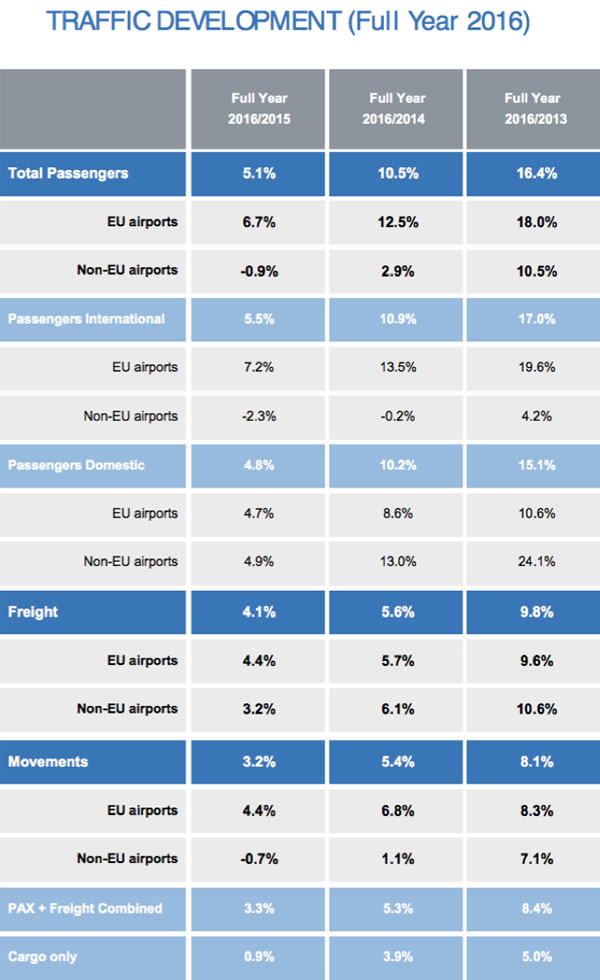

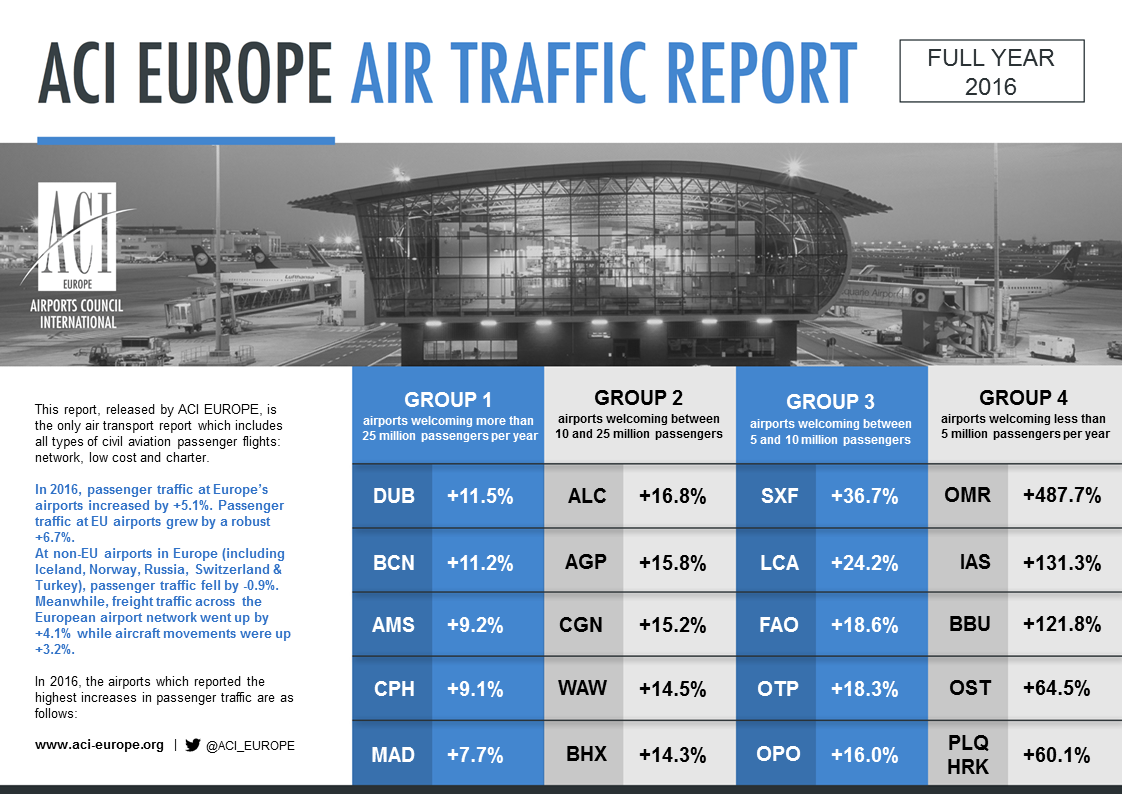

EUROPE. European airport passenger traffic posted a record year in 2016, surpassing 2 billion for the first time. Passenger volume jumped by +5.1% year on year in 2016, with growth driven by EU states, according to Airports Council International (ACI) Europe.

Traffic climbed by +6.7% in the EU, while non-EU airports posted a decline of -0.9% as terrorism and political instability took its toll on destinations such as Turkey.

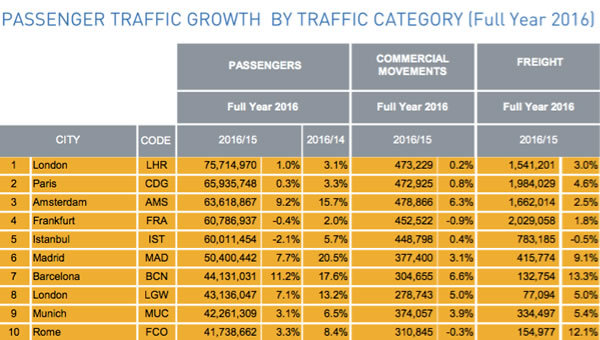

The figures showed that London Heathrow (75.7 million passengers and +1% growth) and Paris Charles de Gaulle (65.9 million passengers and +0.3% growth) maintained their positions as the busiest European airports.

Amsterdam Airport Schiphol, which saw passenger numbers rise by +9.2%, replaced Istanbul Atatürk as the third busiest European airport with 63.6 million passengers. The Turkish hub dropped to fifth place (60 million passengers and -2.1%) behind Frankfurt (60.7 million passengers and -0.4%).

ACI Europe Director General Olivier Jankovec said: “While geopolitics and terrorism in particular played an increasing role in shaping the fortunes and misfortunes of many airports, the underlying story is one of continued growth and expansion – with passenger volumes growing in excess of +5% for the third consecutive year.

“This means that Europe’s airports have welcomed an additional 300 million passengers since 2013, with 80% of it – 240 million – flooding the EU market. Unsurprisingly, that increase is starting to weigh on capacity levels, operations and resources.”

Jankovec attributed much of the growth to a combination of improving economic conditions, low oil prices and airline capacity expansion.

ACI arranges Europe’s airports into four groups, based on the number of passengers they handle each year. During the full year, airports welcoming more than 25 million passengers per year (Group 1) saw traffic jump by +2.6%.

Airports welcoming between ten and 25 million passengers (Group 2), those handling between five and ten million passengers (Group 3) and airports dealing with fewer than five million passengers (Group 4) reported rises of +6.7%, +10.3% and +5.8% respectively.

Passenger traffic growth was particularly strong in the fourth quarter of 2016 and in December, according to ACI Europe.

In December alone it grew by +10.9% year on year, which meant Europe was the fastest growing world region – ahead of Asia-Pacific (+9.6%).

Within Europe, the EU market jumped by +11.8% with a notable improvement in the traffic performance of the top hubs compared to earlier in the year. The non-EU market returned to significant growth (+8.1%) as Russian airport traffic improved and Turkish hubs experienced reduced traffic losses.

“This current growth dynamic is likely to hold up in the comings months, possibly until early spring,” explained Jankovec.

“Short-term downside risks relate to the price of oil – which is forecasted this year to be almost 30% above its 2016 average – and airlines exerting capacity discipline. Beyond that, our trading environment is becoming more unpredictable and prone to disruptions, due to mounting geopolitical risks.”

The outlook in the medium term is less clear, according to ACI Europe.

Jankovec said the permanence of terrorism threats, increasing political instability and Brexit comprise “a set of emerging mega-trends which are now challenging globalisation and free trade – and which could fundamentally alter airports’ long-term business prospects”.