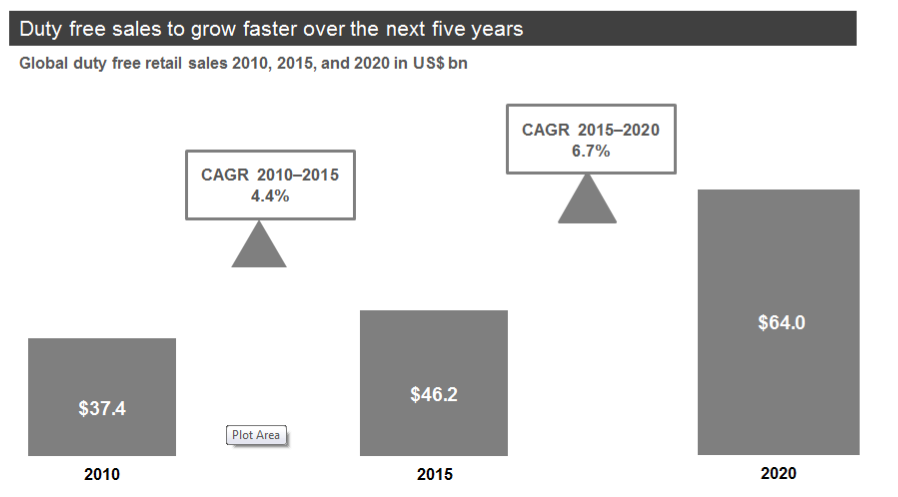

INTERNATIONAL. The global duty free market is expected to expand to US$64 billion by 2020, according to research from Verdict Retail.

The retail analyst’s ‘Global Duty Free Retailing 2015–2020’ report predicts that the industry will outpace historic levels to expand at an annual CAGR (compounded annual growth rate) of 6.7% between 2015–2020.

In that period, the global duty free market will generate an incremental US$17.8 billion in sales with Asia Pacific’s share of that reaching 53%. Between 2010 and 2020, Asia Pacific will expand its share by +16%, while Europe will lose -12% from its earlier market leading share of 40% in 2010.

Global growth will mainly be driven by an increase in the number of international travellers, supported by the expansion of low cost airlines and the introduction of new air routes across the world. Chinese spending and the expansion and modernisation of duty free retail space in key markets will also be vital factors.

Chinese duty free spending will be particularly key in Asia Pacific and European duty free markets. “Chinese now prefer new travel destinations to explore new culture and benefit from currency exchange, which became an important factor following the devaluation of Chinese Yuan,” the report states.

“Major duty free markets are relaxing visa policies, expanding downtown duty free, and modernising airports, including retail, to entice Chinese travellers who are tech-savvy and like to shop at leisure.”

Markets and segments

South Korea will continue to be the largest duty free market in the world and will record an annual CAGR of 9.6% to reach US$10.7 billion by 2020, according to the report.

Despite a decline in 2015, due to a slowdown in Chinese duty free spending and the MERS (Middle East respiratory syndrome) outbreak, the market will benefit from new visa policies, the entry of new duty free players, and a rise in demand for Korean cosmetics and fashion.

China, the second largest duty free market, will record 11.3% annual CAGR on the back of growth in offshore duty free, an increase in the duty free allowance for non-local Chinese, and an expected boom in arrivals duty free.

India will record the highest annual CAGR of 20.7%, mainly driven by soaring arrivals duty free “as young and aspirational Indians increasingly take foreign trips”, the report says.

Other high-growth markets such as Japan will benefit from Chinese arrivals, weaker exchange rates, and the opening of luxury duty free malls.

Perfumes & cosmetics is the largest and also the fastest growing category in the global duty free market, the report states. “Major duty free operators are uplifting their offerings by increasing duty free retail space for the category, launching exclusive products in partnership with renowned fragrance brands, and opening speciality stores for beauty and fragrances,” it says.

Other trends

The ‘Global Duty Free Retailing 2015–2020’ report also highlights a number of key trends that will continue to impact the duty free market. It notes that an increase in low cost carriers has resulted in a new type of traveller that is “aspirational and seeks luxury products at an affordable price”.

Terrorism has particularly affected duty free sales in Egypt and France, it says, while the duty free markets in Turkey and the UAE have particularly suffered from the drop in Russian spending due to the devaluation of the Russian ruble, and a restriction on travelling to Turkey.

Verdict Retail also notes the impact of duty free operators and airport retail authorities expanding their digital presence. Travellers increasingly prefer pre-planning their duty free purchases and are connected to the Internet, social media, and other mobile-based services on-the-go, it says.

Finally, duty free operators are also targeting cruise and inflight retail which the report says “offers high growth potential”.

Verdict Retail’s report covers 50 markets around the world – 24 in Europe, 12 in Asia Pacific, nine in the Americas, and five in the Middle East and Africa. Click here for more information and to purchase the full report.