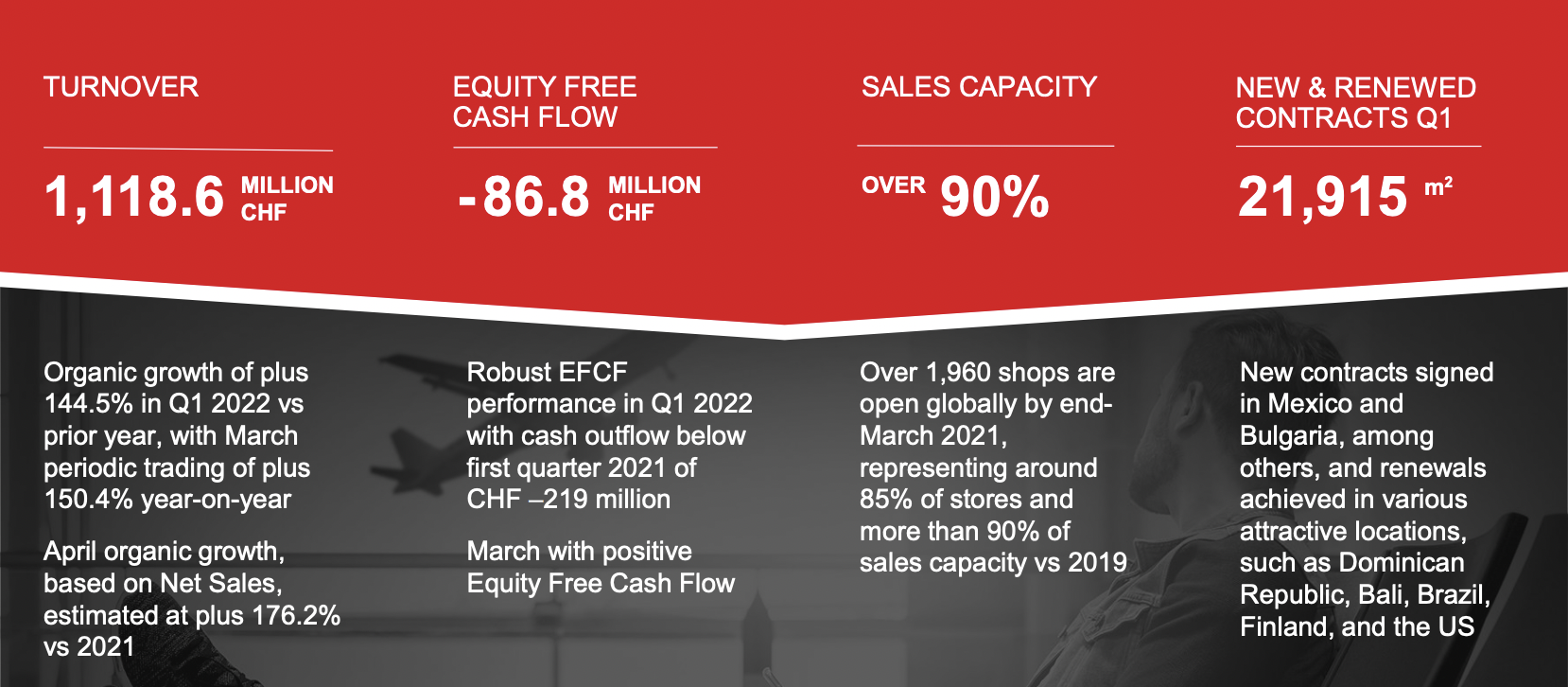

INTERNATIONAL. Leading travel retailer Dufry Group today reported first-quarter revenue, with turnover reaching CHF1,118.6 million (US$1,134 million). This represented organic growth of +144.5% year-on-year, with like-for-like growth contributing +143.4% and net new concessions +1.1%.

The retailer said that Q1 was “characterised by continuous improvements during January and February, resulting in increasing sales trends in most regions globally from March onwards”.

The performance was driven by healthy growth across the EMEA region and positive contributions from the Americas, especially the US and Central America & Caribbean. The translational foreign exchange effect was -1.5% mainly from the weakness of the Euro and UK Pound against the Swiss Franc.

Perfumes & cosmetics continued to be the leading category at 27.1% of sales, followed by food & confectionery (22%) and wines & spirits (18.6%). Food & confectionery, alongside convenience products and electronics, have recovered faster in the current environment, said Dufry.

Dufry had opened over 1,960 shops worldwide by the end of March, representing around 85% of stores and more than 90% of 2019 sales potential. The company highlighted increased commercial activity with agreements for 21,915sq m of new or renewed retail space signed during the first quarter.

CEO Julián Díaz commented: “Until the last week of January, the first quarter was still impacted by some travel constraints. Since February, we have seen an easing of restrictions and general improvement of the health situation. This translated into an immediate uptake in travel, and in travel retail as an integral part.

“The positive trend has so far continued into April and May, with contributions from nearly all regions globally. Comparing February year-to-date and April year-to-date, Dufry’s turnover has more than doubled. Within EMEA, the best performing region has been the Mediterranean, but also Southern Europe and the UK have significantly progressed.

“Looking at the Americas, Central America & Caribbean, as well as the US, continued to trend above group average. The regional performance also started to be supported again by our South American operations, especially by Argentina, Colombia, and Ecuador. Whilst most regions globally are experiencing an increasing sales trend, most of the APAC countries are still adhering to a zero-Covid policy. Consequently, most of the operations, which cater to international passengers, continue to be closed.”

He added: “The positive sales trend is reflected in our robust cash flow performance for the quarter. Equity Free Cash Flow reached CHF -86.8 million – a significant improvement from our first quarter 2020 and 2021 performances of CHF -483.1 million and CHF -219.3 million respectively, but also compared to historical first quarter cash flow performances.

“Despite the typical seasonality of the business, Equity Free Cash Flow in Q1 2022 performed even better than pre-crisis Q1 2019 EFCF of CHF -123.0 million. This result is positively influenced by the measures we have taken over the last two years, including concession reliefs and tighter cash management, with Q1 2022 also partly benefitting from working capital movements and some phasing of CAPEX.

“Our financial position gives us the flexibility to focus on continued reopenings and commercial initiatives. Over 85% of our shops are open, representing more than 90% of the 2019 sales potential. We have signed important new and renewed contracts, for example, in attractive touristic destinations like Bali, Dominican Republic, California (US), Mexico and Bulgaria, among others.

“It is personally important to me to confirm our commitment to our employees in the Ukraine, who are very much in our thoughts. We are supporting all our Ukrainian employees and their families during these extremely difficult times – as is always the case with all our colleagues worldwide. We have offered all employees and their families relocation to other Dufry locations worldwide, and they have received all possible support by the local teams, including financially, legally, administrative but especially also on a personal level with the whole Dufry family being fully committed to help. We will continue to closely analyse the situation and react accordingly.”

As reported, Xavier Rossinyol will take over from Díaz as CEO on 1 June. Díaz said: “During the recent weeks, Dufry’s Designated CEO Xavier Rossinyol and myself worked closely together to allow for a well-organised transition. I would like to express my gratitude to all of you, our stakeholders, and particularly to the Board of Directors and all colleagues at Dufry for the support I have received during the past eighteen years.

“I am immensely grateful for the opportunity I had to lead and contribute to the development of this great company, and I am firmly convinced about Dufry’s prosperous future.”

Performance by region

Europe, Middle East and Africa

Turnover amounted to CHF505.9 million (US$513 million) in Q1 2022, up by +283.7% on the same period in 2021 in organic terms (65% of 2019 levels). Nearly all regions contributed positively as of March in line with the improving health situation and the easing of travel protocols. Best performing markets were the Mediterranean countries, including Turkey, Greece, and the Middle East. The UK, France, Spain, Eastern Europe, and Africa benefited from leisure demand. The geo-political situation hit Russian and Ukrainian operations, with “limited spillover to the broader region so far,” said Dufry. Asia Pacific

Asia Pacific

Turnover amounted to CHF 22.1 million (US$22.4 million) in Q1 2022, with organic growth down -7.9% compared to 2021 (12.4% of 2019 levels). Dufry highlighted tightened travel restrictions around the Olympic Winter Games in China in February and a rise in Covid cases since the beginning of the year.

“While selected countries like Australia, Bali, Cambodia have started reopening, other governments still adhere to a zero-Covid approach or restrictive measures. As soon as restrictions are lifted, demand is expected to show a fast rebound as experienced throughout other geographies globally. Best performing in the region were China and Macau due to domestic travel activity, with temporary interruptions whenever cases occur.”

The Americas

Turnover was CHF 545.1 million (US$552.7 million) in Q1, with organic growth up +121.7% year-on-year (with turnover at 71% of Q1 2019). The region has seen a rapid rebound since February, noted Dufry, buoyed by US domestic, intra-regional and increasingly transatlantic travel, as well as tourist travel to Mexico, Central America and the Caribbean destinations, including the Dominican Republic, and the Caribbean Islands. South America also started to trend upwards, especially in Argentina, Colombia, and Ecuador.

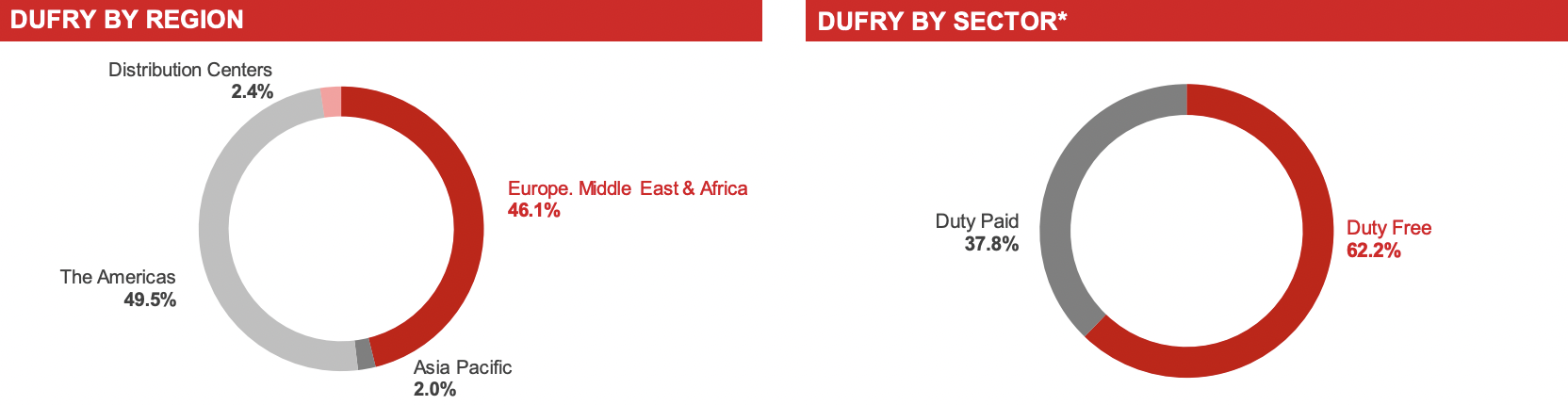

The regional net sales split mirrors current travel patterns, said Dufry, with Europe, Middle East and Africa contributing 46.1%, Asia-Pacific 2% and the Americas 49.5%. Global distribution centres accounted for 2.4% of Q1 2022 net sales. This figure reached “a more normalised level as Hainan is now being supplied by the local joint venture in China,” noted Dufry.

For April, Dufry estimates organic growth (based on net sales) to reach +176.2% versus April 2021. By region, EMEA is estimated to grow by +394.7% and the Americas by +105.6%, both on a year-on-year basis. The April 2022 estimate for APAC stands at -1.8%versus the previous year.

Business development

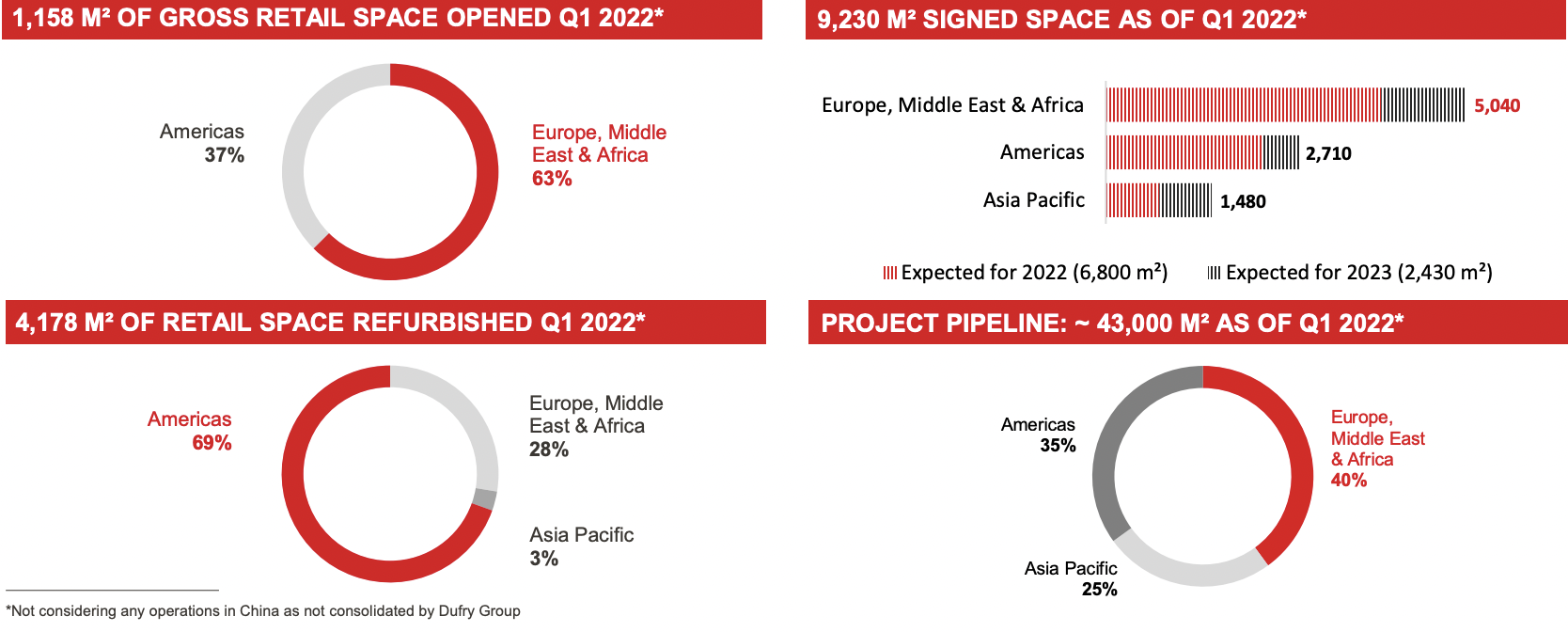

Dufry signed new or updated concession agreements for 21,915sq m of space in Q1 2022. Highlights included the newly-built Felipe Ángeles International Airport in Santa Lucia, México, and Recife International Airport, Brazil. Other additions were the contract extension with La Romana International Airport and Seaport in the Dominican Republic for ten years.

Dufry also renewed its duty free concession at Bali Ngurah Rai Airport for six years, and extended at Helsinki Airport for five more years, alongside a duty paid contract for ten years through Hudson at Ontario International in the USA. Also in the US, Dufry announced a partnership with Starbucks to operate and develop stores in US airports, with the first stores planned to open at New York LaGuardia Airport this Summer.

Total gross retail space opened during Q1 amounted to 1,158sq m, mainly related to Seville, Spain. Other openings included Mexico City (Mexico), Rosario (Argentina), Nador (Morocco), Cayenne (French Guyana), Montego Bay (Jamaica), and Athens (Greece).

Refurbishments during the first quarter amounted to 4,178sq m, including stores in Santiago (Chile), Seville (Spain), Corfu (Greece), Agadir (Morocco), Recife (Brazil), Vancouver (Canada), Rio de Janeiro (Brazil), Detroit, Las Vegas and Fort Lauderdale (US) among others. The current pipeline of opportunities stands at approximately 43,000sq m as of the end of March.