SOUTH KOREA. Korea Customs Service (KCS) and Incheon International Airport Corporation (IIAC) are locked in talks this afternoon Korean time after the airport operator decided to issue a Request for Proposals (RFP) for the duty free concessions at the new Terminal 2.

The Moodie Davitt Report can reveal details of the RFP for one of the biggest opportunities in the global duty free industry. The tender has been issued against the backdrop of an extraordinary power struggle over who should assess the bids.

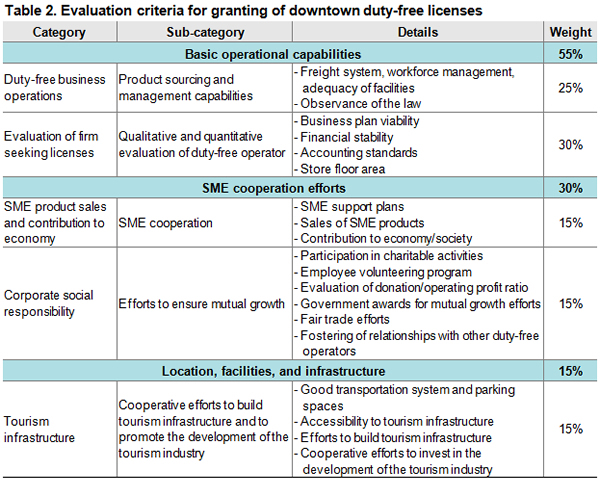

In an unprecedented intervention late last year, the government agency insisted it, not the airport company, should have the final say as to which companies should be awarded the T2 concessions. The KCS wants to create a licensing committee to evaluate the T2 bids and judge the offers according to a much wider set of criteria (see table below) than those used by IIAC and with less emphasis on the financial offer. The committee would work on a similar basis to those that assess rival candidates for downtown duty free shops.

Unable to resolve the impasse, the IIAC, acutely aware of T2’s planned opening in October, felt it had no choice but to issue the RFP now. Any further delay would have seriously compromised bidding and assessment time, it reckoned.

Bids will be assessed on a weighting of 60% for the technical offer and 40% for the financial proposal. However, the matter may not be resolved as the KCS considers the tender invalid. Likely bidders contacted by The Moodie Davitt Report today say the matter is shrouded in uncertainty and they remain unsure whether the bid will proceed as planned.

KCS has told local media today that it will not grant the winners with the necessary licenses to trade. The government agency commented via Korean media, “We will continuously try to find a reasonable solution about who has the right to choose the concessionaires.”

In an ominous sounding message to industry giants Lotte and Shilla, KCS said, “And even before the effect of newly amended regulations regarding qualification limitations on monopoly and oligopoly bidders, KCS will apply new rules to regulate their participation in the process.”

One experienced observer of Korean travel retail told The Moodie Davitt Report: “The IIAC’s proposal today reflects their intention to resist against the KCS, unilaterally pushing forward the [tender] process. My view is what the KCS has been demanding is completely illogical, misunderstanding the basic differential between downtown and airports. Furthermore, they don’t have such a right at airports, as the IIAC itself is a landlord, who should find ways to best manage the site.

“Anyway, this RFP should be just regarded as a preliminary one, with strong potential that the KCS may fight against it.”

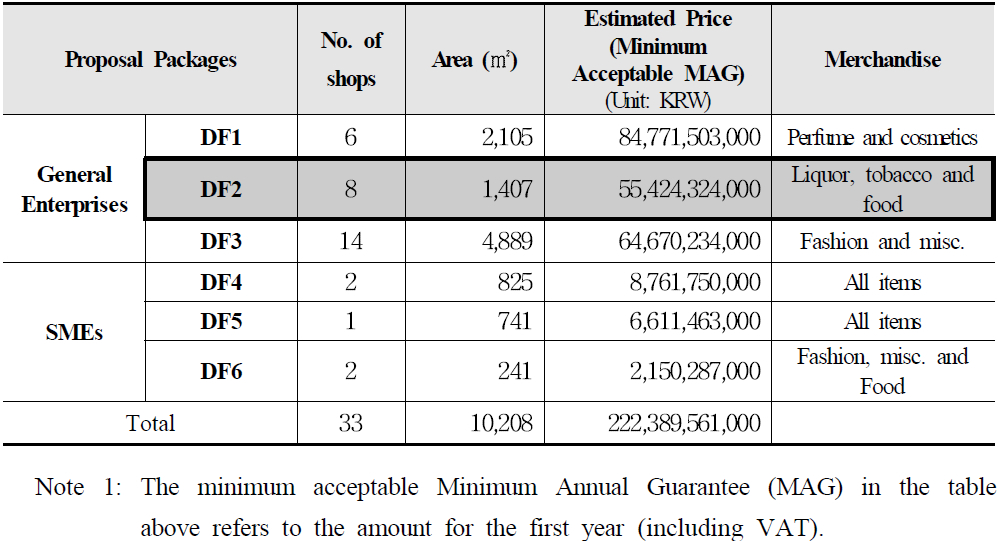

All contracts run for five years from the time of T2’s opening, tentatively scheduled for October 2017. Here are the key details of the tender structure and the minimum annual guarantees payable.

Note: As a currency guideline, KW222,389,561,000 = US$192.3 million; KW84,771,503,000 = US$73.3 million; KW55,424,324,000 = US$47.9 million; and KW64,670,234,000 = US$55.9 million

Note: As a currency guideline, KW222,389,561,000 = US$192.3 million; KW84,771,503,000 = US$73.3 million; KW55,424,324,000 = US$47.9 million; and KW64,670,234,000 = US$55.9 million

NOTE TO AIRPORT OPERATORS: The Moodie Davitt Report is the industry’s most popular channel for launching commercial proposals and for publishing the results. If you wish to promote an Expression of Interest, Request for Proposals or full tender process for any sector of airport revenues, simply e-mail Martin Moodie at Martin@MoodieDavittReport.com.

We have a variety of options that will ensure you reach the widest, most high-quality concessionaire/retailer/operator base in the industry – globally and immediately.

Similarly The Moodie Davitt Report is the only international business intelligence service and industry media to cover all airport consumer services, revenue generating and otherwise. We embrace all airport non-aeronautical revenues, including property, passenger lounges, car parking, hotels, hospital and other medical facilities, the Internet, advertising and related revenue streams.

Please send relevant material, including images, to Martin Moodie at Martin@MoodieDavittReport.com for instant, quality global coverage.

All such stories are consolidated in our popular Tender News section (see home page dropdown menu) that has been running since 2003.