The Moodie Davitt Report introduces a new series called The Analyst, written by The Mercurius Group Founder & President Ivo Favotto*, with whom we will be working on a number of projects in the future. In this first article, the Sydney-based consultant examines the changing dynamics and retailer make-up of the Australian duty free market.

The Moodie Davitt Report introduces a new series called The Analyst, written by The Mercurius Group Founder & President Ivo Favotto*, with whom we will be working on a number of projects in the future. In this first article, the Sydney-based consultant examines the changing dynamics and retailer make-up of the Australian duty free market.

The views expressed in this column are not necessarily those of the publisher.

Around the world we are seeing duty free retailers consolidating. In fact, 20 years ago, the top ten retailers accounted for 20% of global industry sales. Now it’s almost 60%. But not in Australia where in fact, the opposite is occurring.

The process of fragmentation started in 2007 with JR/Duty Free’s re-entry into the on-airport market via the capture of the Darwin Airport concession from Nuance. Across the Tasman Sea in New Zealand, JR stepped up the pace, beating Nuance-owned Regency for one of the two duty free concessions at Auckland Airport in 2009.

But it wasn’t till later that the process of fragmentation really began to gather pace as JR emerged as a viable alternative to Nuance for the bigger airport contracts. In November 2011 the company won the Cairns Airport concession from Nuance [which announced at the last minute that it would not submit a bid –Ed]. With hindsight, this was the starting point for a spectacular fragmentation of Australia’s duty free industry, turning the clock back 20 years in consolidation terms.

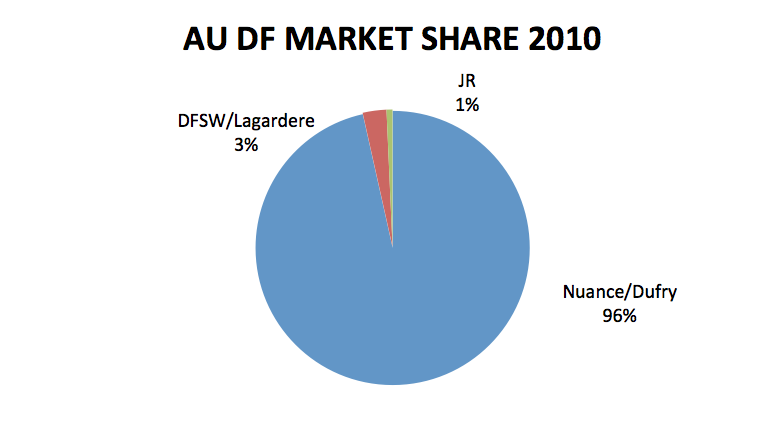

In 2010, Nuance (acquired by Dufry in 2014) was the dominant operator in the region. Through a series of acquisitions and tender wins under its former Swissair ownership (the predecessor to the current Swiss International Airlines, prior to its collapse in 2002) Nuance had managed to gain a significant dominance over the Australian market. By 2010 it held 96% of the Australian on-airport duty free market, including the concessions at Sydney, Melbourne, Brisbane, Perth and Cairns airports.

The remaining 4% of the on-airport market was split into 3% held by Duty Free Stores Wellington (DFSW) and 1% by JR/Duty Free at Darwin [the retailer held a much higher share of the off-airport market]. DFSW was a company owned by the pioneering New Zealand based Archibald family and later acquired by Lagardère Travel Retail in 2012. DFSW held the concessions at Adelaide and Gold Coast airports, which at that time had modest international passenger numbers.

Also at this time, the off-airport market in Australia was shrinking (with the possible exception of DFS Group’s Japanese and Chinese passenger-focused downtown stores). The diplomatic and cruise channels were still small, making Nuance by far the dominant industry operator.

However, Nuance’s financial woes in Australia at that time were well documented. According to publically available documents lodged by the company with the Australian Securities and Investments Commission (Australia’s corporate regulator) and previously quoted by The Moodie Davitt Report, Nuance Australia lost a whopping A$22 million (US$16.3 million at today’s exchange rates) in 2010 and reported accumulated losses of A$193 million (US$143 million today) that year (losses which got even bigger later).

So, it was not surprising that Nuance probably did not want to, or could not afford to, vigorously defend its concession portfolio and protect its dominant position. And so the empire fell. First Cairns in 2011 (to JR), then Perth in 2012 (to JR), then Brisbane in 2014 (you guessed it… again to JR) and finally Sydney in 2015 (to Gebr Heinemann).

The only concession currently held by Nuance/Dufry in Australia is at Melbourne Airport. As reported by The Moodie Davitt Report in 2009, this concession started in 2010 with an eight-year term and hence would be scheduled to come to market in 2017. Despite much market speculation there is no news yet on whether Nuance/Dufry has gained a contract extension without going to tender.

The big winner out of the collapse of the Nuance concession portfolio has been JR/ Duty Free, which has been able to add the sizeable Perth and Brisbane concessions to its Cairns and Darwin business. JR now has an estimated 34% of the Australian on-airport duty free market, although its stranglehold on the NZ market loosened in 2015 when the company chose late in the process not to defend its share of the Auckland Airport concession, citing profitability concerns.

The other winner was Heinemann, which became the largest operator in Australia when it acquired the Sydney Airport concession, securing it an estimated 42% of the Australian market. Nuance/Dufry is currently hanging in there with 21% while DFSW/Lagardère retained its two small locations and recently added another micro duty free operation in Townsville (a North Queensland regional airport).

So where to from here? A potential (but unlikely) tender in Melbourne next year aside, there don’t seem to be any big duty free concessions coming to tender any time soon with Perth, Brisbane and Sydney all having just been to market. In New Zealand, too, both Auckland and Wellington are out of the way.

That said, some of the smaller concessions might be due to come to market soon, assuming the respective operators don’t achieve contract extensions before then.

Gold Coast Airport, with Lagardère Travel Retail’s concession expected to expire in 2018 (as reported by The Moodie Davitt Report in 2009, DFSW won an eight-year extension commencing from 2010) is one example. There the terminal is undergoing an expansion in time for the 2018 Commonwealth Games.

Cairns could also be coming up in 2017 or 2019 (as reported by The Moodie Davitt Report in 2011, JR won a five-year concession, with a renewal option, that commenced in 2012).

Adelaide is another possibility (as reported by The Moodie Davitt Report in 2013 LagardèreTravel Retail secured an extension at that time although for how long is unclear).

Given the recent fragmentation, there should be no shortage of interested parties in these smaller opportunities, particularly if you toss into the mix Aer Rianta International – which recently entered the Pacific market with its spectacular win in Auckland.

And what about potential future consolidation? Industry speculation would suggest JR could be up for sale at some point. But such conjecture has been around for a while and meanwhile the JR juggernaut continues to roll on, as evidenced by the company’s recent successful tender defence in Wellington.

Speculation also surrounds whether Nuance/Dufry will hang around in Australia over the longer term with just the one concession, though there may be other angles at play. Dufry may try to gain scale to its Australian business through acquisitions (they are the industry acquisition kings after all), via tendering for some of the smaller concessions or by competing in categories such as News & Convenience by bringing its Hudson News concept to the Pacific.

Lagardère is still in a growth phase, following its important win in Auckland. It also still seems to be on the acquisition trail, evidenced by the company’s recent purchase of the US-based Paradies.

And Heinemann is being, well, Heinemann and once in place is not likely to go anywhere any time soon.

So fragmentation seems to be here to stay in the Pacific – for a little while longer at least. That’s good news for airports, which like to have a degree of price tension as part of any tender. And it’s also good news for suppliers, who have no doubt used the fragmentation to do a little bit of P&L repair work. After all, it’s easier to negotiate with many smaller operators rather than one big one, even if it does mean more work.

At some point however, the consolidation cycle will inevitably come around again. The question is when. And where.

Please visit The Mercurius Group website for more information and analysis.

*About Ivo Favotto

Ivo Favotto has a long and distinguished record in the airport and travel retail sectors. A trained economist, he entered the airports/infrastructure sector with Australia’s Federal Airports Corporation in 1992 as GM – Planning & Economics.

He later built a highly successful international airports/infrastructure consulting practice, working with three firms – Bach Consulting, Arthur Andersen and URS Corp – and advising many of the world’s leading airports, governments and investors in the areas of retail planning, master planning and privatisation/transaction support.

In 1998 he established the market-leading Airport Retail Study, selling it to Moodie International so he could join The Nuance Group (now owned by Dufry) as Executive Vice President – Strategy & Business Development in Zürich. He later returned to his native Australia as Director – Sydney Airport before being named Executive General Manager of Duty Free & Luxury, Pacific for Lagardère Travel Retail.

He has now formed The Mercurius Group, a Sydney-based consultancy focused on industry research, consultancy and benchmarking studies. The company also assumes responsibility for revamping and relaunching The Airport Commercial Revenues Study (ACRS), which Ivo founded (as The Airport Retail Study) and sold to Moodie International in 2007 as part of an informal alliance between Mercurius and The Moodie Davitt Report.

He has now formed The Mercurius Group, a Sydney-based consultancy focused on industry research, consultancy and benchmarking studies. The company also assumes responsibility for revamping and relaunching The Airport Commercial Revenues Study (ACRS), which Ivo founded (as The Airport Retail Study) and sold to Moodie International in 2007 as part of an informal alliance between Mercurius and The Moodie Davitt Report.

Contact: Tel: +61 423 564 057; E-mail: ifavotto@themercuriusgroup.com; Website: www.themercuriusgroup.com