SOUTH KOREA. Incheon International Airport Corporation (IIAC) and Korea Customs Service (KCS) have resolved their dispute over who should assess bids on the forthcoming Terminal 2 duty free tender by adopting an unprecedented two-stage judging process.

As reported, IIAC issued the Requests for Proposal on Wednesday (1 February), after failing to resolve an extraordinary row over KCS’s insistence that it, not the airport operator, should judge the bids.

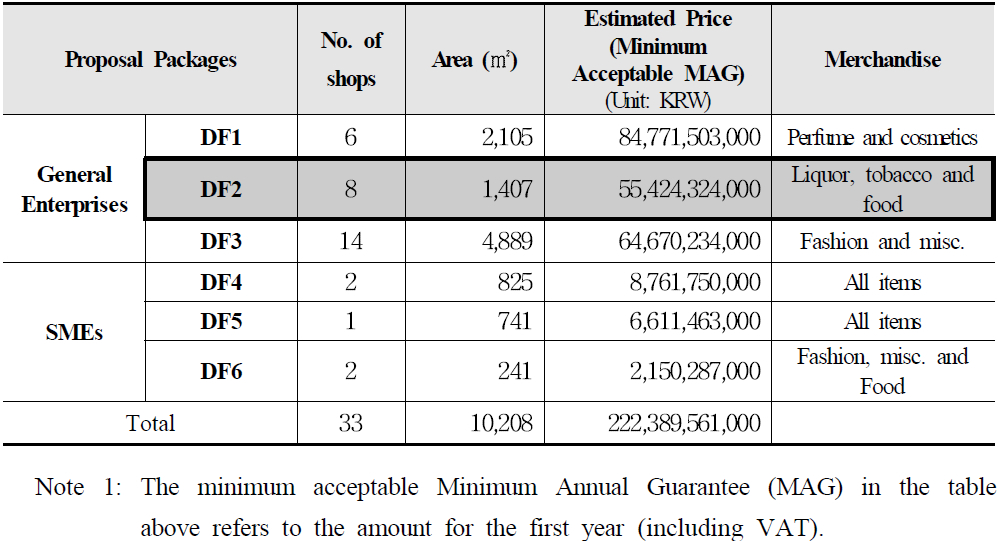

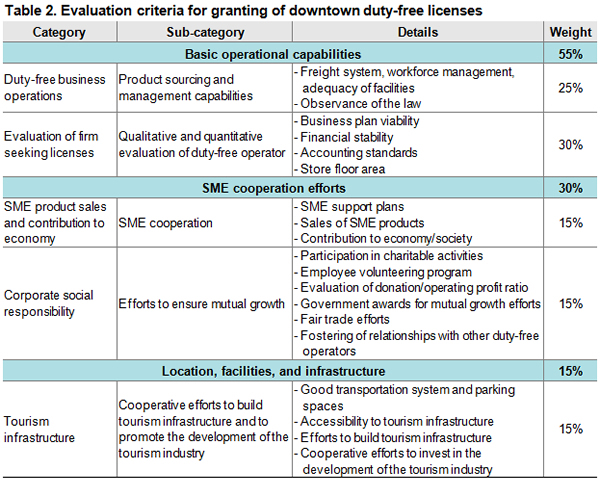

The KCS wanted to create a licensing committee to evaluate the T2 proposals and judge the offers according to a much wider set of criteria (see table below) than those used by IIAC (60% technical, 40% financial) and with less emphasis on the financial component.

Unable to resolve the impasse, IIAC, acutely aware of T2’s planned opening in October, felt it had no choice but to issue the RFP this week. That led to a predictably furious response from KCS, which declared the RFP “invalid”.

However, after two days of talks, involving the Ministry of Land, Infrastructure, Transport and Maritime Affairs (KACC), a compromise has been reached, creating a two-tier evaluation process.

IIAC will judge the bids on its original criteria of 60% technical and 40% financial, using a 500-point scale. Its ranking will then be submitted to KCS for the government agency to conduct a second-stage evaluation using a wider set of criteria.

Crucially, IIAC will propose two bidders for each licence, which the KCS will then deliberate over before choosing a winner

The KCS will then apply a 1,000 point scoring system in which the financial offer will carry a 40% ranking (400 points) but technical evaluation will only be worth 10% (100 points). Critically, KCS will adopt its own judging of these first two criteria, before applying a further 500 points (50%) based on other factors (see table 2 below), including contribution to small & medium enterprises and a downgrading for any “market-dominant” position – worrying news for industry giants Lotte Duty Free and The Shilla Duty Free.

Crucially, IIAC will propose two bidders for each licence, which the KCS will then deliberate over before choosing a winner.

This extraordinary resolution to an extraordinary dispute would seem to also eliminate any faint chance of success any international bidder (to whom the RFP is open) would have.

A source at IIAC told The Moodie Davitt Report: “We are not happy with the outcome but we have to follow government procedures.

“Incheon Airport will select two candidates for each licence but unfortunately we cannot finalise the winners. We will create the short-list which then goes to the KCS committee for evaluation. Importantly, they must follow our scoring and cannot re-evaluate the bids.

“Also, bidders must prepare two proposals, one for IIAC, the other for the KCS licensing committee, which makes it a tougher job. Also, the KCS will insist on seeing evidence of support for Korean tourism and local SMEs, which will not help attract overseas bidders.”

Bids will be evaluated by IIAC in early April, with the KCS committee examining the short-list from mid-April and awards expected by the end of the month.

Noting the recent controversy over the tender process, the IIAC source noted: “In the long term we may have to look at restructuring the bidding process for licences at the airport.”

Below are the full details of the RFP which will now proceed as planned.

One senior Korean duty free retailer told The Moodie Davitt Report: “Many in the industry forecast that Lotte and Shilla will be severely disadvantaged by the anti-monopoly and oligopoly clause that KCS strongly wants to adopt. On the other hand, this bidding process also seems to be alienating foreign bidders as much as the last Incheon bidding did.

“KCS’s evaluation standards are familiar to the Korean retailers but will be very strange to foreign companies since they contain elements such as the history of a bidder’s contributions to the local economy and to local SMEs.”

Note: As a currency guideline, KW222,389,561,000 = US$192.3 million; KW84,771,503,000 = US$73.3 million; KW55,424,324,000 = US$47.9 million; and KW64,670,234,000 = US$55.9 million

Note: As a currency guideline, KW222,389,561,000 = US$192.3 million; KW84,771,503,000 = US$73.3 million; KW55,424,324,000 = US$47.9 million; and KW64,670,234,000 = US$55.9 million

NOTE TO AIRPORT OPERATORS: The Moodie Davitt Report is the industry’s most popular channel for launching commercial proposals and for publishing the results. If you wish to promote an Expression of Interest, Request for Proposals or full tender process for any sector of airport revenues, simply e-mail Martin Moodie at Martin@MoodieDavittReport.com.

We have a variety of options that will ensure you reach the widest, most high-quality concessionaire/retailer/operator base in the industry – globally and immediately.

Similarly The Moodie Davitt Report is the only international business intelligence service and industry media to cover all airport consumer services, revenue generating and otherwise. We embrace all airport non-aeronautical revenues, including property, passenger lounges, car parking, hotels, hospital and other medical facilities, the Internet, advertising and related revenue streams.

Please send relevant material, including images, to Martin Moodie at Martin@MoodieDavittReport.com for instant, quality global coverage.

All such stories are consolidated in our popular Tender News section (see home page dropdown menu) that has been running since 2003.