UK. Heathrow Airport today reported improved revenues and reduced losses for the first six months of 2022. But the company warned that recovery in the “deeply scarred” aviation sector will take years. It also hit out at the UK regulator’s plans to limit investment in capacity.

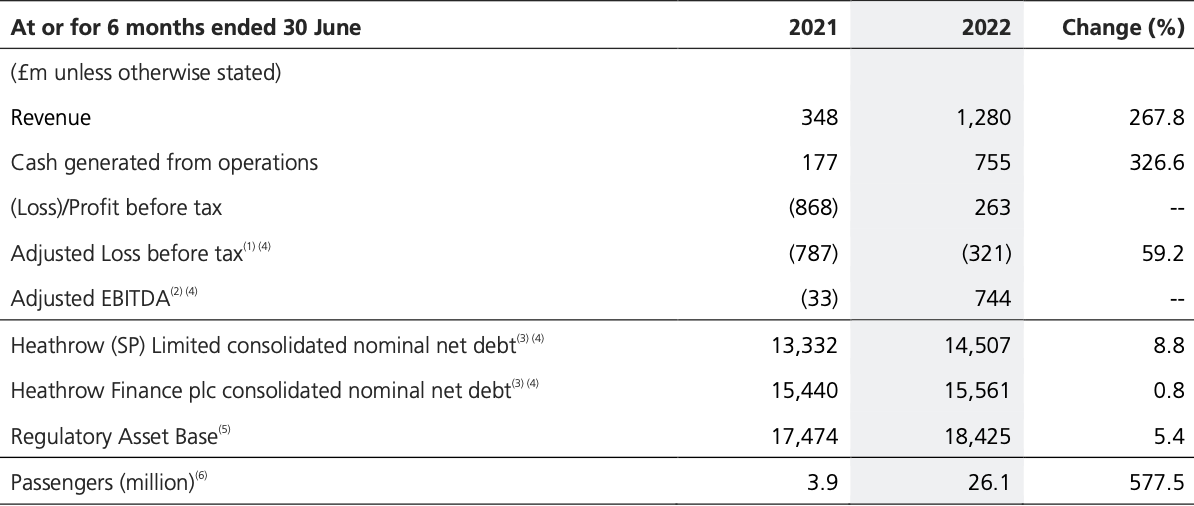

In the six months ended 30 June, revenue increased +268% year-on-year to £1,280 million. Q2 revenue alone leapt by +317%, reflecting the sharp increase in passengers.

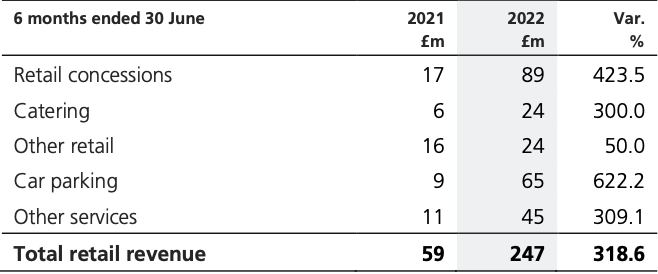

Retail revenue in the half increased by +318.6%, driven by departing passengers, car parking revenue, premium services and the mix of retail services available in the six months of 2022, compared to last year when governmental restrictions on non-essential shops were in place in the first five months.

However, Heathrow said that its luxury business “is showing early signs of the softening we anticipated as a result of the removal of VAT-free shopping”. Retail revenue per passenger decreased -38.2% to £9.47. Click here for a recent interview with Retail Director Fraser Brown on performance to date in 2022.

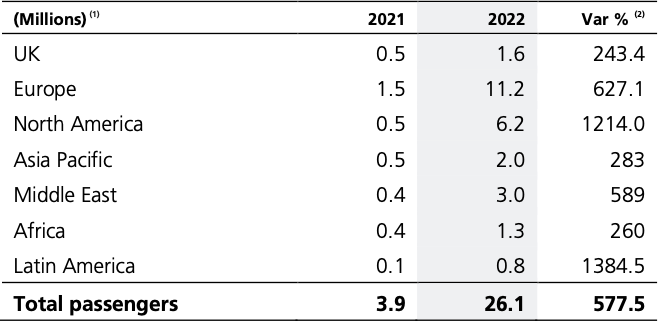

Passenger numbers in June were the highest since the start of the pandemic at almost six million passengers, or 83% of 2019 levels. Over the first half of 2022, 26.1 million passengers travelled through the airport, a leap of +577% year-on-year.

Adjusted EBITDA increased to £744 million from a negative £33 million last year, with an adjusted loss of £321 million compared to £787 million a year ago.

Operational issues, led by a lack of airline ground handling staff, continue to have a negative impact.

Heathrow said in its results statement: “We estimate that airline ground handlers have no more than 70% of pre-pandemic resource, and there has been no increase in numbers since January. In the second half of June, as departing passenger numbers regularly exceeded 100,000 a day, we started to see a worrying increase in unacceptable service levels for some passengers.

“This showed us that demand had started to exceed the capacity of airline ground handlers and we took swift action to protect consumers by applying a cap on departing passenger numbers, better aligned with their resources. Airline ground handler performance has been much more stable since the cap came into effect, and we have seen a marked improvement in punctuality and baggage performance. Heathrow’s cap is 50% higher than Schiphol, which shows how much better the airport and airlines have planned at Heathrow than our competitors. The cap will remain in place until airlines increase their ground handler resource.”

The company said that the Civil Aviation Authority’s regulatory plan for the forthcoming period (H7) will deliver “worse outcomes for passengers”.

Heathrow Airport said: “It focuses on cost cutting to improve airline margins when we should be rebuilding capacity, with a focus on safety, consumer service, resilience and efficiency.

“Overall, it doesn’t provide enough cashflow to allow us to invest in operations and capital investments, such as a new T2 baggage system or new security lanes to meet the DFT’s 2024 deadline, at a time when they should be encouraging investment. The CAA took a similar approach in the 2000s, which led to years of ‘Heathrow hassle’ for consumers and high margins for airlines. It is not too late to correct these errors and we will submit a detailed assessment in early August.”

CEO John Holland-Kaye said: “We can’t ignore that COVID has left the aviation sector deeply scarred, and the next few years will need investment to rebuild capacity, with a focus on safety, consumer service, resilience and efficiency.

“Airlines need to recruit and train more ground handlers; airports need catch up on underinvestment during the COVID years – at Heathrow, that means replacing the T2 baggage system and new security lanes. Recent months have shown that passengers value easy, quick and reliable journeys, not penny pinching, and the CAA should be encouraging the investment that will deliver for consumers.”