The Estée Lauder Companies has reported double-digit sales growth in travel retail in the EMEA (Europe, the Middle East and Africa) region for the first quarter of fiscal 2017.

The Estée Lauder Companies has reported double-digit sales growth in travel retail in the EMEA (Europe, the Middle East and Africa) region for the first quarter of fiscal 2017.

This was generated by new launch initiatives, global passenger traffic growth and new consumer coverage, the company said. Jo Malone, Tom Ford, MAC, Bobbi Brown and Aveda “contributed sharply” to the sales gains.

An overall increase in make-up sales, in line with global trends, came partly through a broadening of the brand’s presence in travel retail.

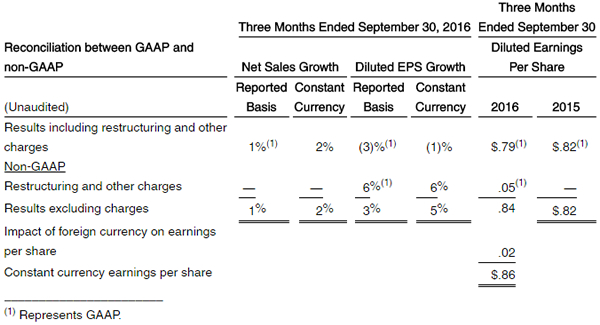

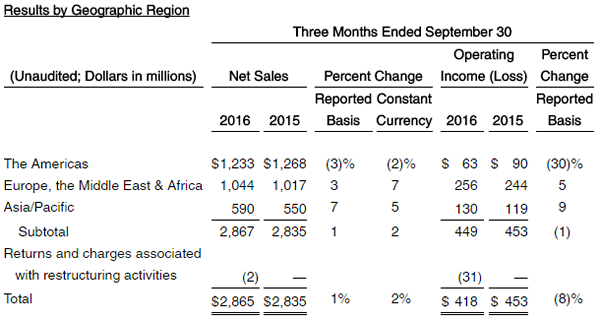

The travel retail channel was a strong contributor to overall +1% year-on-year sales growth in the first quarter of fiscal 2017, Estée Lauder said. Total net sales of US$2.87 billion were achieved.

However, travel retail and other growth was largely offset by continued macro challenges and restructuring costs.

The macro challenges included a decline in retail traffic through mid-tier department stores in the USA; a decrease in tourism and a decline in Chinese travellers. In addition, restructuring and other charges of US$31 million (US$20 million after tax) were recorded during the fiscal 2017 first quarter in connection with Estée Lauder’s Leading Beauty Forward initiative.

The multi-year initiative, announced in May 2016, aims to free resources for investment. “[Leading Beauty Forward] will result in related restructuring and other charges totalling between US$600 million and US$700 million, before taxes,” the company stated. “Once fully implemented, Leading Beauty Forward is expected to yield annual net benefits of between US$200 million and US$300 million, before taxes, of which a portion is expected to be reinvested in future growth initiatives.”

President and Chief Executive Officer Fabrizio Freda commented: “Our first quarter sales grew in line with our expectations, while disciplined expense management delivered earnings per share that exceeded our guidance. Our small- to mid-sized brands were strong contributors to sales as were the travel retail channel and many developed and emerging markets.

“As expected, this growth was partially offset by continued macro challenges, a decline in retail traffic in US mid-tier department stores, the results of the slowdown in the Middle East, continued softness in Hong Kong, and difficult comparisons with the prior year in the USA and France.

“Throughout the remainder of the fiscal year, we expect our sales growth to progressively accelerate based on a steady flow of new products, momentum and increased targeted consumer reach for our small- and mid-sized brands and MAC, and increased social media initiatives to drive brand engagement.

“We intend to continue to execute on our biggest strategic opportunities and further strengthen our multiple engines of growth to increase profitability and gain share. This includes accelerating our focus on leveraging our stronger engines of growth in make-up, fragrances and key international markets.

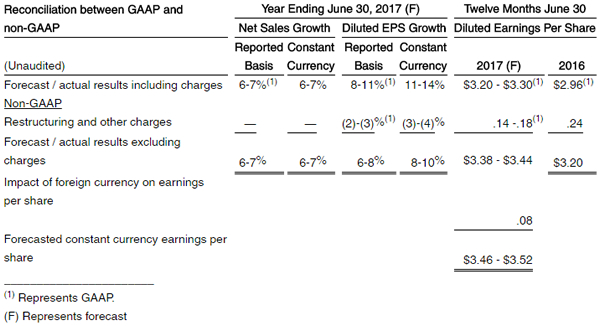

“Our focus remains on delivering sustainable and profitable annual growth, and the many actions we have planned give us confidence to reaffirm our expectations for constant currency sales growth of +6% to +7% and earnings per share growth of +8% to +10%, before charges, for the 2017 fiscal year.”

Category performance

Category performance

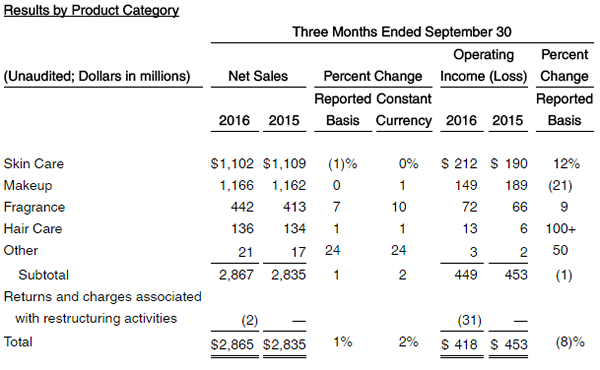

Skincare

• Reported net sales decreased slightly, due to the unfavourable impact of foreign currency translation.

• La Mer recorded double-digit sales gains thanks to new product introductions such as The Moisturizing Soft Lotion. Origins enjoyed strong growth reflecting increases in facial mask products. The introduction of the Tulasara line of skincare products boosted Aveda, while the company also reported sales growth from recent acquisitions.

• Offsetting this were lower skincare sales from Estée Lauder and Clinique, due in part to the overall global slowdown in the category. There were also lower sales in certain countries in Asia Pacific, particularly Hong Kong. The result also reflected a difficult comparison with greater launch activity the previous year.

• Operating income increased with higher results from Clinique and Estée Lauder thanks to a higher level of prior-year period support spending behind launches as well as higher sales from the brands noted above.

Make-up

• Sales increased slightly mainly due to double-digit increases from Tom Ford and Smashbox and solid growth from Estée Lauder and Clinique. The overall increase in this category resulted from new product offerings and the broadening of the brand’s presence in a number of channels including travel retail and speciality multi-brand retailers reaching new customers.

• Estée Lauder’s higher sales came from the Double Wear and Pure Color Envy product lines while Clinique’s higher sales reflected recent product offerings such as Superbalanced Silk Make-up Broad Spectrum SPF15.

• Lower sales, primarily from MAC, offset these increases reflecting the decline in foot traffic in US mid-tier department stores. However, internationally, MAC grew in-line with global prestige make-up.

• Operating income decreased, primarily reflecting the lower sales at MAC North America, partially offset by higher operating results from Estée Lauder, Clinique, Tom Ford and Smashbox.

Fragrance

• Net sales increased thanks to strong double-digit growth from luxury brands Jo Malone London (following the recent launch of Basil & Neroli), Le Labo and incremental sales from By Kilian together with strong growth from Tom Ford thanks to the continued success of the Soleil franchise and the Neroli Portofino line.

• Fragrance operating income increased, with higher results from Jo Malone and Estée Lauder being partially offset by higher investments behind new products at Tom Ford.

Hair care

• Net sales increased, primarily due to growth from Bumble and bumble products, along with selective global expansion.

• Hair care operating income increased, reflecting higher net sales and effective expense management.

By region

By region

The Americas

• In North America, most of the company’s brands generated growth with double-digit gains from Tom Ford and Smashbox and solid growth from Clinique, Jo Malone London and Origins.

• Sales in the company’s online and speciality multi-channels grew by strong double-digits.

• Sales increases in this category were offset primarily by the decline in retail traffic in US mid-tier department stores, principally affecting Estée Lauder and MAC, as well as a decrease in tourism. In addition, sales in the USA faced a difficult comparison to the prior-year quarter when Estée Lauder and Clinique launched major skincare products.

• On a reported basis, sales in Canada and Latin America each increased single digits. In constant currency, sales in Latin America rose double digits, led by strong growth in Mexico.

• Operating income in the Americas decreased, reflecting the lower sales at MAC.

Europe, the Middle East and Africa

• As noted, double-digit sales growth in travel retail was generated on new launch initiatives, global airline passenger traffic growth and new consumer coverage.

• Virtually all markets recorded net sales growth, with many posting double-digit increases, led by Central Europe, Italy, Israel, Spain and the Balkans and solid growth in Germany.

• In constant currency terms, sales growth in the region was strong with all countries generating sales gains except France, due to a decline in tourism, and the Middle East.

• Operating income increased, in part led by strong double-digit operating results in travel retail.

Asia Pacific

• Net sales increased on a reported basis with double-digit growth in Japan, Korea and Australia. Favourable foreign currency translation benefitted several markets in the region.

• Sales in constant currency increased in most countries with double-digit growth recorded in Korea, the Philippines and New Zealand. Higher sales in China reflected sales gains in most brands and strong double-digit increases in the online, freestanding store and speciality multi-channels.

• Sales in Hong Kong declined reflecting continued challenges, particularly for Estée Lauder, Clinique and La Mer brands, resulting from the reduction in Chinese tourism.

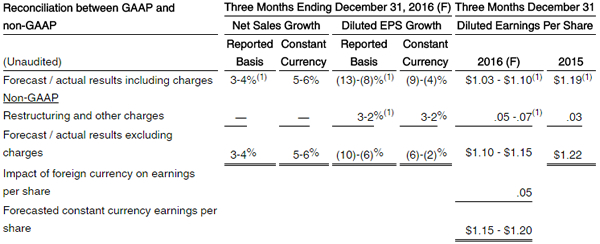

Moving into the fiscal 2017 second quarter and looking ahead to the full year, the company noted that global prestige beauty remains a vibrant industry estimated to grow approximately +4% to +5%.