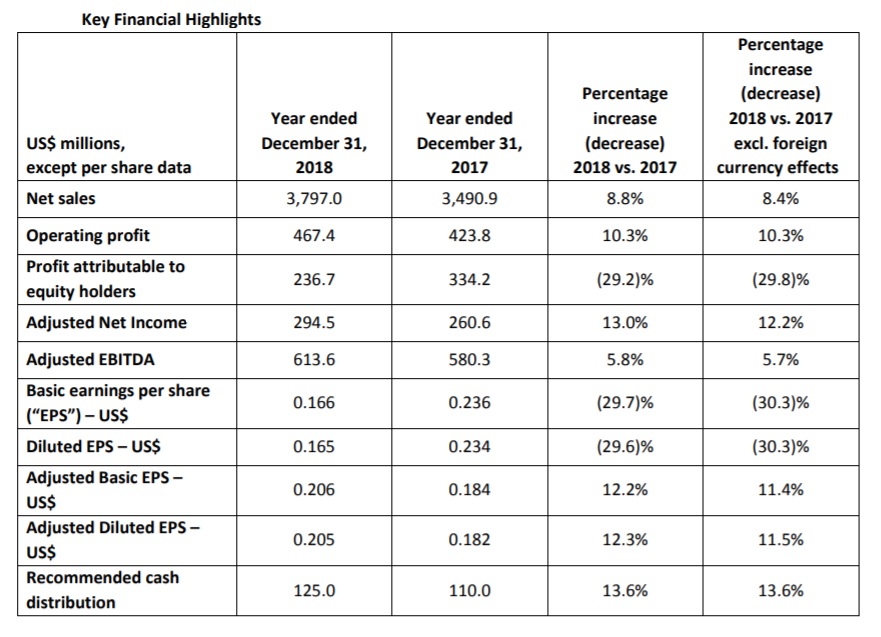

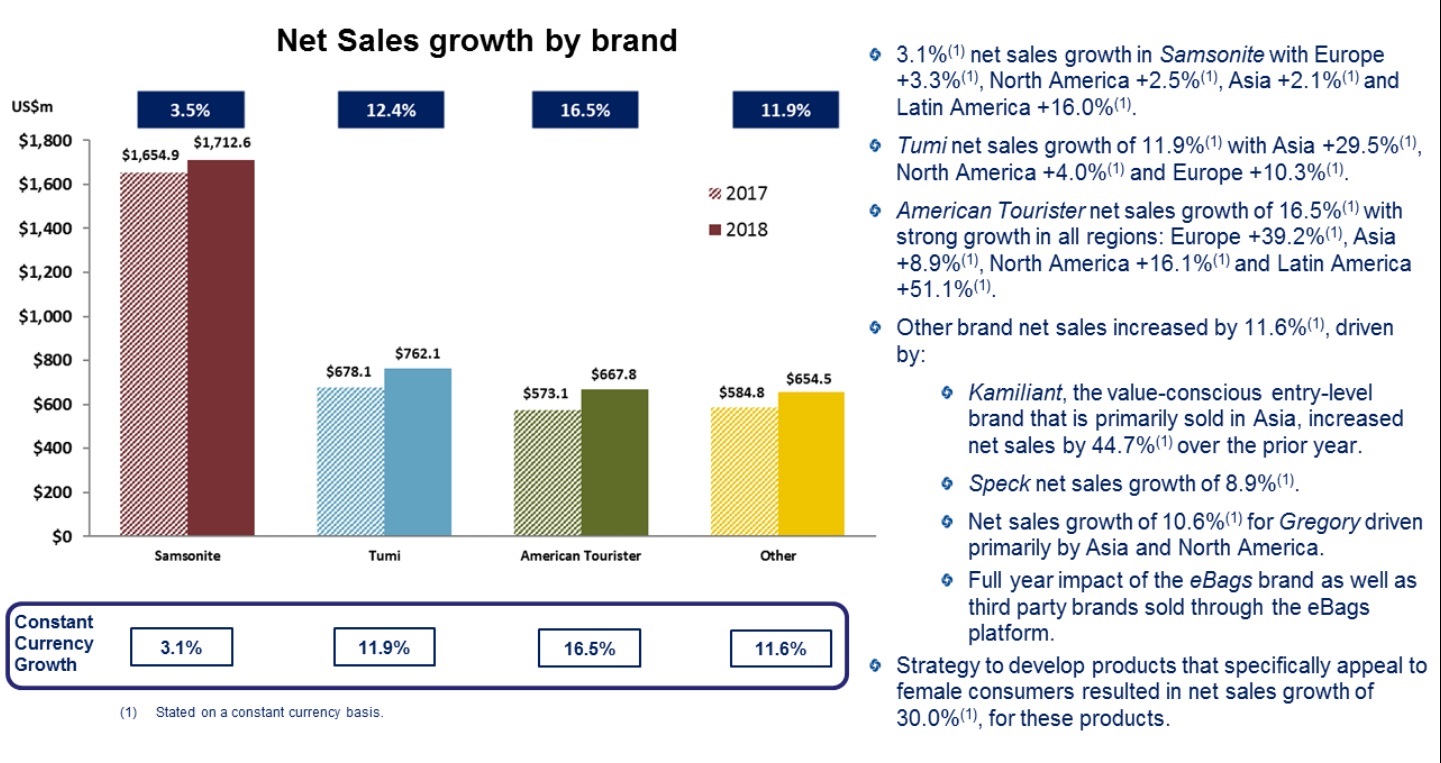

Samsonite International – the owner of the Tumi brand – saw group net sales increase by 8.4% on a constant currency basis to reach US$3,797 million for the year ended 31 December 2018. Excluding the contributions from eBags, the e-commerce website acquired in May 2017, net sales increased by 7.5%. Sales via eBags were US$154.9 million in 2018.

Tumi sales rose by 11.9% to US$762.1 million. Chairman Tim Parker made special mention of Tumi’s continuing international expansion.

“We’re very pleased indeed with Tumi’s results. This has been more than just a textbook merger and it’s now very much part of the Samsonite family. We’ve seen encouraging growth across major markets: up 4% in the US home market, 30% in Asia, 10% in Europe where we are expanding the network, and we’ve started direct distribution in Latin America.”

Focus on the American Tourister brand has also paid off. “It is now a second major brand of real substance,” noted Parker. Last year, American Tourister signed up footballer Cristiano Ronaldo as its brand ambassador which helped to lift global sales by 16.5% to US$667.8 million in 2018.

In 2018, the Samsonite brand accounted for 45.1% of group sales, Tumi for 20.1%, and American Tourister for 17.6%. Other brands owned by the group include Kamiliant, Lipault, Hartmann, eBags, Saxoline, Xtrem and Secret, as well as third party brands sold through the Rolling Luggage and Chic Accent retail stores and the eBags website.

In 2018 US$580.8 million, or 15.3% of the Hong Kong-listed group’s sales were derived from e-commerce. This represented an increase of 18.5% compared to the previous year.

Commenting on overall performance, Parker said the 2018 results “marked the seventh consecutive annual increase in turnover since our flotation in 2011” partially helped by “benign global trading conditions in the first half of 2018” which drove regional momentum.

Regional gains, but with caveats

CEO Kyle Gendreau added: “All of our regions delivered solid net sales gains. After a strong start, we had to contend with heightened geopolitical and macroeconomic uncertainties that impacted our performance in a number of markets during the second half of 2018.” Over the year, North America was up 6.5%, Asia 10.2%, Europe 8.6% and Latin America 15.5%.

The Asian market (US$1,324 million) is now almost the same size as North America (US$1,483 million). Its performance was helped by strong growth in Japan (16.2%), Hong Kong including Macau (16.6%), and India (23.2%) but that was partially offset by slower growth in China (3.2% in H2 2018) due to weakened consumer sentiment and in South Korea where H2 2018 sales decreased by 1.5% due to “challenging market conditions”.

“We also experienced a deceleration in Europe during the second half, particularly in France (down 1.2%) owing to increased economic and political volatility. Overall, Europe recorded second half 2018 growth of 6.4%, compared to 11.4% during the first half of 2018,” said Gendreau.

On the US, the biggest country market for Samsonite by far, Gendreau noted: “The market experienced increased uncertainty due to concerns about trade relations with China, while the strengthening dollar resulted in lower tourist arrivals, impacting sales in our gateway markets.”

Despite those developments, US sales in the second half 2018 grew by 3.5%, compared to a 4.8% increase during the first half of 2018, excluding eBags.

Travel and tourism to drive long-term “promising” outlook

“As we continue into 2019, the global economic backdrop has become more clouded, with US-China trade tensions, signs of economic growth slowing in the European Union, uncertainty around Brexit, and a general increase in political volatility and economic uncertainty impacting consumer sentiment worldwide,” Gendreau said.

“However, with travel and tourism enjoying robust growth, the long-term outlook of the global bags and luggage market remains promising, and we will continue to invest in our business to drive future growth. We are confident we can leverage our scale and our strong, diversified portfolio of brands to expand our business around the world,” he concluded.

Samsonite’s core financials can be seen in the table below.