The Gucci brand continued to drive the performance of parent company Kering in its third financial quarter (to 30 September) as the luxury goods group posted a +27.6% rise year-on-year in revenue to €3,402 million. Gucci’s travel retail performance was among the factors cited by the group in its Q3 analysis.

The Gucci brand continued to drive the performance of parent company Kering in its third financial quarter (to 30 September) as the luxury goods group posted a +27.6% rise year-on-year in revenue to €3,402 million. Gucci’s travel retail performance was among the factors cited by the group in its Q3 analysis.

Kering CFO Jean-Marc Duplaix hailed “another quarter of outstanding double-digit growth” for the group. He described the growth as “both global and balanced”.

He noted: “With sustained top line gains, Kering continues to significantly outperform. This demonstrates the tremendous momentum of our brands and their first-rate customer appeal.”

Kering Chairman and CEO François-Henri Pinault commented: “We are extraordinarily proud of the remarkable performances Kering delivers quarter after quarter.

“Our growth, whose pace is unprecedented in the luxury sector, is sound, well-balanced and sustained across all regions and distribution channels.”

Gucci shines

Gucci was the clear standout in the company’s luxury portfolio, with Q3 revenue up by a sharp +34.9% to €2,096 million.

Kering said Gucci’s success was led by growth in Asia Pacific and North America (sales in both markets climbed by more than +40%). The group also noted strong growth in Western Europe and Japan as important factors. Travel retail, it added, showed a “healthy momentum”.

This month, luxury brands’ share prices (including Kering’s, as noted by The Moodie Davitt Report content partner Jing Daily) have been impacted by a crackdown on Chinese daigou shoppers. Some analysts have commented that this could lead to a slowing of Gucci’s impressive growth in recent years.

However, Jean-Marc Duplaix played down these concerns earlier this week (as reported by WWD), noting the brand’s positive Q3 performance in China as evidence.

On release of Gucci’s Q3 report he added: “Greater China, including mainland, Hong Kong and Macau, grew above +40%.”

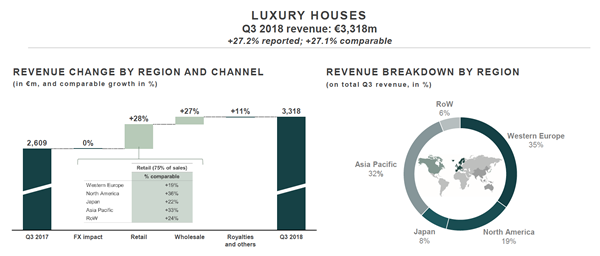

Luxury Houses

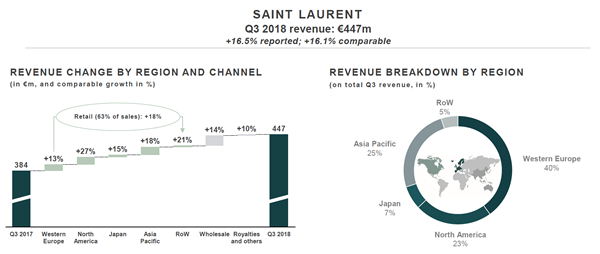

The group’s Luxury Houses overall showed +27.2% reported revenue growth (+27.1% at constant scope and exchange rates). Sales at Saint Laurent were up +16.5% on a reported basis. Kering also noted “exceptional momentum” at Balenciaga, continued sales growth at Alexander McQueen, and “solid performances” in watches & jewellery as important factors.

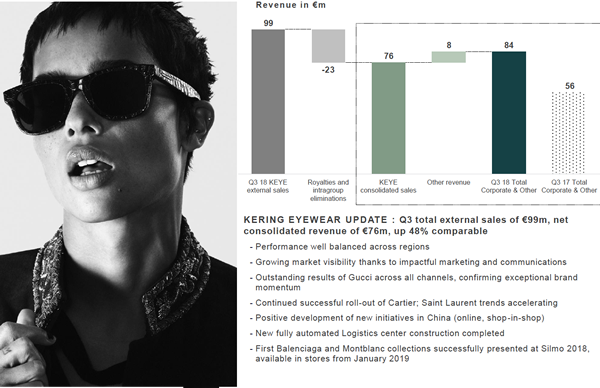

Corporate and Other

Kering said that its ‘Corporate and other’ segment delivered strong Q3 growth with revenue up +48.8% (+43.7% at constant scope and exchange rates) to €84 million. Kering eyewear was a significant contributor, with net consolidated revenues up +48%. Its performance, said the group, was well balanced across all regions.