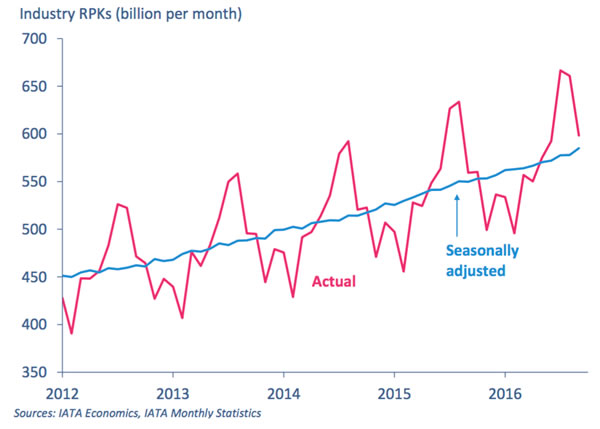

INTERNATIONAL. Global passenger traffic grew +7% in September, the strongest year-on-year increase in seven months.

The International Air Transport Association (IATA) said airlines from the Middle East and Asia Pacific posted the fastest traffic growth for the fourth consecutive month, with double-digit annual increases in both cases. All regions posted growth in excess of +4%.

Capacity climbed +6.6% and load factor edged up 0.3 percentage points to 81.1%. Growth in domestic traffic slightly outpaced growth in international traffic, IATA said.

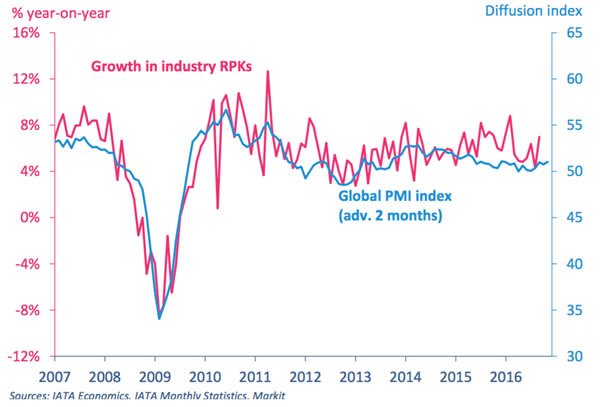

“September’s growth in passenger demand was healthy,” said IATA Director General and CEO Alexandre de Juniac. “Importantly, this rebound from August weakness suggests that travel demand is showing its resilience in the aftermath of terror attacks. We must, of course, be ever-alert to the ongoing terror threat.

“And overall the industry is still vulnerable to being buffeted by rising geopolitical tensions, protectionist political agendas, and weak economic fundamentals. This will still be a good year for the airline industry’s performance, but our profitability will continue to be hard-won.”

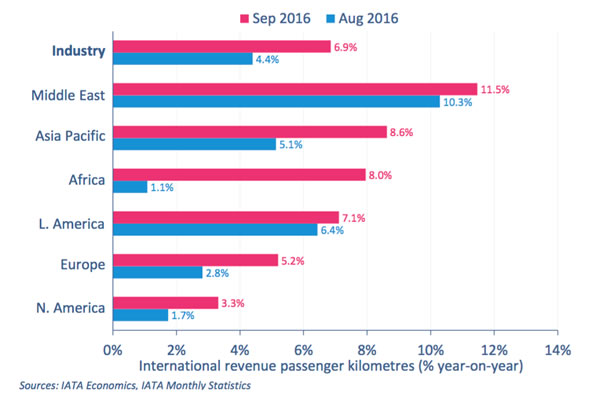

International traffic rose +6.9% in September, compared to + 4.4% in August. Year-on-year growth accelerated in all regions.

Growth of +5.2% in Europe was set against a backdrop of a subdued but recovering Eurozone economy with demand “returning to normal after the disruption caused by terrorism and political instability earlier this year”.

Year-on-year growth in Africa jumped to +8.0% in September. Economic conditions in much of the continent remain challenging, particularly in the biggest economies of Nigeria and South Africa, IATA said.

International traffic flown by Asia Pacific airlines – the second largest international region – rose by a robust +8.6%. IATA noted: “There are still signs of Asian passengers being put off by terrorism in Europe: traffic on the Europe-Asia route fell by -1.5% year-on-year in August (the latest data available), and it remains the slowest-growing of the ‘big-four’ international routes so far this year. But overall traffic has risen at an annualised rate of +6.3% since March, helped by robust growth in ASEAN [Association of Southeast Asian Nations].”

Strong +11.5% growth was recorded in the Middle East during the month. Increases in capacity continued to outpace that of demand, IATA said. Load factors on the largest routes to and from the Middle East, those between Asia and Europe, fell by 3.5 and 4.5 percentage points respectively in August 2016, compared to the same period in 2015.

The upward trend in North American carriers’ international traffic has eased of late, according to IATA, but seasonally-adjusted passenger volumes have still risen at an annualised rate of around +6% since March. “Given the shape of developments last year, annual growth is likely to pick up further in the coming months. Demand on the transpacific market is solid, with volumes rising by +4.3% year-on-year in August. Meanwhile, the upward trend in Latin American carriers’ international traffic also eased slightly during Q3, but traffic still grew by a robust +7.1% year-on-year. The upward trend has been helped by strong demand on international routes within the region.”

Domestic air travel accelerated to +7.2% year-on-year in September, up from+ 4.1% in August. This was led by +23.6% growth in India and a +14.0% increase in China.

“Such strong growth rates relate to sizeable increases in real consumer spending in both countries, although growth in India is well ahead of what the usual elasticities would imply,” IATA commented.

“This is partly because airlines are adding airport-pairs and flight frequencies, which reduce journey times for passengers and has the same stimulatory effect on demand as a cut in fares. Both Indian and Chinese airlines have increased the number of airport-pairs served in 2016, but average flight frequencies in China have fallen compared to last year.”