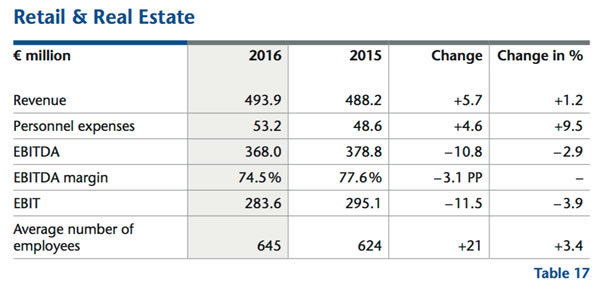

GERMANY. Frankfurt Airport owner Fraport has reported €493.9 million in revenue from its Retail & Real Estate division in 2016, a slight rise of +1.2% year-on-year. But the key figure of net retail revenue per passenger slid to €3.49 from €3.62 a year earlier. Fraport attributed this to “lower average spend among passengers from China, Russia and Japan, as well as the impact from the depreciation of various currencies against the Euro”.

EBITDA at the Retail & Real Estate division fell by -2.9% to €368 million, largely as a result of higher personnel expenses. With depreciation and amortisation almost flat, the segment’s EBIT reached €283.6 million, down -3.9%.

As reported, Fraport and Gebr Heinemann struck a joint venture to manage travel retail at Frankfurt Airport from 1 January. Commenting in its annual report, Fraport said that the move was driven by the prospect of rising digital as well as physical store sales, and would be aided by expanded retail space and new concept stores. The joint venture, noted Fraport, will be a “premium partner” in its digitalisation efforts. “These include expanding the online retail platform by offering delivery to customers’ homes or the gates, as well as stronger integration of existing loyalty programmes,” it said.

Passenger traffic at Frankfurt Airport dipped by -0.4% to 61 million passengers in 2016. This was a result of the relatively weak spring and summer months, which were “characterised by markedly restrained travel bookings in the wake of geopolitical uncertainties”.

Group revenue declined by -0.5% year-on-year to €2.59 billion. EBITDA leapt by +24.2%, reaching a new record high of €1.05 billion. This was supported by the compensation payment received for the Manila terminal project, which boosted EBITDA by €198.8 million. Fraport’s sale of a 10.5% share in Thalita Trading Ltd., the owner of the operating company at St. Petersburg Pulkovo Airport, contributed another €40.1 million to EBITDA. Adjusting for these effects, EBITDA would have remained at the previous year’s level of about €853 million.

Net profit increased by +34.8% to €400.3 million, partly due to the above one-off impacts.

Twin boost in Brazil

In other Fraport news, the company has achieved a double win in the third round of airport privatisations in Brazil. At a public auction the company placed the top bids of R1,505.75 million (€446.81 million) for Fortaleza Airport and R382.01million (€113.36 million) for Porto Alegre Airport. The airports are currently run by state-owned Infraero.

Along with the concession fee, Fraport will pay a fixed fee amounting to 5% of each airport’s annual revenue. The concession will run for 30 years at Fortaleza and for 25 years at Porto Alegre. Fraport will be the sole owner and participant in these concessions. The concessions and future results will be fully consolidated at Fraport Group level.

Fraport AG said it expects an additional accumulated EBITDA at group level of around €350 million during the first five years and an accumulated negative contribution to profit ranging from the mid to high double-digit million Euros. Due to the takeover of the concessions and the capital expenditure, Fraport AG expects an increase in group net debt by up to around 700 million Euros in the first five years.

Fraport AG Executive Board Chairman Dr. Stefan Schulte said: “We are excited to start working at Fortaleza and Porto Alegre airports soon. We are committed to further developing both airports markedly for the benefit of the Brazil. For our airline and passenger customers, we will quickly implement improved processes and services as well as attractive food & beverage offerings.”

Fortaleza Pinto Martins International Airport is located in the federal state of Ceará in the northeast of Brazil. With over four million inhabitants, the Fortaleza metropolitan region ranks sixth in the country. The airport received 5.7 million passengers in 2016, making it the country’s 12th busiest airport.

Porto Alegre Salgado Filho International Airport serves as the gateway to Brazil’s southern-most federal state of Rio Grande do Sul, which has a population of over ten million people. The airport welcomed 7.6 million passengers in 2016, making it Brazil’s ninth largest airport by passenger traffic.

As reported, Zurich Airport AG captured the contract for Florianópolis while Vinci Airports won the bid for Salvador Airport in the privatisation auction.