![]() CHINA. Japanese beauty (J-beauty) brands are on the rise in China at the expense of Korean beauty (K-beauty) products, according to Jing Daily (partner in an information-sharing alliance with The Moodie Davitt Report).

CHINA. Japanese beauty (J-beauty) brands are on the rise in China at the expense of Korean beauty (K-beauty) products, according to Jing Daily (partner in an information-sharing alliance with The Moodie Davitt Report).

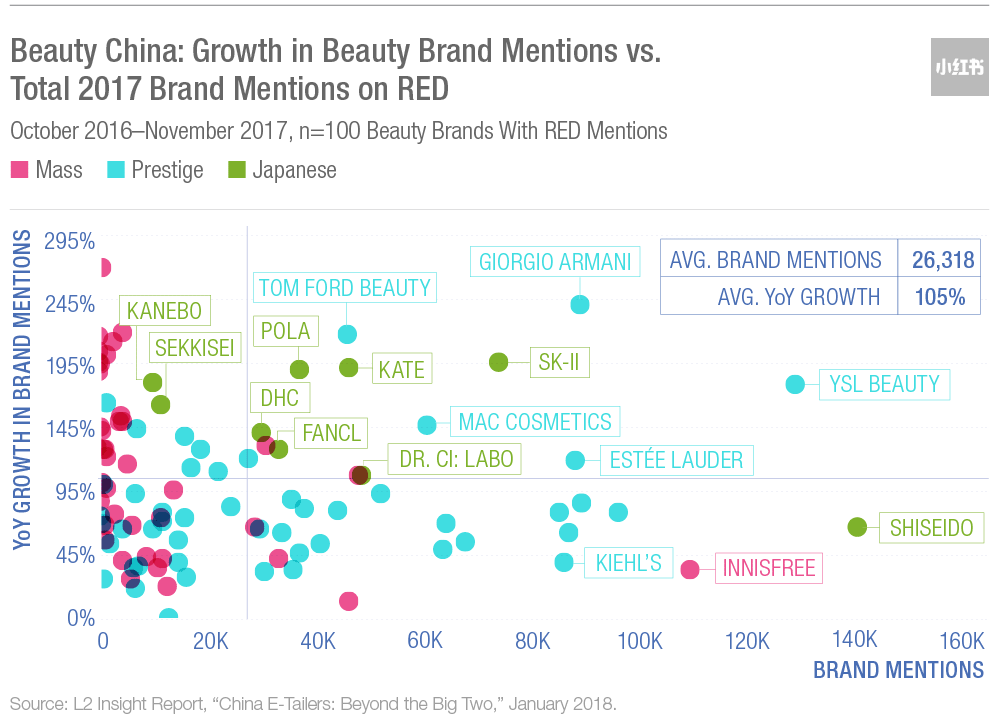

New York research group L2 has issued a report which found that sales growth and digital visibility of J-beauty brands increased faster than that of K-beauty brands last year.

Jing Daily noted that Amorepacific Corporation, the Korean beauty company that owns brands such as Etude House, posted a -76% loss in the fourth quarter of 2017. The company singled out the lack of interest from Chinese consumers as the biggest reason for the decline.

By contrast, major J-beauty labels such as Shiseido and SK-II achieved positive growth – in large part because of their performance in China. A report by Nikkei Asian Review in mid-2017 revealed that Shiseido raised its annual profit expectations on the basis of strong China demand.

Japanese brands including SK-II, Dr. Ci: Labo, Fancl, DHC, Kate, and Pola were also among the most mentioned beauty products on popular Chinese app RED, according to the L2 report.

The fall-out from the THAAD crisis, which resulted in frosty relations between China and South Korea, is thought to be partly responsible for the dip in K-beauty brands’ performance, Jing Daily noted. But the travel ban can’t fully explain K-beauty’s decline in China.

“Japanese cosmetics are particularly advantageous in the development of small category and featured products,” said China Beauty Expo General Secretary Sang Ying. “Many companies spend decades for one product. This has created the ingenuity ‘quality’ sign for Japanese products.”

Today, consumers in China are more concerned about quality than ever, as they are “more demanding and pragmatic”, according to McKinsey & Company. They are willing to pay more for better quality products, and Japanese products are perceived to be higher quality.

K-beauty’s branding and marketing approach has also “gone awry”, Jing Daily said. “K-beauty brands typically promote the idea that women need to be forever young and look like innocent young girls,” it said. “That’s a concept that is increasingly dismissed by well-educated women in the country. On the other hand, Japanese beauty brands such as SK-II are pioneering new marketing campaigns in East Asia based on empowerment and independence.”

Some high-end, luxury Korean brands such as Hera and Sulwhasoo are bucking the trend and expanded in China last year. “It is a sign that foreign beauty brands are moving towards the higher-end to stay competitive,” Jing Daily concluded.

Click here to read the full article and to subscribe to Jing Daily.

*This article was originally published by the much-respected JING DAILY, a Moodie Davitt Report content partner.

*This article was originally published by the much-respected JING DAILY, a Moodie Davitt Report content partner.