenders confidence. People see duty free as a safe zone in which they can enter.”

The outlook for traffic

ASUTIL also supplied latest information on the planned opening of national aviation networks, with most having opened in July or set to open in August – good news for travel retailers at airports in those states.

The session also featured an update from ACI Latin America-Caribbean (ACI-LAC) Director General Rafael Echevarne, who said that passenger traffic in the year to June in the region had fallen by -51% year-on-year.

He said: “We foresee similar patterns for the rest of the year and every day of lockdown has an impact on the ensuing recession. We encourage countries to reopen and restart air transportation as a matter of urgency as it’s important for economic and social recovery.”

Echevarne commented on the difference between states within Latin America, noting that government policies and therefore traffic varied strongly between each. Mexico, as noted above, was the only country in the world to have imposed no restrictions on passenger traffic. Ecuador has returned to full domestic and international traffic while Uruguay is the only state in the region to have reintroduced EU flights.

“There are big differences,” he noted. “Mexico is back from -90% to -70% down on last year due to strong domestic traffic. Brazil also has a big domestic market although it is not recovering as Mexico has done so far.”

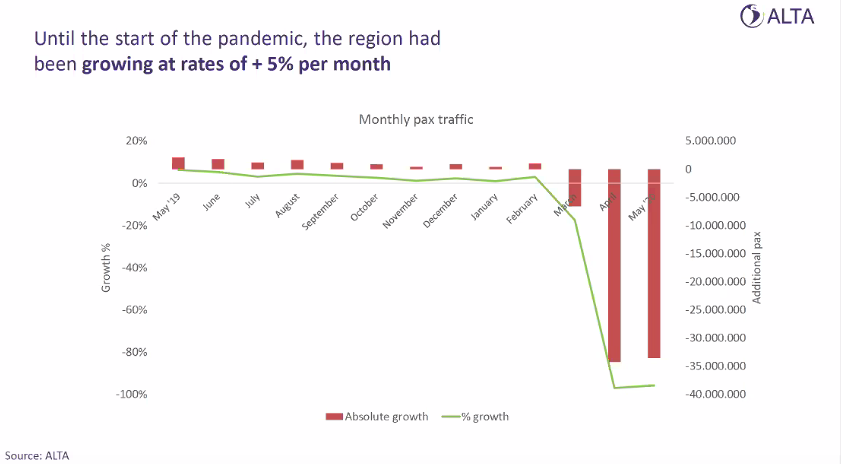

Latin American and Caribbean Air Transport Association (ALTA) Legal Director & General Counsel Gonzalo Yelpa added further data to the conversation, saying that until the pandemic, air traffic had been growing at +5% per month in Latin America.

“Traffic is now sharply down,” he said. “We had expected numbers would hit 50% of those in 2019, but it’s not clear if we will even reach that now. Traffic has fallen by -95% in April and May. The only connectivity we saw for a period was Brazil domestic, plus Mexico and Chile, also mostly domestic. Everywhere else there was almost total shutdown. The numbers for April and May takes us back to the 1960s, when we had 1-1.15 million people flying per month.”

He said that the forecast economic impact on airlines would be huge, with IATA predicting US$18 billion in lost income for Latin American-Caribbean carriers in 2020. “Global losses are forecast at US$314 billion but the big difference to other regions is that state aid or bailouts apply there.

“We understand there is pressure on governments from the public and opening borders is seen by some people as a threat. But currently it looks like it will be 2025 when we see recovery to 2019 levels. Airlines are running out of cash and some of our members have entered administration. If it goes on, the recession will affect the type of recovery. And in that recovery, capacity will be tight, with scarce resources [fewer aircraft -Ed], and even if demand is there, there may not be the capacity to satisfy it.

“We need to build confidence and we need consistent [regulatory] approaches, not a patchwork across such a geographically spread region, one that is so dependent on tourism. It is something governments must address to ensure a rational restart of operations.”