SOUTH KOREA. The country’s duty free market grew by around 35% year-on-year in 2018 to over US$17 billion, according to a reliable source in the local supply community quoting official statistics.

The spectacular top-line result was driven by a near 45% increase in sales to foreigners, principally Chinese. Sales to Koreans grew by around 7%.

“The top-line results from the Korea Duty Free Association were generally very strong but the retailers’ profit margins were severely hit by the cost of generating the daigou business downtown,” a senior source told The Moodie Davitt Report. Almost 80% of sales across the airport and downtown sectors were to foreigners, a channel driven by daigou shoppers (or shuttle traders) buying for resale in China.

As reported, Korean travel retailers and their suppliers are anxiously monitoring the impact of China’s new e-commerce law, introduced on 1 January, which is in part designed to crack down on the daigou trade.

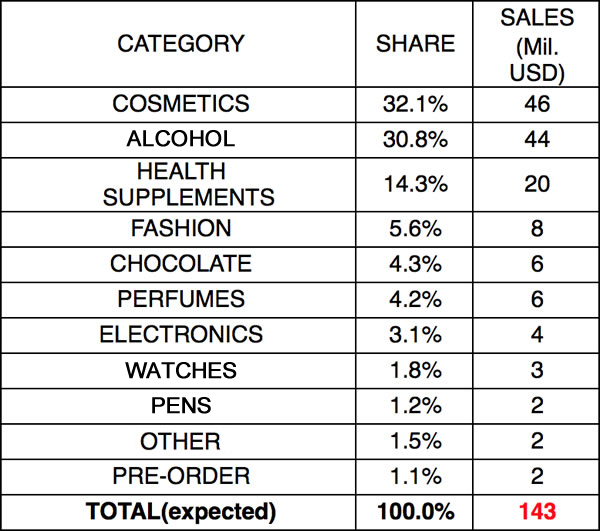

The figures exclude airline duty free. As revealed by The Moodie Davitt Report, Korean Air posted 2018 duty free sales of US$143 million, making it once again the world’s leading airline for onboard retail. We estimate Asiana Airlines’ sales at around US$80 million.

Downtown sales the driving force

Sales at downtown duty free stores nationwide rose 42% year-on-year to just under US$14 billion.

Lotte Duty Free remained the leading retailer in this channel by turnover. Its Myeong-dong flagship store in Seoul posted a revenue gain of around 37% to over US$3.8 billion (as reported, it reached US$3.6 billion, a landmark 38-year high on 14 December, representing a 35% increase over the previous best full year).

Some 88% of sales were to foreign customers, most of them Chinese, led by daigou shoppers who have so dominated the Korean duty free business over the past two years. Sales to Koreans actually dropped by over 6% but those to foreigners increased more than 46%.

The Shilla Duty Free’s flagship store in Seoul ranked second among downtown stores, posting sales of around US$2.6 billion, up 40% year-on-year. Around 82% of sales were to foreigners, with both this sector and purchases by Koreans up by about 39%.

Shinsegae Duty Free’s Myeong-dong store came in third among downtown duty free retailers, posting an impressive 50% surge in sales to over US$1.8 billion. Around 89% of purchases were made by foreign customers, with turnover rising by more than 53%. Sales to Koreans also prospered, growing by about 34%. The same retailer’s new store in Gangnam, which opened on 18 July 2018, recorded revenues of US$159 million in just over five months of trading, with some 90% of sales being made to foreigners.

HDC Shilla, opened in December 2015, ranked fourth with sales of around US$990 million, a 34% increase year-on-year. Sales were overwhelmingly dominated by foreign shoppers (93%). Close behind was Lotte Duty Free World Tower, with sales soaring 83% to nearly US$930 million (the store reopened on 5 January 2017 after a long period of closure from June 2016 due to the controversial loss of its licence).

Doota Duty Free (which opened in Seoul in May 2016) generated sales of around US$621 million, up by 58%. Almost all Doota’s sales were to foreign (mainly Chinese) customers.

Dongwha Duty Free and Hanwha Galleria Duty Free each recorded sales of nearly US$317 million, up 14% and 8% respectively.

Lotte Duty Free Coex, which had its licence renewed during the year, posted a 100% increase to US$195 million.

Market entrant Hyundai Duty Free, which opened in Seoul’s Samseong-dong business district on 1 November, generated sales of around US$57 million, suggesting it will become at least a US$350 million force this year if trading conditions remain favourable (a big if given the potential impact of China’s new e-commerce law on daigou shoppers).

SM Duty Free, a leading small and medium enterprise (SME) posted a 4% decrease downtown compared with 2017 to US$53 million.

Jeju recovery but Busan patchy

On Jeju Island, where sales (excluding the separate Korean-only stores) are almost entirely dependent on Chinese customers, The Shilla Duty Free recorded a near 55% rise in sales downtown to just under US$790 million. Rival Lotte Jeju Duty Free posted sales of US$685 million, up 62%. JTO Duty Free, hit hard the previous year by a slump in Chinese trade due to the THAAD row between South Korean and China, achieved a 142% revival to US$26 million.

In Busan, Lotte Duty Free was the leading downtown player with sales of US$325 million, a rise of 13% over 2017. Busan is less reliant on the Chinese market than Seoul or Jeju and around 37% of Lotte’s sales were to Koreans. Shinsegae Duty Free’s downtown turnover fell -7.5% to US$220 million, driven by an 18% slump in sales to Koreans who represented 32% of business.

Airport performance affected by contract changes

Airport duty free performance represented a contrasting picture. Sales at the country’s leading gateways are much more evenly split between Korean nationals and foreign shoppers. Total sales in the channel rose almost 14% to nearly US$2.8 billion, split 51/49% by Korean and international customers in market share terms.

The Shilla Duty Free was the leading Incheon International Airport travel retailer, posting sales of US$590 million (down 10.5%) at its flagship Terminal 1 concession. Around 43% of sales were to Koreans, the balance to foreign visitors.

At Incheon T2, which opened on 18 January 2018, Shilla’s sales reached around US$263 million, while at Jeju Airport, where its operations began on 1 March, sales were US$26 million, over 90% of them to foreign visitors (almost all Chinese).

Lotte Duty Free posted sales at Incheon T1 of US$522 million, down 47% on the whole year’s previous turnover. The fall was due to the retailer exiting all but its liquor & tobacco concessions at Incheon T1 on 31 July 2018 (it resigned three contracts covering perfumes & cosmetics, leathergoods & fashion and miscellaneous categories). At its new T2 business, it achieved sales of US$176 million with Korean shoppers generating 58% of business.

At its Korean customer-dominated Busan Gimhae Airport concession, Lotte Duty Free’s sales rose by around 9.5% year-on-year to US$117 million. At Seoul Gimpo Airport, where it commenced operations on 13 August, Lotte’s turnover rose 60% to around US$91 million.

Shinsegae Duty Free consolidated its position as the country’s third-biggest travel retailer. Sales at its existing Incheon Airport T1 business fell 20% to US$152 million, while it generated US$230 million in revenues from the T1 business it picked up from Lotte Duty Free in August 2018. At Incheon Airport T2, Shinsegae’s sales reached around US$185 million.

SM Duty Free posted US$63 million in sales at Incheon T1 (down 12%) and US$31 million at T2.

Domestic duty free struggles

‘Domestic duty free’ sales to Koreans at Jeju Island’s designated stores fell almost 4% to just over US$505 million.

The lion’s share was again represented by JDC Jeju Airport Duty Free, which posted sales of around US$462 million, down -2.6% year-on-year. The JTO downtown store’s turnover fell 14% to US$36 million.