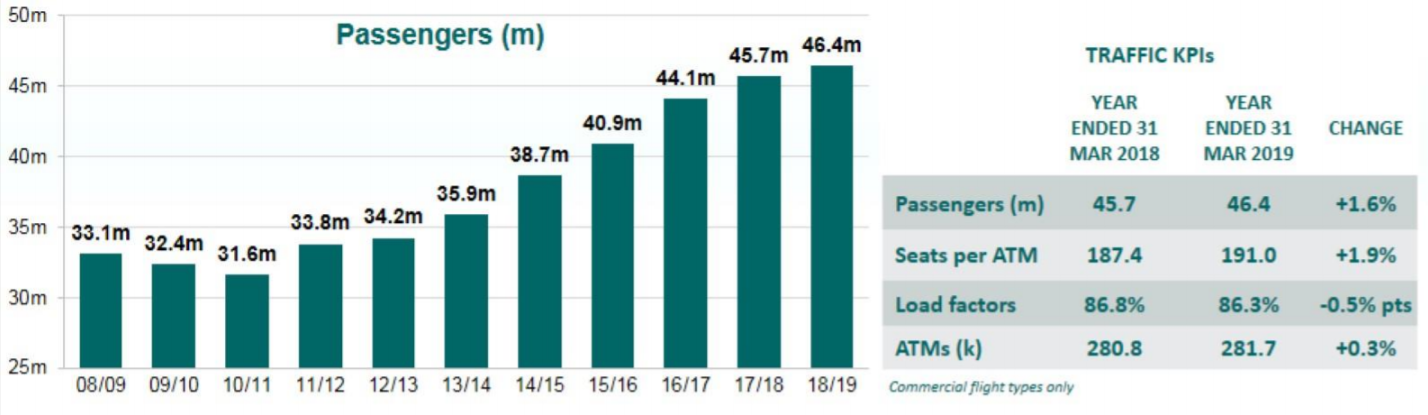

UK. Gatwick Airport today revealed a 7.9% rise in retail income for the year ending 31 March to £191.3 million (US$240 million), well ahead of a modest 1.6% gain in passenger traffic to 46.4 million.

Net retail income per passenger, a key commercial performance indicator, rose by 6.0% to £4.05 (US$5.08). Duty free and tax free income grew by 10.5% while food & beverage turned in a stellar performance, with income up by 11.5% year-on-year. Dufry-owned World Duty Free is the duty free concessionaire at the airport. It also operates several tax free businesses.

An extra 1.1 million long-haul passengers buoyed commercial results. Long-haul growth was driven by Gatwick’s growing Asia connections, which rose 45% year-on-year, good news for airport retailers. Around one in five passengers now travel long haul to and from Gatwick as the airport’s global connections expand. China Eastern airlines started flying to Shanghai in December 2018 and Norwegian commenced a new Rio de Janeiro service in March this year.

An extra 1.1 million long-haul passengers buoyed commercial results. Long-haul growth was driven by Gatwick’s growing Asia connections, which rose 45% year-on-year, good news for airport retailers. Around one in five passengers now travel long haul to and from Gatwick as the airport’s global connections expand. China Eastern airlines started flying to Shanghai in December 2018 and Norwegian commenced a new Rio de Janeiro service in March this year.

Car parking income edged ahead by just 0.6%, affected by a 3.9% decline in UK resident, non-transfer departing passengers.

Total airport revenue increased 6.1% to £810.8 million (US$1.016 billion). A combination of new routes, increased frequencies and retail development drove a 7.3% rise in EBITDA to £441.4 million (US$553.50) and a 2.9% profit after tax gain to £208.1 million (US$261 million). Total income per passenger increased by 4.5% to £17.47 (US$21.91).

Walkthrough formula pays off

The opening of the North Terminal walkthrough store in September 2017 helped drive the performance of World Duty Free (in the first half of the year. Additionally, the opening of a new World Duty Free collections store in North Terminal and an extension to the Dufry-owned retailer’s contract on improved terms sustained growth into the second half.

In summer 2018, four new retail units opened in the space World Duty Free vacated after the walkthrough store opened – World Duty Free Collections, WHSmith, JD Sports and Dixons. This prompted further unit changeovers in North Terminal. New brands included Rolling Luggage, Harry Potter, Ann Summers and Oliver Bonas

Food & beverage buoyant

The strength of the F&B category continued with income up 11.5%, and a 9.8% increase in income per passenger. To meet demand, Pret a Manger in North Terminal was extended and there is an ongoing development to extend Pret a Manger in South Terminal. Itsu opened in South Terminal in the early autumn. In March, a new restaurant concept ‘Sonoma’, operated by The Restaurant Group, opened in the North terminal to replace Garfunkels and Armadillo. The second phase of this project has just started and later in the year two new catering outlets will open in the space previously occupied by Eat and Shake a Hula.

REVENUE BREAKDOWN

Gatwick Airport Chief Executive Officer Stewart Wingate said: “Today’s results underline our ambition to be a thriving global airport which continues to invest in our passengers and local communities, while strongly supporting UK plc.

“Over the last year, we have achieved strong passenger growth matched by a reduction in our local noise footprint; robust financial results matched by record levels of investment back into the airport; and growing global connections fuelling increased trade and tourism opportunities.

“These strong results give us a firm foundation for future sustainable growth and later this year we look forward to publishing our final master plan which will help set the long-term growth and development plan for Gatwick.”

Footnote: As reported, London Gatwick last month announced that Vinci Airports had completed the purchase of a 50.01% stake in the airport. Global Infrastructure Partners will continue to manage Gatwick’s remaining 49.99% interest.