FRANCE/INTERNATIONAL. A strong performance in North America helped to drive impressive top and bottom line growth at Lagardère Travel Retail in 2016, according to full-year results released by its parent Lagardère Group.

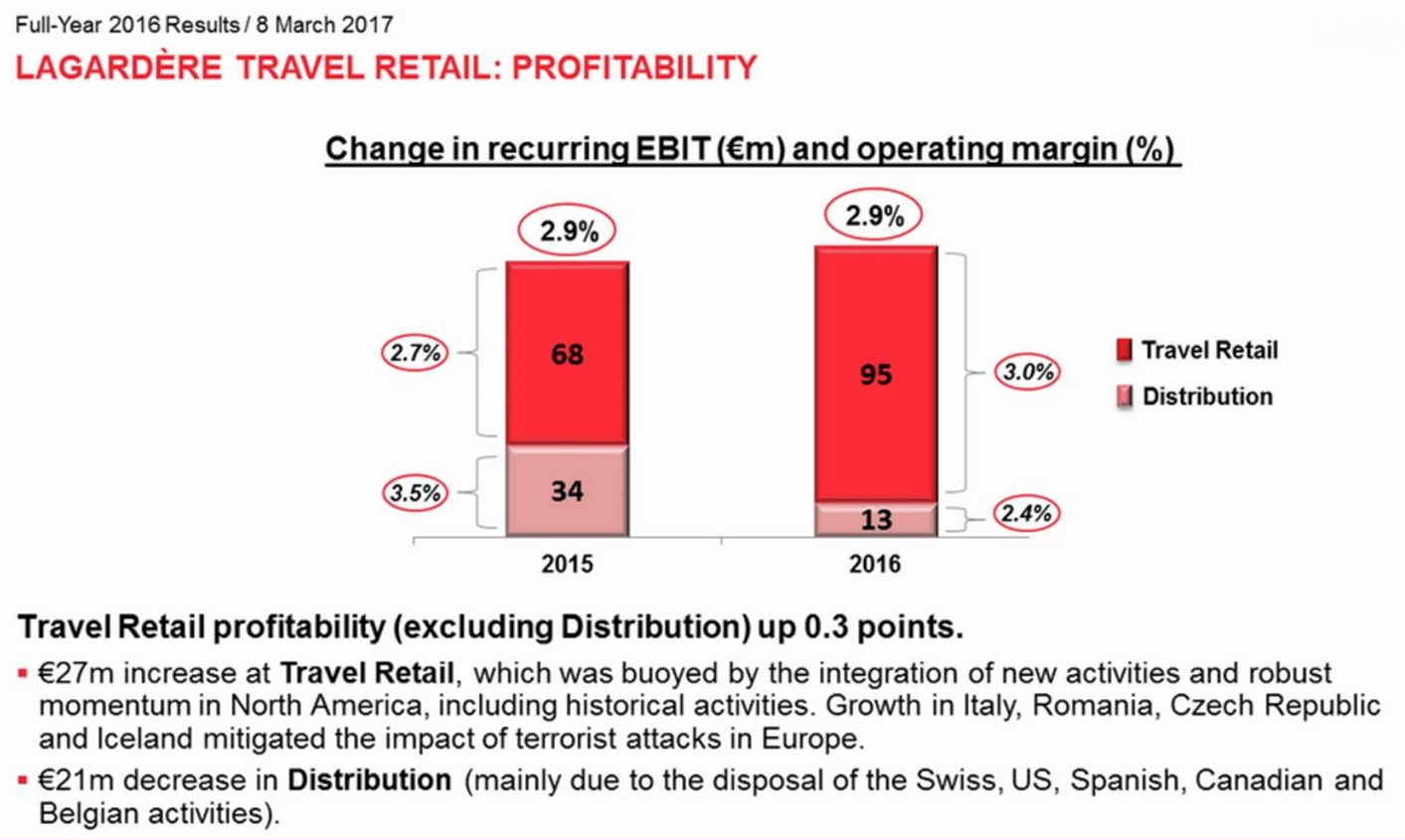

The travel retail division’s operating margin (excluding the press and distribution arm) edged up 0.3 points to 3% and recurring EBIT increased by €27 million to €95 million (US$28.5 million to US$100 million).

As reported in February, Lagardère Group revenue from travel retail (excluding the press distribution arm) hit €3,132 million in 2016, up by +7.1% like-for-like and +23% on a consolidated basis.

Lagardère Travel Retail revenue (including travel retail and distribution activities) reached €3,695 million, which was an increase of +5.0% like-for-like and +5.3% on a consolidated basis.

Revenues rose by +9.7% in North America, which the company attributed to network expansion and sales synergies arising from the integration of Paradies. The group also referenced “robust momentum of the legacy business in North America” as a factor in the profit increase.

The Asia-Pacific region – another key growth driver for the travel retail division – reported a revenue hike of +8% thanks primarily to the good performance of fashion stores in China and of duty free activities in New Zealand.

Business in France held firm (up +0.5%), thanks mainly to the performance of the division’s Travel Essentials and Foodservice segments.

This followed the extension and modernisation of the network, and an upturn in the Duty Free segment towards the end of 2016. Duty Free benefited from a favourable comparison effect after a weak fourth-quarter 2015 shaped by the Paris terrorist attacks.

EMEA (excluding France) enjoyed strong 10.9% revenue growth, spurred by network development, modernisation of concepts and what the organisation described as “a dynamic sales policy” which helped limit the impact of the terrorist attacks.

EBIT in the EMEA region was particularly affected by the terrorist attacks, apparently having an estimated negative €7 million (US$7.4 million) impact. However, gains in Italy, Romania, the Czech Republic and Iceland were said to have partially offset this decline.

Revenue for Lagardère’s Distribution operations was down by -3.8%, while recurring EBIT fell by €21 million to €13 million (US$22.2 million to US$13.7 million), due primarily to the disposal of activities in Switzerland, Spain, the US, Canada and Belgium.

The performance of the travel retail division was said to have played a major part in the wider Lagardère Group’s +2.5% like-for-like revenue increase to €7,391 million and sharp rise in recurring EBIT to €395 million (2015: €378 million).