SOUTH KOREA. Incheon International Airport Corporation (IIAC) has launched revised tenders for the Terminal 1 duty free concessions recently exited by Lotte Duty Free, The Moodie Davitt Report can confirm.

An on-site Request for Proposals orientation for prospective bidders will take place on Friday 20 April. The new five-year contracts start on 6 July by which time Lotte Duty Free will have vacated the space.

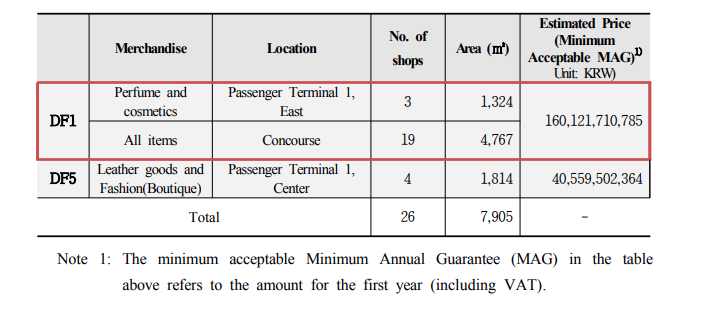

IIAC has revised the tender conditions, combining the previous three packages into two (see below). Single bidders can apply for both packages. The new tender will combine P&C (DF1) and ‘all categories’ (DF8) into one package. Leathergoods and fashion accessories (DF5) remains a separate opportunity. By combining DF1, which has higher potential spend per passenger (SPP) and sales volume, with DF8’s lower potential SPP and sales, the airport company aims to create a more attractive proposition for bidders.

The new tender will combine P&C (DF1) and ‘all categories’ (DF8) into one package. Leathergoods and fashion accessories (DF5) remains a separate opportunity. By combining DF1, which has higher potential spend per passenger (SPP) and sales volume, with DF8’s lower potential SPP and sales, the airport company aims to create a more attractive proposition for bidders.

MAG terms

The new Minimum Annual Guarantee (MAG) terms state the retailer must pay the greater amount between the MAG and percentage fee. For the first year, this is will be the agreed amount.

After the first year, the retailer must pay 50% of the rate of change in passengers added to or deducted from the MAG for the first year. The annual increase/decrease rate of MAG shall be limited to ±9%.

If the percentage rent, which equals the semi-annual turnover by merchandise multiplied by percentage rent, exceeds the sum of semi-annual MAG paid, the operator must pay the difference to IIAC.

The Shilla Duty Free, Shinsegae Duty Free and newcomer Hyundai Duty Free are likely contenders. Lotte Duty Free could bid again, management told The Moodie Davitt Report last week, depending on how the tender is structured.

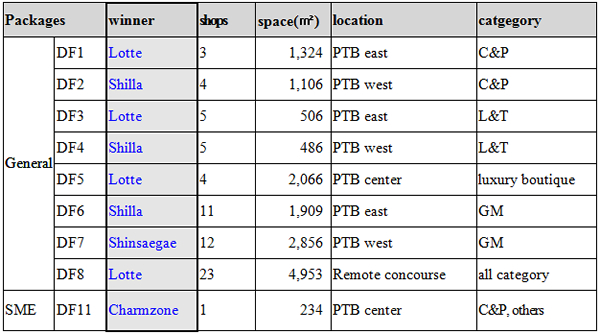

Lotte Duty Free won four packages in IIAC’s highly-competitive T1 tender race in 2015: DF1 (P&C); DFS (liquor & tobacco), DF5 (leathergoods and fashion accessories), and DF8 (all categories) with a series of blockbuster bids.

As reported, Lotte Duty Free quit its non-liquor and tobacco contracts after failing to renegotiate concession terms. Its heavy, back-loaded T1 fee structure was pivotal to a -99.25% collapse in 2017 operating profits to just KRW2.5 billion (US$2.38 million) in 2017. The retailer blamed the dire performance on plummeting sales from the crucial Chinese tourist market due to the THAAD dispute and the escalating Incheon concession fees.

In April, rival South Korean travel retailer The Shilla Duty Free reached an agreement with IIAC to cut the retailer’s concession fees for its duty free contract at T1 by -27.9%. This broadly reflects the dilution of T1 traffic to the new T2. Shinsegae Duty Free has also agreed to the terms, the company confirmed to The Moodie Davitt Report today.

By allowing bidders the opportunity to win both packages – permitted for the first time since the airport’s opening in 2001 – IIAC hopes to avoid a repeat of the T2 luxury boutique and fashion accessories tender in 2017. On that occasion the tender failed on multiple occasions to draw interest due to a perceived excessive cost of entry.

However, if a single bidder wins both contracts, sources say that the Korea Fair Trade Commission could object. The regulatory body criticised IIAC for awarding Lotte Duty Free the exclusive contract to operate liquor and tobacco between 2008 and 2014. Therefore, from 2015, IIAC opened the tender process to multiple retailers for each category.

The tender evaluation will be assessed according to a a 60:40 weighting of bidders’ technical proposals and financial proposals. IIAC will select two operators with the highest scores and notify the Korea Customs Service of its choices.

Tender registrations must be made in person on 23 May. The deadline for business and financial proposals is 24 May.

NOTE TO AIRPORT OPERATORS: The Moodie Davitt Report is the industry’s most popular channel for launching commercial proposals and for publishing the results. If you wish to promote an Expression of Interest, Request for Proposals or full tender process for any sector of airport revenues, simply e-mail Martin Moodie at Martin@MoodieDavittReport.com.

We have a variety of options that will ensure you reach the widest, most high-quality concessionaire/retailer/operator base in the industry – globally and immediately.

Similarly The Moodie Davitt Report is the only international business intelligence service and industry media to cover all airport consumer services, revenue generating and otherwise. We embrace all airport non-aeronautical revenues, including property, passenger lounges, car parking, hotels, hospital and other medical facilities, the Internet, advertising and related revenue streams.

Please send relevant material, including images, to Martin Moodie at Martin@MoodieDavittReport.com for instant, quality global coverage.

All such stories are consolidated in our popular Tender News section (see home page dropdown menu) that has been running since 2003.

The Moodie Davitt Report will continue to bring you details on this important tender process as they are announced.