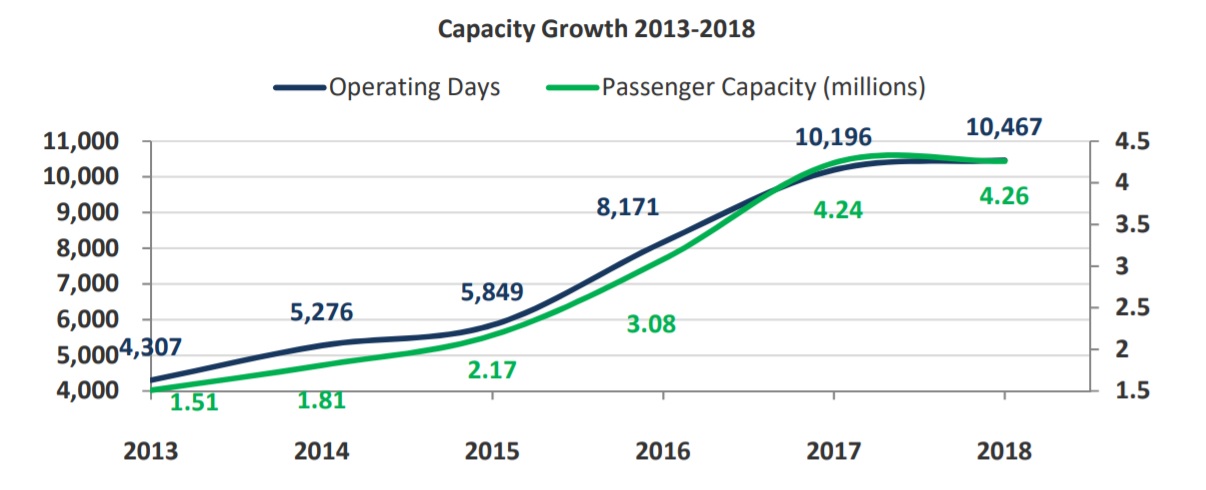

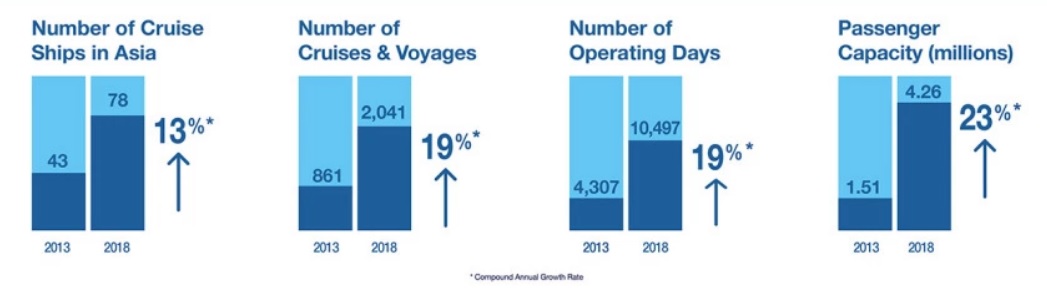

ASIA. While the market in Asia has seen some ship withdrawals and a slight fall in scheduled cruise calls in 2018, the general trend is strongly upwards. That’s according to Cruise Lines International Association (CLIA), which has just released its 2018 Asia Cruise Trends report.

Though planned calls have fallen, the five-year trend is strong. In 2013, only 43 ships cruised in Asia compared to 78 today, marking growth of over +80% since 2013.

Click on image to enlarge.

The report – produced in collaboration with Chart Management Consultants – says that this year has seen more varied ship products in Asian waters, with 38 cruise brands deployed in the region [which does not include Australia /Pacific]. Significant increases in large vessels (2,000 to 3,500 passengers) are being deployed in Asia, as well as small upscale ships.

“Asia once again showed impressive results in 2017 with most Asian source markets registering double-digit year-on-year growth,” said CLIA Australasia & Asia Managing Director Joel Katz.

Click on image to enlarge.

“Asia outperformed other established markets… as cruise lines continue to deploy significant capacity in the region, including brand new, large cruise ships purpose-built for Asian consumers. 2018 is expected to deliver another year of growth.” However the rate of cruise calls was flat this year.

As previously reported, Asian-sourced ocean-cruise passenger numbers hit another record high in 2017 at just over four million, up +20.6% (a very slight upwards revision in the new report from +20.5%). Asia accounted for about 15% of total global ocean passenger volume in 2017, with mainland China the dominant source market.

China accounted for almost 60% of all Asian passengers but the market experienced a deceleration last year, adding 286,000 passengers compared to more than one million in 2016. Asia’s other major passenger source markets were Taiwan (374,000), Singapore (267,000), Japan (262,000), Hong Kong (230,000), Malaysia (188,000) and India (172,000).

Click on image to enlarge.

The Asia Cruise Trends report, now it’s fourth year, says that ports in Southeast Asia are expected to see significant growth with a more than +20% increase in port calls in 2018. The study notes: “In total there will be over 7,100 port calls in Asia with Japan, mainland China, Thailand, Vietnam and Malaysia expected to receive the most number of cruises.”

By sub-region, East Asia accounts for 60% of port calls, followed by Southeast Asia (36%) and the remaining in South Asia (4%).

Shorter cruises are also preferred by Asian travellers. Sailings of four to six nights – and taken predominantly within the region (91%) – are by far the most popular. The weighted average age of an Asian cruise passenger is 44.6 years old, making them among the younger cruise travellers globally.

To get a copy of the full 2018 Asia Cruise Trends report – which has a detailed breakdown of deployments and calls by market – please click here.

Click on image to enlarge.