CHINA. Hainan province’s recently liberalised offshore duty free shopping policy, part of its hugely ambitious Free Trade Port development, is attracting growing interest from powerful Chinese online and offline retailers hoping to enter the market.

As reported, the exhanced offshore duty free shopping policy encourages additional competition, though China Duty Free Group is considered certain by analysts to retain its dominant position.

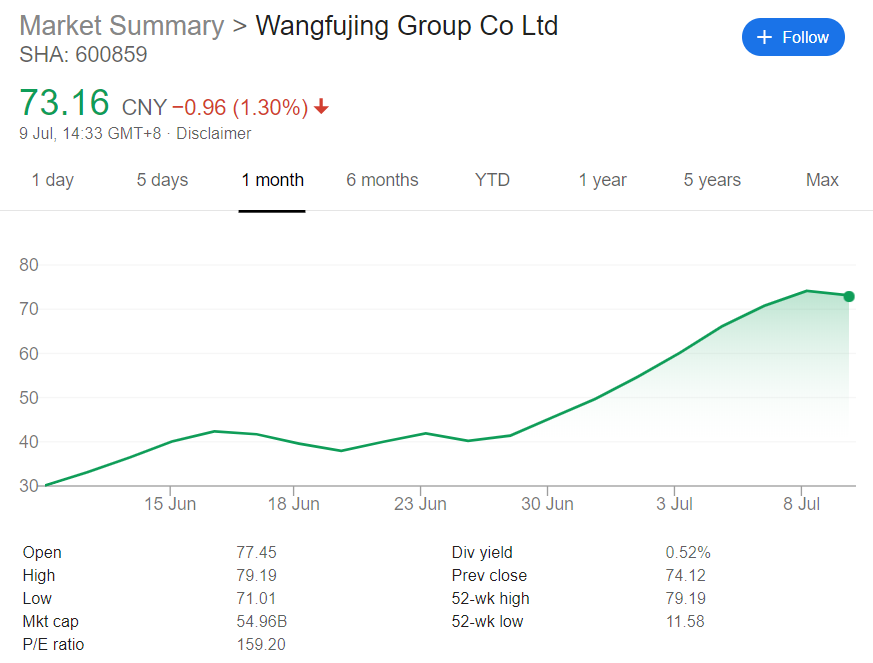

State-owned China Daily reported today that shares in four major Chinese players have soared on the back of Hainan-related investment statements. As revealed by The Moodie Davitt Report today, Beijing department store operator Wangfujing Group is to set up a wholly owned subsidiary, Beijing Wangfujing Duty Free Management Co Ltd, backed by registered capital of RMB500 million (US$72 million). The group’s stock price has soared +196% over the past month since it gained a duty free licence.

Bailian Group stock rose by the daily +10% limit yesterday to RMB23.97 after the company said that it has applied for a duty free licence. Bailian Group is a large Shanghai-based state-owned enterprise with diverse interests, including department stores, shopping malls and supermarkets. It ranks as China’s largest state-owned commercial distribution group.

Bailian confirmed on Tuesday that it has submitted an application for a duty free licence but noted that there was “uncertainty” over whether it would be granted. “At present, the company’s main activities remain in the retail business of taxable goods, and our production and operation conditions have not changed,” it said in a statement.

The China Daily report also noted that ecommerce giant JD Worldwide is planning to open offline duty free experience shops in Hainan province.

Shares in Chinese travel agency Caissa Tourism Group (in which JD.com has a minority stake), also surged on Wednesday to CNY18.49 following a statement the previous day that duty free shops and tourism are its priority businesses in Hainan province.

In a statement to the markets yesterday after abnormal fluctuations in its share price over three consecutive trading days, Caissa commented that while there was nothing untoward in that movement, the group does plan to prioritise duty free shops and other tourism activities in Hainan province.

“In the future, the company will work with partners to seize policy opportunities and continue to deepen multi-dimensional cooperation in the field of tax and duty free and will jointly promote the multi-channel integration of the duty free and tourism industry.

“As of now, the company’s outbound travel business has not resumed, but in view of the fact that the domestic epidemic situation has been basically controlled, and with the gradual opening up of provinces and surrounding tourism, plus the restoration of flights and railway traffic, the company is currently actively promoting the restoration of related businesses,” Caissa said.

Caissa said that it already has a close involvement in the duty free sector through joint venture projects with prominent travel retailer CNSC. Since 2019, Caissa has cooperated with CNSC on the Tianjin International Cruise Port duty free store and downtown shops in Nanjing and Beijing.

Caissa has also established a duty free business management platform in Haikou, Hainan province, named Haikou Tongshengshijia Duty Free Group.

Caissa said that it has also invited two Hainan companies to become long-term strategic investors – Wenyuan (Sanya) Equity Investment Fund Partnership Enterprise, andShanghai Licheng Asset Management Co.