UAE. Etihad Airways has reported a net loss of US$1.87 billion in 2016, largely as a result of impairments charges and investments in European airlines Alitalia and airberlin.

UAE. Etihad Airways has reported a net loss of US$1.87 billion in 2016, largely as a result of impairments charges and investments in European airlines Alitalia and airberlin.

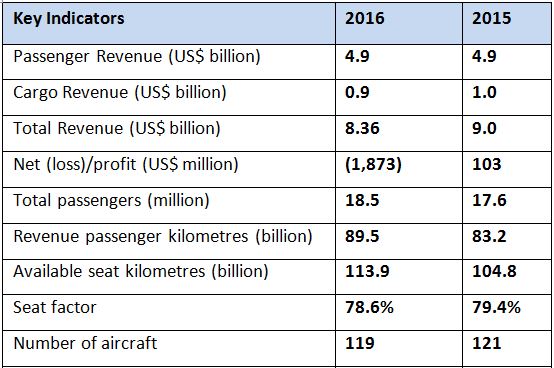

In 2015, the Abu Dhabi-based airline recorded a net profit of US$103 million. The loss last year was the first since 2011.

Middle East carriers have seen growth slow in the past two years as terrorism has impacted global traffic flows and lower oil prices have curtailed regional travel.

Etihad recorded US$ 8.36 billion in revenues and said the core airline business achieved passenger revenues of US$ 4.9 billion and 79% load factors while carrying a record 18.5 million passengers, up +5.1% year-on-year.

Available seat kilometres (ASKs) increased by +9% to 113.9 billion. Yields fell -8% amid market capacity pressures and the tough global economic climate, the airline said, but this was partially offset by a -11% reduction in unit costs.

Total impairments of US$ 1.9 billion included a US$ 1.06 billion charge on aircraft, reflecting lower market values and the early phase out of certain aircraft types, Etihad noted. A US$ 808 million charge on certain assets and financial exposures to equity partners mainly related to Alitalia and airberlin.

Legacy fuel hedging contracts also had a negative bearing on performance in 2016, though Etihad expects this exposure to have less of a financial impact during 2017.

Etihad recently opted to keep its inflight duty free service in-house after considering the merits of outsourcing in an extensive review of its retail business.

In February this year Etihad Aviation Group and Deutsche Lufthansa concluded a US$100 million global catering agreement as part of a wider commercial partnership. The four-year catering contract will see Lufthansa’s LSG Sky Chefs provide catering services to Etihad Airways in 16 cities in Europe, Asia and the Americas.

The companies also outlined plans to broaden their commercial partnership in the future, with passenger services among the areas being explored.

Etihad Aviation Group Chairman H.E. Mohamed Mubarak Fadhel Al Mazrouei said a “culmination of factors” contributed to the disappointing 2016 results. “The Board and executive team have been working since last year to address the issues and challenges through a comprehensive strategic review aimed at driving improved performance across the group, which includes a full review of our airline equity partnership strategy.

“The record passenger numbers in 2016 affirm Etihad’s role as a significant economic enabler for Abu Dhabi, and our airline business continues to support Abu Dhabi’s vision to develop tourism, grow commerce and strengthen links to key regional and international markets.”

Interim Group Chief Executive Officer Ray Gammell commented: “We are focused on maintaining the solid performance of our core airline business – operationally and financially – even amid difficult market headwinds. At the same time, we continue to implement changes across the group as part of the comprehensive strategic review, with a focus on improving revenues and reducing costs.

“During 2016, the airline commenced a ‘Right Size & Shape’ programme that generated total overhead savings of 4% through headcount reductions and other measures by the end of the year, even as capacity and total passenger number increased.

“This year is just as challenging for the global aviation industry and the ever-evolving competitive environment is likely to impact overall performance in 2017. However, our airline business remains strong and class-leading, and as an aviation group, we are in a stronger position.”