FRANCE/INTERNATIONAL. Lagardère Group today reported annual revenue of €7,069 million in 2017, up +4.0% on a like-for-like basis, reflecting an “outstanding contribution” from the Travel Retail division. Today’s figures supplement preliminary revenue figures, reported on 8 February.

As we reported last month, Lagardère Travel Retail revealed full-year revenue of €3,412 million, down by -7.7% but up by +9.1% on a like-for-like basis.

The difference between the figures reflects a €9 million negative foreign exchange effect and in particular a €556 million negative scope effect, as follows:

- a €576 million negative impact from deconsolidations, essentially relating to the divestment of Press Distribution activities in Belgium, Hungary, Canada and Spain;

- a €20 million positive impact from acquisitions, relating mainly to the acquisition of duty free businesses in Poland and Estonia.

Importantly, if the Distribution division is stripped out, travel retail revenues rose by +8.6% on a consolidated basis.

Lagardère Travel Retail revenue growth was propelled by strong performances in the EMEA and ASPAC regions, noted the group.

In France, the business generated solid +8.0% growth, led by food service activities on the back of new stores and the development of business in Nice. A key dynamic was the momentum in the duty free segment, focused mainly around regional airports.

EMEA (excluding France) posted strong growth (up +13.6%), spurred by network development, especially in Switzerland, Eastern Europe and Italy, as well as by a rise in passenger traffic and the modernisation of concepts.

Despite an unfavourable calendar effect and the impact of the hurricane season in the second half of the year, North America delivered a resilient performance and remained in growth (up +2.7%), lifted by new business.

The Asia Pacific region delivered +9.8% revenue growth, propelled by the new Hong Kong concession, strong performances by fashion stores in China and the upturn in the Pacific region on the back of the modernisation of the duty free store in Auckland.

The division’s operating margin was 3.3%, with recurring EBIT up to €112 million. The operating margin for Travel Retail edged up 0.3 percentage points to 3.3%.

Travel Retail recurring EBIT was up by €17 million or +18%, buoyed mainly by good performances in the EMEA region; this was attributable to organic growth in Italy and the Czech Republic. France also had momentum on the back of the travel essentials and food service activities. Recurring EBIT growth in North America was lifted by business integration synergies and growth, said the group, which offset the impact of the hurricane season and the unfavourable calendar effect compared to 2016.

Group recurring EBIT came in at €403 million, a rise of +8% compared to 2016, powered in part by a good performance from Travel Retail. Group share of net profit rose marginally to €179 million.

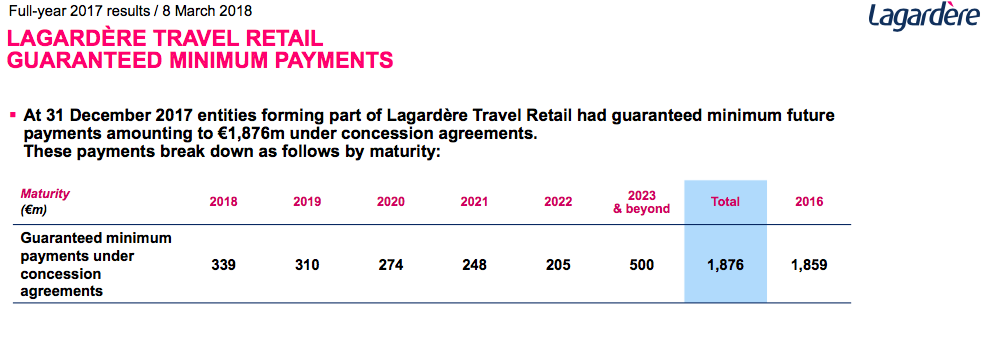

The group also highlighted Lagardère Travel Retail’s position with regard to its minimum annual guarantee obligations over time. At 31 December 2017 entities related to Lagardère Travel Retail had guaranteed minimum future payments amounting to €1,876 million under concession agreements; the table outlines how these commitments break down year by year.