INTERNATIONAL. Dufry Group today revealed what it termed a “resilient” set of full-year results for 2018, despite difficult trading conditions in certain territories.

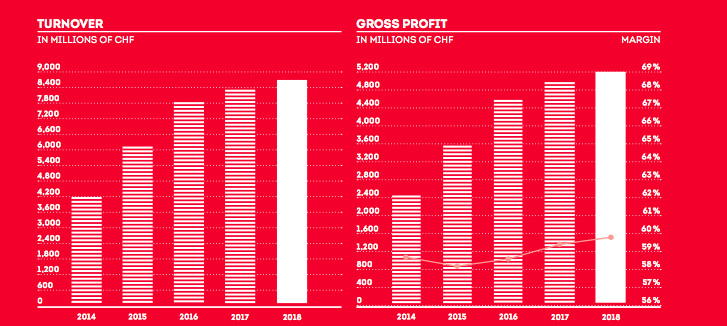

Turnover grew by 3.7% year-on-year to CHF8,684.9 million (US$8,645 million). In the third quarter of 2018, as reported, tough conditions hit trading in Spain, Brazil and Argentina resulting in a negative organic growth of 0.7%.

Organic growth improved with a 1.8% increase in the fourth quarter, mainly due to the positive contribution of openings in Asia, namely in Hong Kong and Australia.

EBITDA reached CHF1,040.3 million (US$1,035 million), an increase of 3.3%, with the EBITDA margin stable at 12.0%.

CEO Julián Díaz said: “2018 proved to be a challenging year for Dufry but we delivered resilient results. Besides managing the daily business, the teams made a major effort implementing the Business Operating Model (BOM) throughout the whole year – a task that involved countries, divisions and headquarters alike and requested a close collaboration.

“I am pleased with the organic growth recovery in the fourth quarter. After organic growth being negative in the third quarter, this return to positive growth is an important achievement. Also, the continued improvement seen in the first two months of 2019, with total growth at above 3%, confirms that we are moving in the right direction.

Looking at our three key financial metrics, in 2018 we continued to generate top-line growth in most of our operations, driven mainly by organic growth. Our EBITDA margin reached 12.0% and we managed to generate significant improvements in both our free cash flow and equity free cash flow which increased to CHF617.1 million and CHF370.8 million respectively.

“Despite headwinds in selected markets, Dufry has a strong strategic positioning with a broad portfolio of high-quality concessions across many markets in a sector with positive fundamentals. Our focus continues to be the delivery of sustainable long-term results for our shareholders.”

The company cited highlights of the year including:

- Acceleration of the Business Operating Model implementation with CHF40.0 million already reflected in the 2018 results. The remaining CHF10 million to come in 2019;

- Continued refurbishment of operations across the group, with 34,800sq m of space refurbished in 2018, including the implementation of New Generation Store concepts at Heathrow Airport T3 (2,500sq m) and Cancun T3 (1,800sq m) as well as the main store in Glasgow and stores at Malaga and Bali airports;

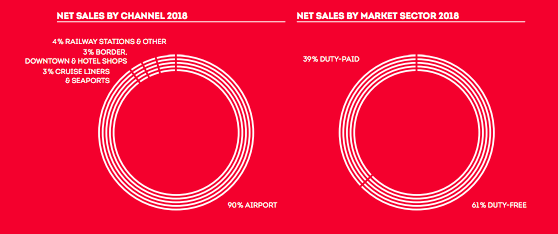

- 26,800sq m of gross new retail space opened in 2018, including the start of operations aboard 16 cruise ships, totalling over 4,000sq m across 48 stores. New duty free operations opened at the MTR high-speed railway station in Hong Kong (three stores over 1,500sq m) as well as 57 stores across several operations in North America adding 5,100sq m;

- Dufry said it has contracts signed to open a further 19,800sq m of space in 2019 and 2020, including operations in 19 new ships from P&O Cruises and Holland America Cruises (27 stores – 4,500sq m), 18 new stores in Boston totalling 1,300sq m, as well as 11 new stores at Chicago Midway, totalling 1,100sq m.

Key financials

As noted, turnover grew by 3.7% to CHF8,684.9 million, with like-for-like growth contributing 1.0% and net new concessions adding 1.7%, which resulted in organic growth of 2.7%. The FX translation effect during the period was 1.0%, mainly due to the strengthening of the Euro and the British Pound versus the Swiss Franc.

In the third quarter of 2018, headwinds impacted our trading in Spain, Brazil and Argentina resulting in a negative organic growth of -0.7%. Organic growth improved to +1.8% in the fourth quarter, mainly due to the positive contribution of openings in Asia, namely in Hong Kong and Australia.

Gross profit grew by 4.4% and reached CHF5,195.7 million in 2018. Gross margin improved by 40 basis points. This came mainly as a result of further negotiations of conditions with suppliers and was supported by a contribution from the acceleration of several brand plan initiatives, resulting either in better terms or “higher compensation” from suppliers, said Dufry.

EBITDA grew 3.3% to CHF1,040.3 million, as noted above, with EBITDA margin stable at 12.0% year-on-year.

Apart from the expansion in the gross margin, the improvement in general expenses came mainly as a result of the contributions from the BOM implementation, generating savings of 20 basis points year-on-year in 2018.

Selling expenses, 90% of which are concession fees, “continued their trend upwards” and rose by 70 basis points as percentage of turnover in 2018. About one third of the increase is due to the effect of the minimum annual guarantee of the company’s onerous Spanish contracts and another 10 basis points due to new operations outside the airport channel.

EBIT fell to CHF371.4 million in 2018 from CHF418.7 million in the year. Other operational result (net) was CHF -49.3 million in 2018, mainly due to costs related to openings and closings of operations.

Depreciation reached CHF202.3 million in 2018, compared to CHF158.9 million in 2017. Amortization and impairment stood at CHF369.6 million in 2018, compared to the CHF423.9 million reported in 2017.

Net earnings to equity holders stood at CHF71.8 million in 2018 compared to CHF56.8 million in the previous year. Financial results, net, reached CHF -137.2 million in 2018 from CHF -216.8 million one year earlier. The improvement was due to refinancing concluded last year as well as lower debt levels in 2018.

Key take-outs – Turnover up 3.7%, with like-for-like growth contributing 1.0%, net new concessions 1.7% and FX 1.0%; – Currency issues in Argentina and Brazil slow sales in Q3 and full year (driving organic sales down -3.5%); – High concession fees in Spain drag results; – EBITDA rises +3.3%; top-line growth (mainly organic) in most regions; – EBITDA margin margin falls by 150 bps in Q4 on rising concession fees and rent increases; -Mid-term average organic revenue growth now expected to be in a range of between 3% and 4% a year; – Acceleration of the Business Operating Model implementation with CHF40 million already reflected in the 2018 results, with more to come in 2019; – Gross profit margin improvement driven by enhanced supplier terms. |

Performance by region

Southern Europe and Africa

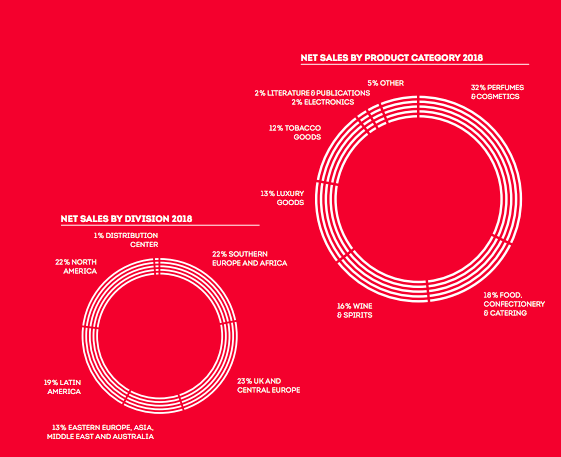

Turnover reached CHF1,854.0 million in 2018, from CHF1,857.8 million one year before. Organic growth in the division was negative by 2.6% in the full year.

Dufry said: “The Spanish business was negatively impacted by a change in the mix of passengers towards lower spending nationalities. On the other hand, Turkey benefited from the shift and posted good performance. Other locations such as Italy, France, Malta and Kenya, all posted good growth.”

UK and Central Europe

Turnover grew to CHF1,974.2 million in the year, versus CHF1,945.1 million in 2017, with organic growth in the division reaching 0.3%. The growth was impacted by the closing of operations in Geneva as of October 2017. Excluding this, organic growth reached 3.4%.

In the UK, the main operation in the division, performance was “solid”, supported by stable growth in passenger numbers as well as refurbishments and marketing initiatives.

Switzerland, excluding Geneva, also posted good growth, due to a combination of the refurbishment and introduction of the New Generation Store concept in Zürich along with growth in passengers.

Eastern Europe, Middle East, Asia and Australia

Turnover amounted to CHF1,153.6 million in 2018, from CHF1,011.4 million in 2017. Organic growth was double-digit at 15.1%. The opening of operations in Hong Kong and Perth were key to maintaining organic growth at high levels, despite the higher comparables since the third quarter.

Eastern Europe had a good performance, although sales growth slowed in the second half. In the Middle East, operations in Jordan, Kuwait, Sharjah and India continued to grow solidly. Dufry noted: “The growth trend in Asia remained strong during 2018 although there was some slowdown in the second half of the year due to stronger comparables. We saw a solid performance in operations such as Cambodia, Macau, South Korea and Indonesia. Australia posted double digit growth in the year, supported by the opening of the New Generation Store in Melbourne.”

Latin America

Turnover went to CHF1,617.0 million in 2018 versus CHF1,694.0 million one year earlier. Organic growth for the year stood at -3.5%.

Dufry said: “Most operations in South America faced challenging conditions driven by a strong devaluation of local currencies. Brazil and Argentina were the most impacted locations with the Brazilian Real and the Argentinean Peso devaluing 15% and 70% respectively in the year. Other operations in South America also saw a slowdown in performance as a knock-on effect from the two key countries above, especially in the second half of the year.”

Central America and Caribbean had “a good performance”, further supported by a strong development of the cruise business, where Dufry started operations on board of 16 new ships.

North America

Turnover reached CHF1,884.4 million in 2018 from CHF1,771.5 million in the previous year. The division delivered a good organic growth, totalling 6.8% in 2018.

This performance was driven by a combination of passenger growth and new openings in the year. The duty paid business delivered a solid performance throughout the year. Growth in duty free operations was “resilient” until the third quarter. During Q4 2018, organic growth slowed slightly down to 4.7%, mainly driven by a change in the Chinese passenger profile resulting in a lower spending and impacting the duty free business in the region.

Trading outlook

Dufry noted that the headwinds in certain countries – particularly in Brazil and Argentina, and to a lesser extent in Spain – are likely to persist for the coming quarters, but it said that its business model and the fundamentals of the travel retail market remain solid.

“Based on current indications of our trading in 2019, we anticipate a continued gradual improvement in organic growth along the year. In the first two months of 2019, total growth was above 3%. The growth improvement in early 2019 is mainly due to the contribution of new concessions.

“We therefore expect to see an outcome for the full year 2018 that will demonstrate continuing year-on-year progress for the overall Group. Mid-term average organic growth is now expected to be in a range of between 3% and 4%; with equity free cash flow further increasing in line with turnover performance and starting from a base of between CHF350 million and CHF400 million.”