GERMANY. Frankfurt Airport owner Fraport Group today revealed its annual results for 2018, and reported a sharp 7.4% year-on-year fall in net retail revenue per passenger to €3.12.

The company said in its annual report: “Influences on retail revenue included in particular the above-average growth in passenger numbers on European routes, where passengers tend to spend less, as well as capacity bottlenecks at the terminals. In addition, the devaluation of various currencies compared to the Euro led to a loss of purchasing power.”

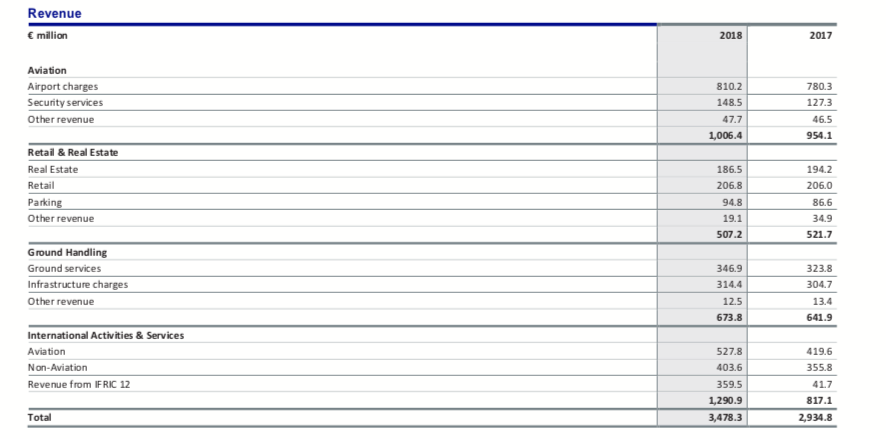

The Retail & Real Estate division saw revenue dip by 2.8% to €507.2 million in the year. A key reason was lower proceeds from the sale of land compared to 2017. Within the division, retail revenue climbed marginally to + €260.8 million. Segment EBITDA increased by 3.4% to €390.2 million, while segment EBIT climbed 2.8% to €302 million.

The retail performance lagged behind overall growth in income. Supported by strong passenger growth at its Frankfurt Airport home base and its group airports worldwide, revenue climbed by 18.5% to nearly €3.5 billion. After adjusting for revenue related to capital expenditure for expansion measures at the international companies, revenue rose 7.8% to over €3.1 billion. About two-thirds of this increase can be attributed to Fraport’s international portfolio – with the airports in Brazil and Greece, in particular, making a significant contribution.

Fraport Executive Board Chairman Dr. Stefan Schulte said: “We are pleased to look back on another very successful year, especially for our group airports around the world. Here in Frankfurt, however, 2018 presented challenges due to the constraints in European airspace and the strong traffic demand. For the medium and long term, we are very well positioned both at Frankfurt Airport and in our international business. Moreover, we are laying the foundations for further long-term growth by implementing our expansion projects.”

The operating result (EBITDA) climbed by 12.5% to over €1.1 billion. Net profit rose by 40% to €505.7 million. This includes earnings gained from the sale of Fraport’s stake in Hanover Airport, which contributed €75.9 million.

With 69.5 million passengers, Frankfurt Airport achieved a new passenger record in 2018 and growth of 7.8% compared to 2017.

Schulte commented: “We are pleased that the airlines have significantly expanded their flight offerings at Frankfurt Airport for the second year in a row, thus improving connectivity and prosperity for businesses far beyond the Frankfurt Rhine-Main Region. Until the first pier of the new Terminal 3 opens in late 2021, we will focus on maintaining a high level of service quality at Frankfurt Airport – while dealing with the constraints affecting the entire aviation industry. In particular, enhancing the situation at the security checkpoints will be a top priority for us.”

Fraport’s international portfolio also posted gains in passenger traffic during 2018. In Brazil, the two airports of Porto Alegre and Fortaleza reported a 7% increase to 14.9 million passengers in 2018 – Fraport Brasil’s first year of operating these airports. At the 14 Greek airports, traffic rose by almost 9% to 29.9 million passengers. Antalya Airport in Turkey grew by a sharp 22.5% to 32.3 million travellers, a new record.

Fraport is forecasting sustained growth at all airports in fiscal year 2019. At Frankfurt Airport, passenger volume is expected to rise between around 2-3%.

Fraport expects consolidated revenue to increase slightly up to around €3.2 billion (adjusted for accounting measure IFRIC 12). Group EBITDA is expected to reach between €1,160 million and €1,195 million, despite the non-recurring revenue from the sale of Fraport’s stake in Hanover Airport.

The application of the IFRS 16 accounting standard – which changes the accounting rules for leases – will make a positive contribution to Group EBITDA, but will also lead to much higher depreciation and amortization in fiscal year 2019, said the company. As a result, Fraport expects group EBIT to be in the range of about €685 million and around €725 million. The company also expects to post net profit of around €420 million and about €460 million.