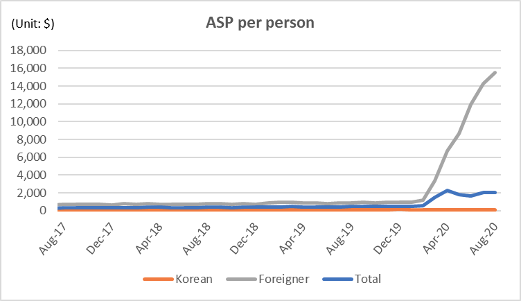

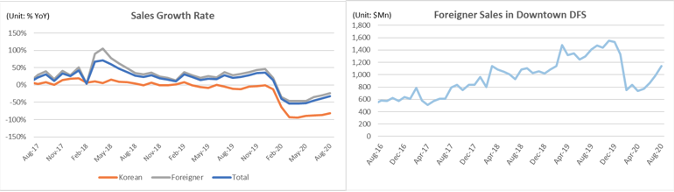

SOUTH KOREA. Duty free sales in South Korea fell by -33% year-on-year in August, to US$1,217.2 million, writes The Moodie Davitt Report Senior Retail and Commercial Analyst Min Yong Jung*. But average sales to foreigners continued to rise, recording a leap of +1626% year-on-year to US$15,539. Sales to Koreans declined by -81% year-on-year to US$51.2 million.

The total sales figure was up +17% on the previous month, after a +13% rise from June to July and +11% from May to June. Sales in the crucial downtown duty free market hit US$1 billion for the first time since the crisis began.

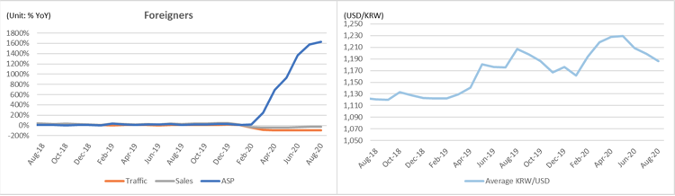

Foreigners – mostly major corporate resellers – continue to drive the duty free market, contributing 96% of sales. Sales to foreigners increased +16% month-on-month to US$1,166 million. While this was down -24% year-on-year, the decline is the lowest since the outbreak of COVID-19 in Korea (January +21%, February -35%, March -46%, April -46%, May -46%, June -35% and July -29% YoY).

Sales to foreigners in downtown duty free hit US$1,138 million, down by -19% year-on-year but up +16% over the previous month. The increased share of downtown duty free sales (94% of all duty free sales in August 2020 versus 84% in January 2020) was expected with daigou resellers doing most of their business in the downtown stores where the product range is diverse and quantities are abundant.

*Note: Korean national Min Yong Jung, formerly based in London and now in Seoul, is Senior Retail and Commercial Analyst at The Moodie Davitt Report. His appointment in June 2019 was the first of its kind in travel retail media. It marked the creation of the Moodie Davitt Business Intelligence Unit, a new division designed to provide a previously unseen level of research and analysis for the travel retail channel.

Do you have research needs related to the Korean and Asia Pacific travel retail and luxury markets? Min Yong Jung can be contacted at minyong@moodiedavittreport.com